Bankrupting OPEC… One Million Barrels Of Oil At A Time

The largest OPEC oil producer and exporter, Saudi Arabia, has seen its Foreign Currency reserves plummet over the past two years… and the liquidation continues. For example, Saudi Arabia’s foreign exchange reserves declined another $2 billion in December 2016 (source: Trading Economics).

Now, why would Saudi Arabia need to liquidate another $2 billion of its foreign exchange reserves after the price of a barrel of Brent crude jumped to $53.3 in December, up from $44.7 in November?? That was a 13% surge in the price of Brent crude in one month. Which means, even at $53 a barrel, Saudi Arabia is still hemorrhaging.

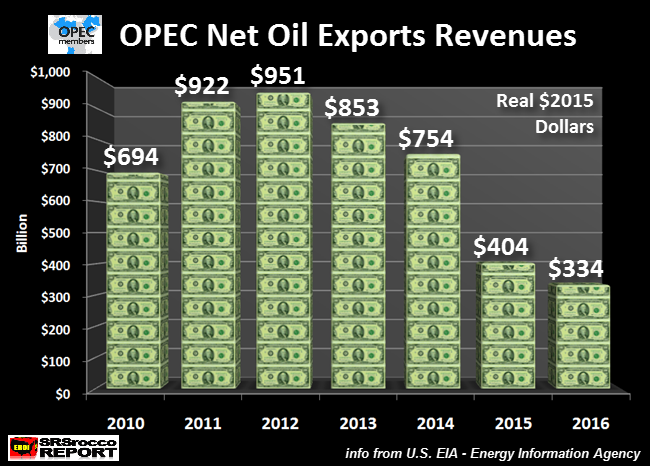

Before I get into how bad things are becoming in Saudi Arabia, let’s take a look at the collapse of OPEC net oil export revenues:

The mighty OPEC oil producers enjoyed a healthy $951 billion in net oil export revenues in 2012. However, this continued to decline along with the rapidly falling oil price and reached a low of $334 billion in 2016. As I mentioned before, this was a 65% collapse in OPEC oil revenues in just four years.

The last time OPEC net oil export revenues was this low was in 2004. OPEC oil revenues that year were $370 billion based on average Brent crude price of $38.3. Compare that to $334 billion in oil revenues in 2016 on an average Brent crude price of $43.5 a barrel.

This huge decline in OPEC oil revenues gutted these countries foreign exchange reserves. Which means, the falling EROI- Energy Returned On Investment is taking a toll on the OPEC oil exporting countries bottom line. A perfect example of this is taking place in Saudi Arabia.

…click on the above link to read the rest of the article…