Chinese 10yr bond yields have been rising steadily since October 2016. They never reached the low or negative levels of Japan or Germany. 1yr bonds bottomed earlier at 1.76% in June 2015 having tested 1% back in 2009.

The pattern and path of Chinese rates is quite different from that of US Treasuries. Last month rates increased to their highest since 2014 and the Shanghai Composite index finally appears to have taken notice. The divergence, however, between Shanghai stocks and those of the US is worth investigating more closely.

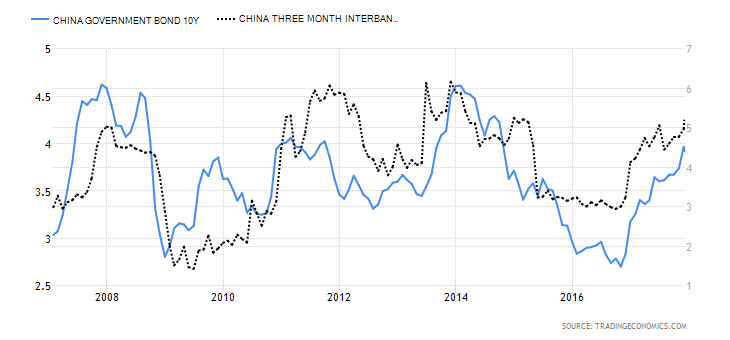

The chart below shows the yield on 10yr Chinese Government Bonds since 2007 (LHS) and the 3 month inter-bank deposit rate over the same period (RHS):-

Source: Trading Economics

From a recent peak in 2014, yields declined steadily until October 2016, since when they have begun to rise quite sharply.

The next chart shows the change in yield of Government bonds and AAA Corporate bonds across the entire yeild curve:-

Source: PBoC

The dates I chose were 29th September – the day before the People’s Bank of China (PBoC) announced their targeted lending plan. The 22nd November – the day before the Shanghai index reversed and 6th December – bringing the data set up to date.

The general observation is simply that yields have risen across the maturity spectrum, but the next chart, showing the change in the spread between government and corporate paper reveals some additional nuances:-

Source: PBoC

Spreads have generally widened as monetary conditions have tightened. The widening has been most pronounced in the 30yr maturity. The widening of credit spreads may be driven by the prospect of $1trln of corporate debt which is due to mature between now and 2019.

Another factor may be the change in policy announced by the PBoC on September 30th. Bloomberg – China’s Central Bank Unveils Targeted Lending Plan to Aid Growth provides an excellent overview:-

…click on the above link to read the rest of the article…