Banks Seek Lower Credit Score Requirements, Targeting Over 50 Million New Subprime Borrowers

When the next bubble bursts – and it will – be sure to take a look back at this article. It might help explain some things. Lenders, seemingly unhappy with the vast avalanche of debt they’ve issued over the last decade, are now looking to “move the goalposts” in order to be able to lend even more money to even less creditworthy individuals.

Gone are the old days of relying on a consumer’s borrowing history to determine creditworthiness, and instead lenders now look at such bizarre trivia as magazine subscriptions and phone bills to decide how much should be lent to potential borrowers. Banks like Goldman Sachs Group, Ally Financial and Discover are now experimenting with the new metrics.

The changes are seismic for many large banks, who spent the last 10 years targeting only extremely credit-worthy borrowers. But, as we all know too well, when that pool runs out the show must go on by any means possible. And that is how we got to no-doc loans and subprime CDOs just before the last bubble burst.

At stake is a lot of potential money: banks are targeting the estimated 53 million U.S. adults that don’t have credit scores and 56 million that have subprime scores. The banks claim that many of these people don’t have traditional borrowing backgrounds, often times because they pay in cash or are new to the U.S. That doesn’t make them bad debt slaves prospects, however. Quite the opposite.

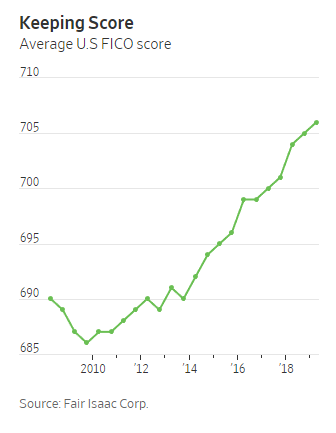

The timing also couldn’t be any better: US consumer debt is higher than ever, as Americans continue to borrow in order to finance everything from cars, college, housing and medical care.

…click on the above link to read the rest of the article…