Perpetual Debt, Perpetual War

It’s always useful to visit the museum in order to offset the recency bias that distorts perceptions of current realities.

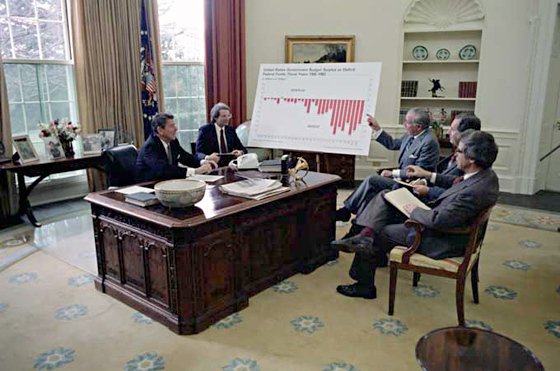

In the great scheme of things, the picture below is admittedly not that ancient – from just 42 years ago. But it is nevertheless a museum piece because it pertains to a matter that has long since faded from the scene. Namely, the public debt and in this instance the day when your editor was compelled to warn the Gipper that the Federal debt was about to cross the dreaded one trillion dollar mark.

Back then, that prospect gave one and all the fiscal heebie-jeebies. Massive public debt was viewed as an immoral imposition on future generations and an economic scourge on the present. That’s because when properly financed in the bond pits it drove up interest rates, thereby crowding-out household and business borrowers and economic growth and rising prosperity on main street.

No more. Massive fiscal deficits year-after-year have become a way of life in the Imperial City, but even then CBO’s latest 10-year forecast is a shocker. It shows that even if there is no recession for the next ten years (fat chance!) and existing tax and spending policies (dashed red line) remain in place without enactment of a single new spending program or tax cut (even fatter chance!), the deficit will exceed $3 trillion per year by the end of the decade.

That would amount to a structural deficit equal to 8.4% of GDP and a ticket to fiscal perdition. In dollar terms, it would add $20.3 trillion to the public debt over the next decade, taking the total debt to $50 trillion by 2032.

…click on the above link to read the rest of the article…