Foreign Investors Bail out of Canada’s Money Machine

On first sight, it wasn’t that bad. Statistics Canada reported today that in September, foreign (non-resident) investors purchased C$3.3 billion of Canadian securities – adding C$3.2 billion in equities and C$0.9 billion in bonds to their holdings while getting rid of C$0.8 billion in money market instruments.

But in July and August, foreign investors had dumped large quantities of equities. While they bought Canadian bonds during those two months, it wasn’t enough.

So for the third quarter overall, foreigners dumped C$9.2 billion of Canadian equities; “the highest such decline since the first quarter of 2013,” Statistics Canada pointed out. They also dumped C$4.5 billion of money market instruments (private corporate paper and federal government business enterprise paper). And they picked up C$12.8 billion of bonds.

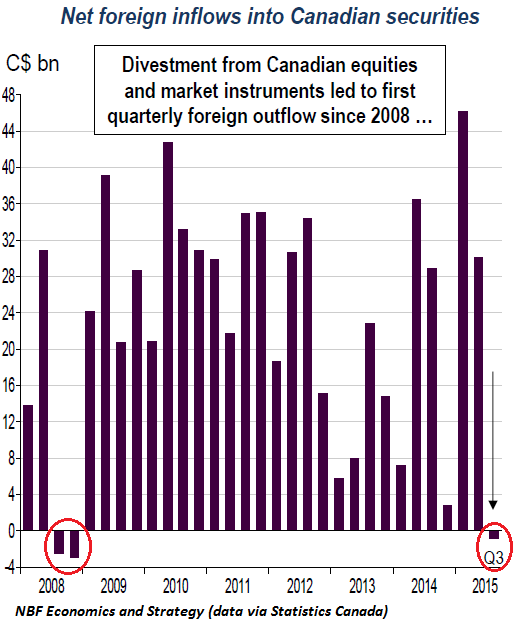

This makes for a total outflow of C$0.9 billion in the third quarter, the first such outflow of foreign investment from Canadian securities since 2008.

The data is very volatile, as the chart by NBF Economics and Strategy, a division of the National Bank of Canada, shows. But it had been volatile only with positive numbers, with increases of foreign investment, ever since that ignominious year 2008. So when this net quarterly outflow does occur, as it did in 2008 and in Q3 2015, it’s a sign of something larger:

“Canada seems to be less alluring to foreign investors these days,” NBF explains.

It doesn’t help that Canadian stocks, as measured by the TSX, are dominated by the energy and mining sector and by former hedge-fund and mutual-fund darling and now deposed Canadian superstar Valeant. So the TSX has gotten clobbered, down 14% since April.

And the Bank of Canada has been in interest-rate-cutting mode this year. Its intention has been to beat down the Canadian dollar even more, which it accomplished. In late October, it hit $0.748, its lowest level against the USD since July 2004.

…click on the above link to read the rest of the article…