The #1 Question I am Receiving From Readers

Could the markets crash again?

This is the #1 question I’m receiving from subscribers. When I ask them why they’re concerned, the #1 explanation is that the economy is in a recession/depression and yet stocks are close to or have already hit new all-time highs.

Let’s dissect this way of thinking…

First and foremost, we need to dispel the myth that the stock market and the economy are closely related.

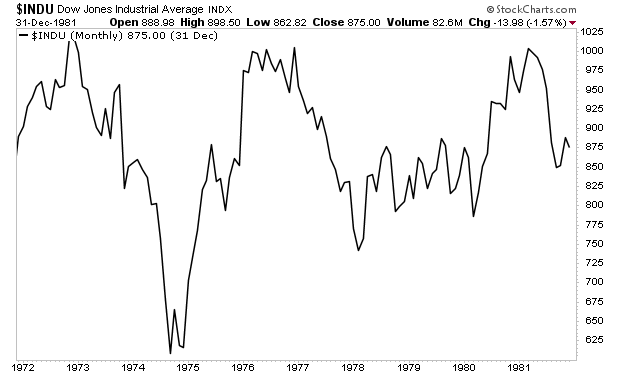

As Puru Saxena has noted, between 1972 and 1982, the US economy nearly tripled in size from $1.2 trillion to $3.2 trillion. And yet, throughout that entire period the stock market traded sideways for ZERO GAINS!

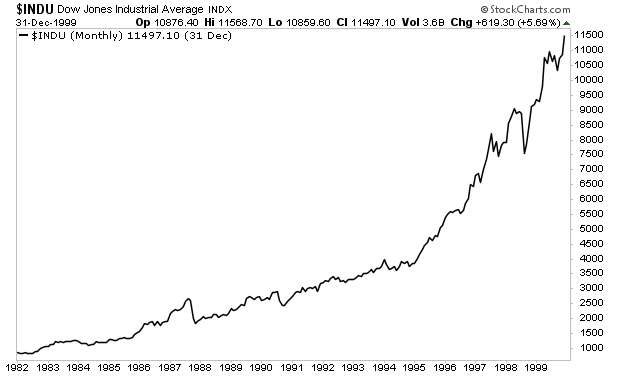

In contrast, from 1982 to 2000, the US economy again nearly tripled in size from $3.2 trillion to $10 trillion. But during this particular time, the stock market exploded higher rising nearly 1,500%!

So, we have two time periods in which the economy nearly tripled in size. During one of them, the stock market went nowhere, while during the other, the stock market rose nearly 1,500%.

Again, stocks have little if any correlation to the economy. There are times when stocks will care a lot about the economy, but those time periods are usually short and due to an unexpected surprise (like the surprise of the economy being shut down to deal with the COVID-19 pandemic).

So, what do stocks care about?

Liquidity.

Historically, whenever central banks start printing money at a rapid clip, stocks do well. A great example of this is the time period from 2008 to 2016 when the economy was weak at best and flatlining at worst. But because the Fed printed over $3.5 trillion during this time period, socks soared, rising over 100%.

Which brings us to today… stocks are rallying hard yet again, despite the economy being extremely weak.

The reason for this is because of the TSUNAMI of liquidity policymakers are throwing at the financial system.

…click on the above link to read the rest of the article…