Postmortem of the Infamous Day WTI Crude Oil Futures Went to Heck in a Straight Line

The US Energy Information Agency (EIA) dissects the historic event.

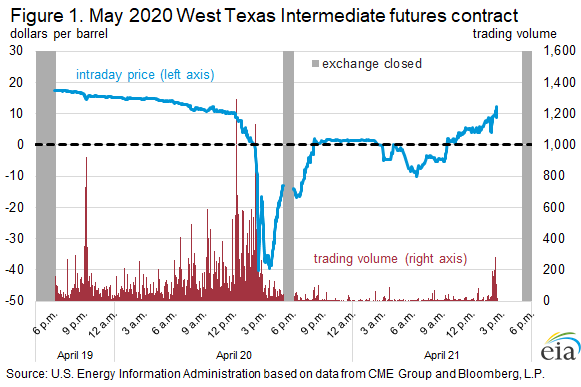

“It’s not often that we’re served up a WTF moment like this,” I wrote on April 20, when the May contract for crude-oil benchmark-grade West Texas Intermediate (WTI) plunged to minus -$37.63 in a straight line, thus violating the WOLF STREET beer-mug dictum that “Nothing Goes to Heck in a Straight Line.” It was the first time in history that a US crude oil futures contract plunged into the negative. The peculiar dynamics that came together and caused this are expected to continue and some of them are expected to get worse over the next month or two. So here is the postmortem of this infamous day, by the US Energy Information Agency (EIA).

By the Energy Information Agency:

WTI crude oil futures prices fell below zero because of low liquidity and limited available storage.

On Monday, April 20, 2020, New York Mercantile Exchange (NYMEX) West Texas Intermediate (WTI) crude oil front-month futures prices fell below zero dollars per barrel (b)—at one point, trading at -$40.32/b (Figure 1)—and remained below zero for part of the following trading day. Monday marked the first time the price for the WTI futures contract fell below zero since trading began in 1983.

Negative prices in commodity markets are very rare, but when they occur they typically indicate high transactions costs and significant infrastructure constraints.

In this case, the WTI front-month futures contract was for May 2020 delivery, and the contract was set to expire on April 21, 2020. Market participants that hold WTI futures contracts to expiration must take physical delivery of WTI crude oil in Cushing, Oklahoma.

…click on the above link to read the rest of the article…