“The Fed Was Suddenly Facing Multiple LTCMs”: BIS Offers A Stunning Explanation Of What Really Happened On Repocalypse Day

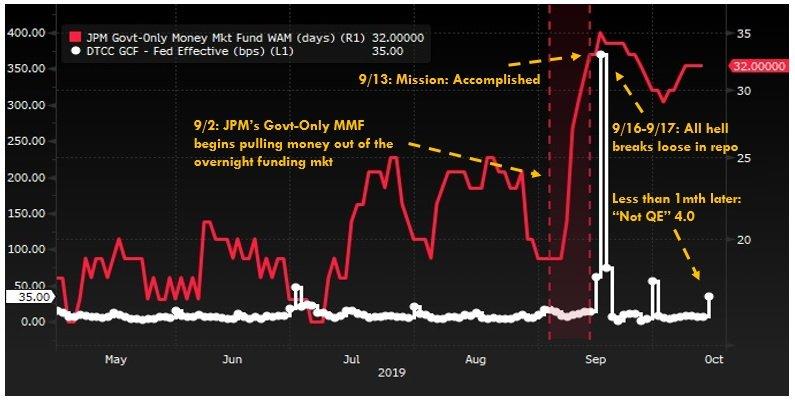

About a month ago, we first laid out how the sequence of liquidity-shrinking events that started about a year ago, and which starred the largest US commercial bank, JPMorgan, ultimately culminated with the mid-September repo explosion. Specifically we showed how JPM’s drain of liquidity via Money Markets and reserves parked at the Fed may have prompted the September repo crisis and subsequent launch of “Not QE” by the Fed in order to reduce its at risk capital and potentially lower its G-SIB charge – currently the highest of all major US banks.

Shortly thereafter, the FT was kind enough to provide confirmation that the biggest US bank had been quietly rotating out of cash, while repositioning its balance sheet in a major way, pushing more than $130bn of excess cash away from reserves in the process significantly tightening overall liquidity in the interbank market. We learned that the bulk of this money was allocated to long-dated bonds while cutting the amount of loans it holds, in what the FT dubbed was a “major shift in how the largest US bank by assets manages its enormous balance sheet.”

The moves saw the bank’s bond portfolio soar by 50%, and were prompted by capital rules that treated loans as riskier than bonds. And since JPM has been aggressively returning billions of dollars to shareholders in dividends and share buybacks each year, JPMorgan had far less room than most rivals to hold riskier assets, explaining its substantially higher G-SIB surcharge, which indicated that the Fed currently perceives JPM as the riskiest US bank for a variety of reasons.

…click on the above link to read the rest of the article…