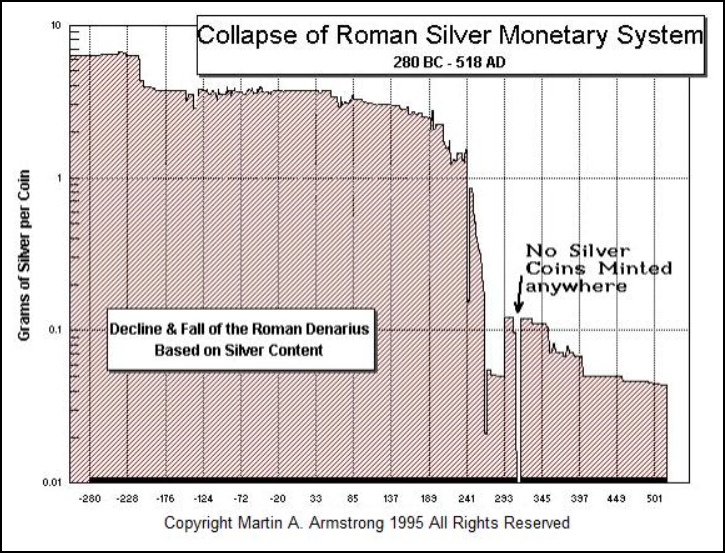

We must remember, a collapse does not happen overnight, but the endgame does. This can be clearly seen in the collapse of the Roman Monetary System:

As we can see from the chart above, the devaluation of the Roman coin, the Silver Denarius, started slowly about 50 AD. This continued until the silver value of the Denarius plummeted in 241. This had a profound impact on the population of Rome, shown in the chart below:

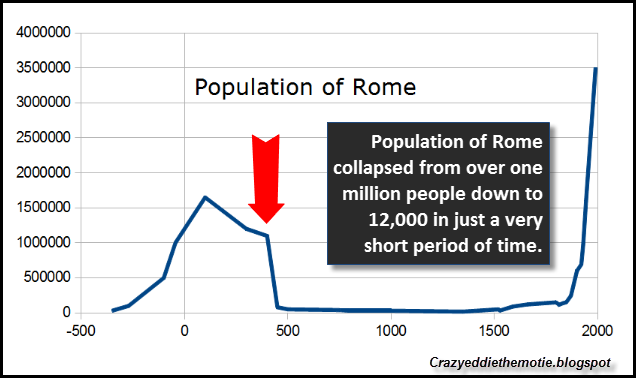

You will notice the population of Rome peaked at approximately 1.6 million people about 100 AD, started to slowly decline, and fell off a cliff at the end of the 5th century. The population of Rome fell from over one million people to 12,000 in a very short period of time. Thus, the collapse of the Roman Monetary System paralleled the disintegration of Rome itself.

What took place in Ancient Rome, is also taking place in our global modern high-tech world. When Nixon dropped the convertibility of the U.S. Dollar into gold in 1971, a few years later… the gold futures markets started trading. No longer was the world’s reserve currency backed by gold, instead the Dollar was valued against the gold price traded on the futures exchanges.

Number Of Owners Per Ounce Of Registered Gold Goes Exponential

Again, to have a properly functioning futures exchange, there has to be available supply of metal. However, if we look at the long-term trend of Registered Gold inventories at the Comex, something looks painfully wrong here:

…click on the above link to read the rest of the article…