Since spring 2013, the Fed has been playing with the idea of raising rates, which it had suppressed to basically zero percent in December 2008. So far, however, it has not taken any action. Upon closer inspection, the reason is obvious. With its policy of extremely low interest rates, the Fed is fueling an artificial economic expansion and inflating asset prices.

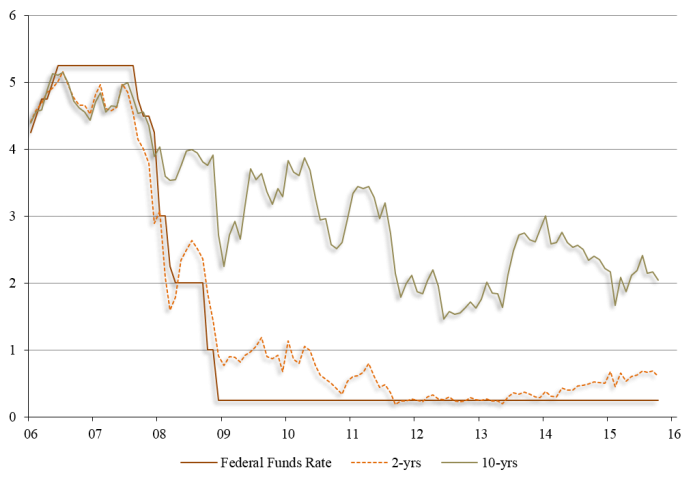

Selected US Interest Rates in Percent

Source: Thomson Financial

Raising short-term rates would be like taking away the punch bowl just as the party gets going. As rates rise, the economy’s production and employment structure couldn’t be upheld. Neither could inflated bond, equity, and housing prices. If the economy slows down, let alone falls back into recession, the Fed’s fiat money pipe dream would run into serious trouble.

This is the reason why the Fed would like to keep rates at the current suppressed levels. A delicate obstacle to such a policy remains, though: If savers and investors expect that interest rates will remain at rock bottom forever, they would presumably turn their backs on the credit market. The ensuing decline in the supply of credit would spell trouble for the fiat money system.

To prevent this from happening, the Fed must achieve two things. First, it needs to uphold the expectation in financial markets that current low interest rates will be increased again at some point in the future. If savers and investors buy this story, they will hold onto their bank deposits, money market funds, bonds, and other fixed income products despite minuscule yields.