Lacalle: Is Now The Time To Buy Gold?

In this interview Daniel Lacalle explains why the fundamentals for gold are stronger each day, and why silver and palladium should not be ignored in the current crisis.

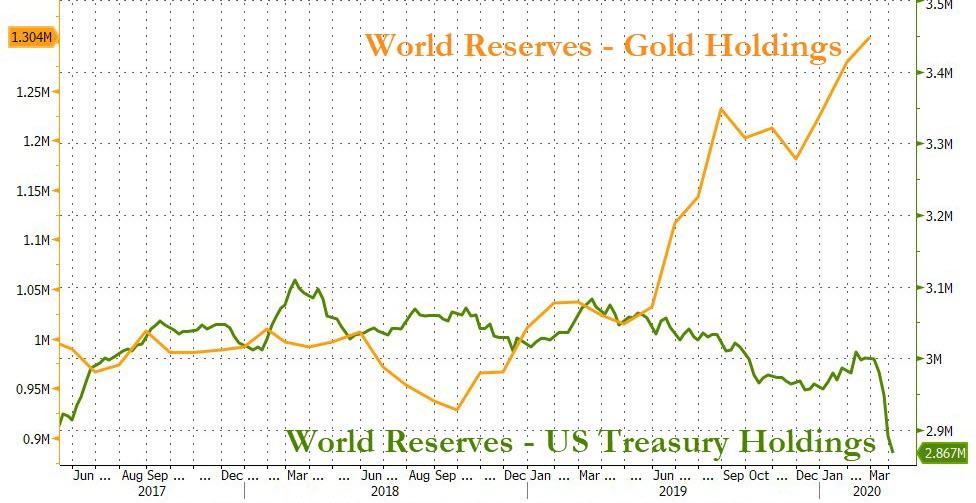

Central banks keep buying more gold and will need even more as massive liquidity measures drive their balance sheets higher.

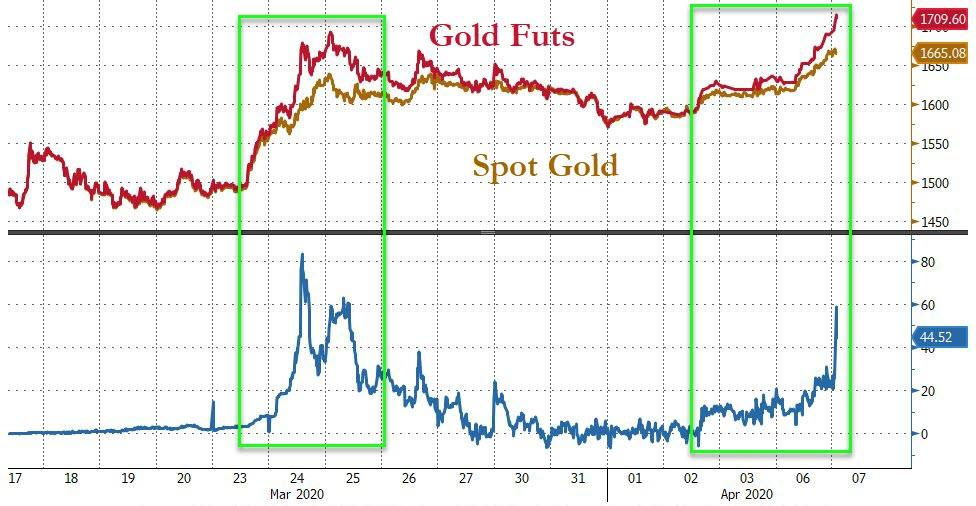

Supply challenges remain with some mines being shut down and new supply coming well below demand (as evidenced by the decoupling – once again – between spot and futs)…

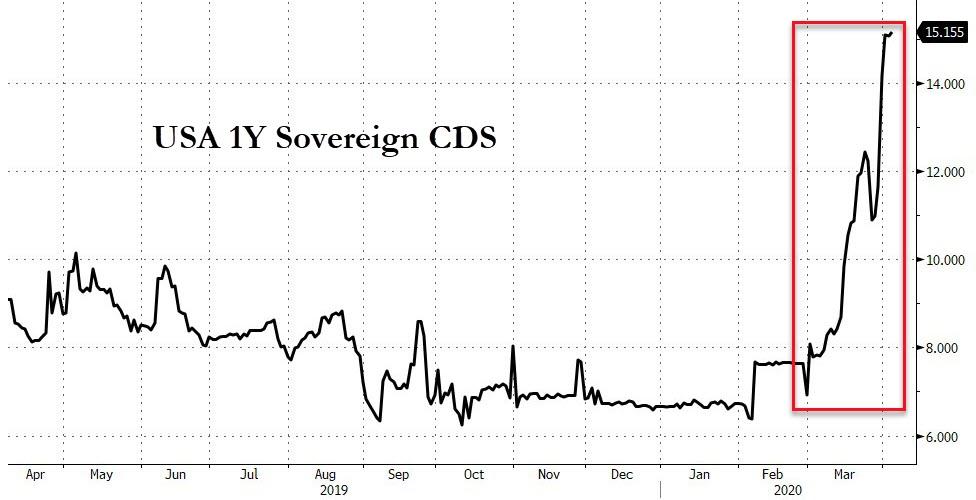

Massive monetary imbalances globally will drive demand from investors looking for a hedge to currency debasement (and that systemic risk is soaring, with sovereign credit markets starting to leak information)…

* * *

Finally, we give the last word to Raoul Pal and his most recent thoughts (excerpted) on “A Dollar Standard Crisis” (referring to his institutional market research at Global Macro Investor)…

….

Don’t forget – the $13tn short dollar positions (foreign dollar debt held mainly by foreign corporation and investment vehicles) is the largest position ever taken in the history of global financial markets.

It can only mean a massive, uncontrolled dollar rally.

QE will not fix this. Swap lines will not fix this. A debt jubilee would fix this or multiple trillions of dollars in write-downs and defaults.

It is the dollar strength that brings to world to its nadir (just like the 1930s). It is the dollar system that is the really big problem.

The dollar has eaten all of its competitors and now it is going to eat itself.

This eventually breaks the dollar after a super-spike as global central banks are forced to find alternatives.

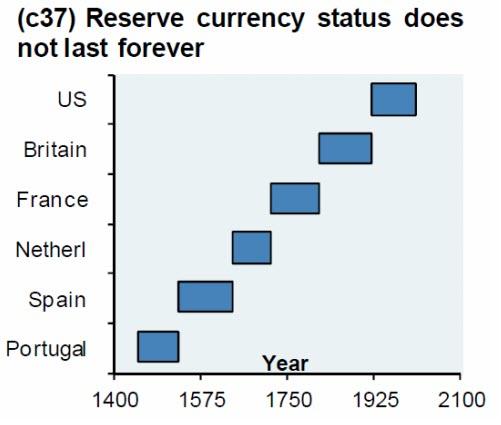

Remember, nothing lasts forever…