Global Corporate Debt is Coming Unglued

Standard & Poor’s slashed the credit ratings of 112 corporations around the globe to default (D) or selective default (SD) in 2015, according to S&P Capital IQ Global Credit. The highest number of global defaults since nightmare-year 2009, when a previously unthinkable 268 companies defaulted, and not far behind the second highest default tally of 125, in 2008.

The oil & gas sector led with 29 defaulters (26% of the total). Metals, mining, and steel followed with 17 defaulters (15% of the total). The consumer products sector and the bank sectors tied for the third place, each with 13 defaulters (12% of the total).

So where are the defaulters? In Russia and Brazil? The economies of both countries have been ravaged by deep recessions and other problems. They rank high on the list but the country with most of the defaulters is… the US.

In total, 66 defaulters were US issuers, up 100% from 33 in 2014, and the highest since 2009. US defaulters accounted for 59% of the global total. Some of this dominant share of defaulters can be attributed to the size of the US economy and the enormous size of its credit market. But the US is also the epicenter of oil & gas defaults, with contagion now spreading to other sectors.

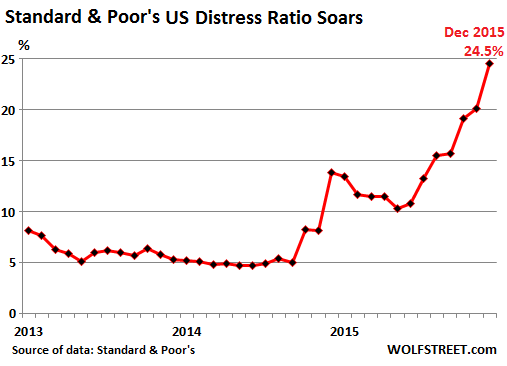

An indication of what’s coming in 2016 is the Standard & Poor’s Distress Ratio. It’s the proportion of junk-rated bonds with yields that exceed Treasury yields by at least 10 percentage points (option-adjusted spread). And this Distress Ratio soared in December to 24.5%, up from around 5% in 2014. There are now 437 bond issues tangled up in the ratio:

Of those 437 bond issues in the Distress Ratio, 127 have been issued by oil & gas companies. The metals, mining, and steel sector has 71 bond issues in the ratio. The remaining 239 issues are spread over other sectors. And a number of these distressed issuers will default down the line. So defaults in the US are likely to get even uglier in 2016.

…click on the above link to read the rest of the article…