Why Real Reform Is Now Impossible

The endless bleating of well-paid pundits in the corporate media about “reform” is just more circus.

It’s difficult for well-meaning pundits to abandon the fantasy that meaningful reform is possible. Indeed, a critical function of the punditry and corporate media is to foster the fantasy that the status quo could be reformed if only we all got together and blah blah blah.

As I explain in my new book Why Our Status Quo Failed and Is Beyond Reform, real structural reform would trigger the collapse of the status quo. (As a reminder, the status quo benefits the few at the expense of the many.)

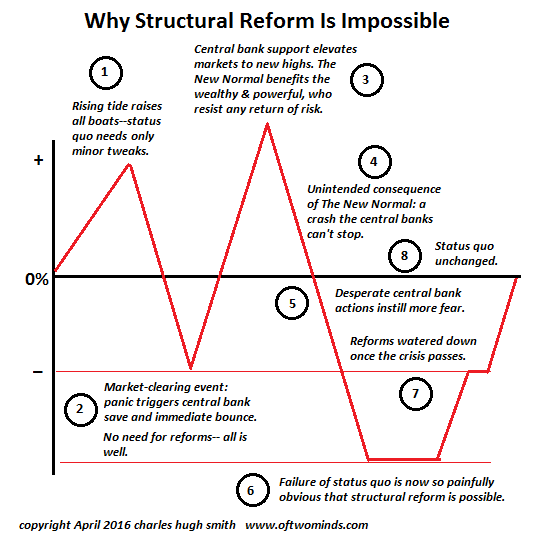

But there’s another dynamic that makes reform impossible. I’ve prepared a chart to explain this dynamic:

Central banks have transformed the market–in stocks, bonds, commodities and risk–into the signaling mechanism that tells us all is well. Even though the real-world finances of the bottom 95% continue deteriorating, a rising stock market and suppressed measures of risk signal that the economy is doing well. If you’re not doing well, it’s your personal problem; the status quo is fine and needs only minor tweaks.

Elevating the market into the oracle of economic health creates a systemic risk: If the market tanks, the status quo is called into question. People start asking, is it truly a wonderful arrangement that benefits us all, or is it really just a skimming machine that funnels money and wealth from the many into the voracious maws of the few?

Central banks thwart this existential danger to the status quo by rescuing the market every time it approaches the market clearing event level. (see chart) In a market clearing event, risky loans and bets are liquidated, credit dries up, risk soars and the price of assets falls to levels that once again make fundamental sense.

…click on the above link to read the rest of the article…