Russian Central Bank buying Gold on the International market?

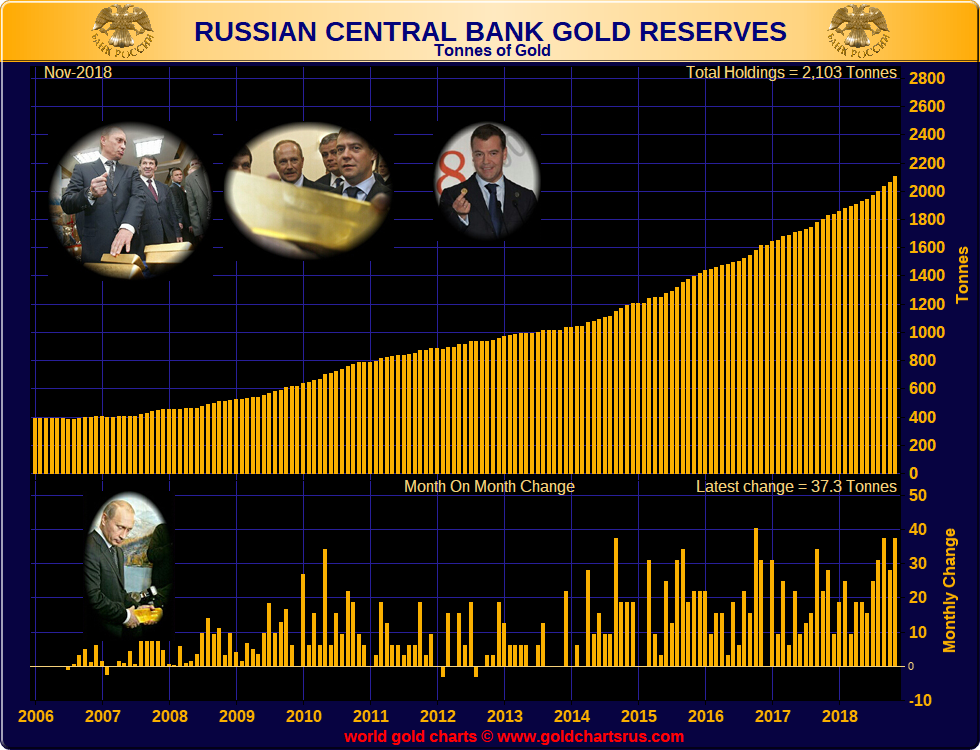

For a number of years now and even more so during 2018, the central bank of the Russian Federation, the Bank of Russia, has remained in the spotlight as one of the world’s largest gold buyers, each month adding substantial amounts of gold to its monetary gold stockpiles.

Having bought another 37.3 tonnes of gold (1.2 million ounces) during November, and Bank of Russia now holds 2103 tonnes of monetary gold. On a year-to-date basis (for the 11 months from January to November 2018), the Russian central bank has added an incredible 264.3 tonnes of gold to its monetary reserve assets.

A key feature of the Russian gold market is that the Bank of Russia has a policy of sourcing its gold from domestic gold mining companies by using large Russian commercial banks such as Sberbank and VTB Bank as intermediaries.

The commercial banks finance the gold mining producers with development credits and loans. The miners then repay the banks with the gold they mine. After the gold is sent for refining to Russian gold refineries, the large commercial banks sell the refined gold (in bar form) to the central bank, which in turn stores the gold bars in the Bank of Russia’s storage vaults in Moscow and St Petersburg. Sounds simple in theory and even in practice. But this model only works smoothly as long as gold demand from the central bank is less than domestic gold mine supply. When demand is greater than supply, the marginal gold demand has to be sourced elsewhere.

All the mined gold and then some

…click on the above link to read the rest of the article…