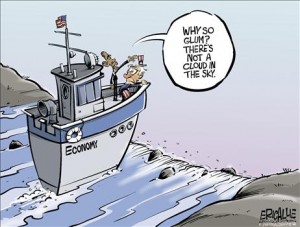

The US and world economies are frauds that are coming unraveled. The Greek bailout is the most recent example of “kick the can down the road” solutions. The US housing bubble was an attempt to cover up/recover from the dot-com bust. Now the US is in a financial bubble engineered to recover from the housing bubble debacle. Soon this bubble will burst. Only the date is unknown.

The US and world economies are frauds that are coming unraveled. The Greek bailout is the most recent example of “kick the can down the road” solutions. The US housing bubble was an attempt to cover up/recover from the dot-com bust. Now the US is in a financial bubble engineered to recover from the housing bubble debacle. Soon this bubble will burst. Only the date is unknown.

Two predictions can be made with reasonable confidence:

- The stock market is likely to be halved and that might be optimistic. Only the date is unknown.

- The economy will eventually resemble the Great Depression. Only the date is unknown.

Nothing is ever certain. An experienced CFO told me at the beginning of my career that “even the impossible has a 20% probability.” In deference to him and years of empirical evidence, I put the the above two events as virtually certain, i.e., an 80% probability.

The Current Problem

Phoenix Capital provided reasons to expect horrible outcomes:

- The REAL problem for the financial system is the bond bubble. In 2008 when the crisis hit it was $80 trillion. It has since grown to over $100 trillion.

- The derivatives market that uses this bond bubble as collateral is over $555 trillion in size.

- Many of the large multinational corporations, sovereign governments, and even municipalities have used derivatives to fake earnings and hide debt. NO ONE knows to what degree this has been the case, but given that 20% of corporate CFOs have admitted to faking earnings in the past, it’s likely a significant amount.

- Corporations today are more leveraged than they were in 2007. As Stanley Druckenmiller noted recently, in 2007 corporate bonds were $3.5 trillion… today they are $7 trillion: an amount equal to nearly 50% of US GDP.

…click on the above link to read the rest of the article…