Bankers Threaten Fed with Layoffs if it Doesn’t Raise Rates

“Let me assure you, if the revenue environment weakens or interest-rate structures don’t move up and the economy slows down, we’ll have to take out more costs,” Bank of America CEO Brian Moynihan said on Thursday at the Barclays Global Financial Services Conference. And that would mean more job cuts.

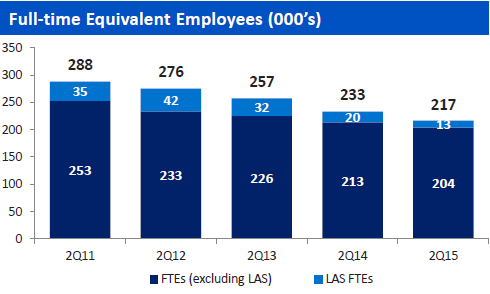

BofA is famous for whittling down its headcount in recent years. In Moynihan’s 25-slide presentation, there was this chart that shows just how skillfully he has trimmed down his workforce, chopping it by 25% overall since the second quarter of 2011:

So if, as he said, “interest-rate structures don’t move up,” there would be more of the same. These interest-rate structures are the result of the Fed’s zero-interest-rate policy. The purpose of this policy suddenly isn’t the wealth effect any longer – Bernanke’s stated purpose – but ironically, as Chair Yellen claimed today somewhat defensively, to “put people back to work.”

Not get them axed from banking jobs.

Banks try to make money in a myriad newfangled ways. But the classic way is on the spread between the interest they pay on deposits and the interest they charge on loans. A wide spread fattens their profits. But these spreads have become paper-thin.

Banks can get all the money they need from the Fed at near-zero cost. They don’t need depositors, and there is no competition for depositors. So, in one of the biggest scams in history, depositors get next to nothing from banks around the country. And the banks’ cost of money is near zero.

…click on the above link to read the rest of the article…