Here’s Why Our Monetary System is a Giant Ponzi Scheme

Ponzi schemes keep going until the perpetrator is stopped from the outside. They never stop by of their own volition. Bernie Madoff kept going until it all blew up.

In the year 2000 the Nasdaq composite exceeded a P/E of 200 before collapsing 78% by October 2002. The more successful a Ponzi the more egregious the bubble and resultant pain. The granddaddy of Ponzi — far greater than anything we’ve seen before — is our monetary system.

Let’s consider what money is. It is a technology that allows us to produce and consume not just in the present but across time.

It is, for this reason, that it needs to provide both a medium of exchange as well as a store of value. If for example a transaction needs to be made over a crop cycle then the value of the money needs to remain sufficiently stable over that time frame to allow the participants to make an exchange and not come out underwater. This benefits neither party to the transaction because, while in the short term party A may get an excellent deal from party B, if the deal is so “excellent” as to bankrupt party B, then no future commerce will be done and overall production declines causing less supply and a fall in the overall standard of living.

The money needs to be useful to both parties. In prisons they use cigarettes. Even if you don’t smoke enough inmates do and the cigarettes don’t change (consistency) and so they form a money.

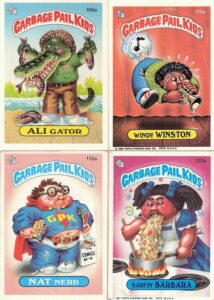

Of course, over time we’ve used all sorts of things used as money: gold, silver, copper, even slaves. At primary school I used to use marbles and Garbage Pail Kids (ah, those were the days).

…click on the above link to read the rest of the article…