Why I Think this Sell-Off is Just One Step in Methodical Unwind of Stock Prices

One after the other, individual stocks are getting crushed.

It was an ugly Monday and Tuesday followed by a Wednesday that at first look like a real bounce but ended with the indices giving up their gains. This was followed, mercifully, by Thursday when markets were closed, which was followed unmercifully by Friday, during which the whole schmear came unglued again.

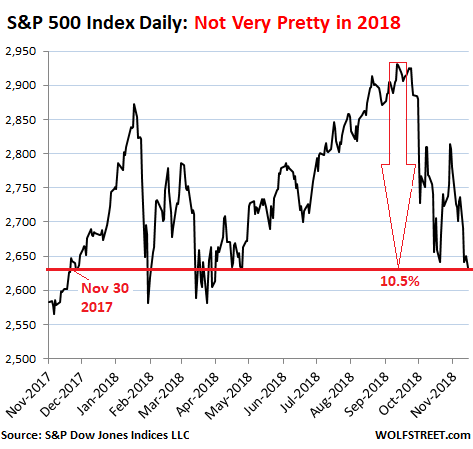

The S&P 500 index dropped 0.7% on Friday to 2,632 and 3.8% for Thanksgiving week, though this week is usually – by calendar black-magic – a good week, according to the Wall Street Journal: During Thanksgiving weeks going back a decade, the S&P 500 rose on average 1.3%.

This leaves the S&P 500 index 1.5% in the hole year-to-date. It’s now back where it had first been on November 30, 2017:

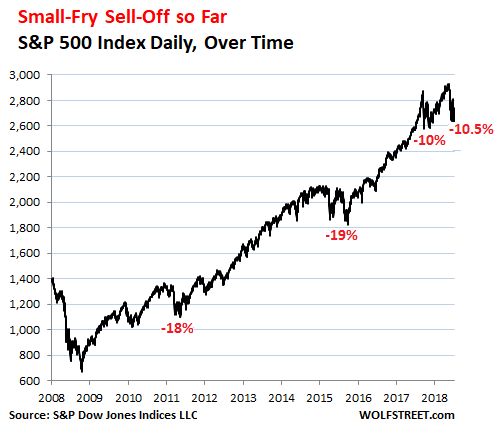

Clearly, when seen over the longer term, the sell-off for now still belongs to the small-fry among sell-offs, with S&P 500 down just 10.5% from its peak:

The Dow dropped 0.7% on Friday and 4.4% during Thanksgiving week, to 24,286. It’s 1.75% in the hole for the year. Technically speaking, it’s not even in a correction, being down only 9.9% from its peak.

And the Nasdaq, dropped 0.5% on Friday and 4.3% during Thanksgiving week. According to the Wall Street Journal, during Thanksgiving week over the past 20 years, the Nasdaq rose on average 1.3%. So this is no good for calendar-black-magic aficionados. Where’s the free-wheeling holiday spirit?

The Nasdaq is now down 14.7% from its peak at the end of August but remains up 0.5% year-to-date.

The Russell 2000 small-caps index edged down today and is down 14.5% from its peak on August 31. It’s 3% in the hole year-to-date and right back where it had first been on September 27, 2017:

…click on the above link to read the rest of the article…