Industrial production over the long term is a sad sight, powered by offshoring.

Industrial production – manufacturing output, oil-and-gas extraction, mining, and gas and electric utilities – fell 1.3% in September from August, pushed down by production of motor vehicles and parts, which plunged 7.2% for the month, and by oil and gas extraction, which fell 3.8%.

Manufacturing of motor vehicles and parts has been hobbled all year by supply semiconductor shortages that have led to rotating shutdowns of parts manufacturing operations and assembly plants. The shortages continued to get worse – despite assurances earlier this year that they would be over with by Q4.

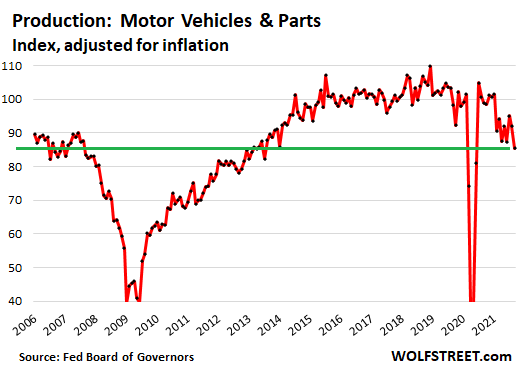

The manufacturing production index for motor vehicles and parts, adjusted for inflation, dropped to a value of 85.4. Beyond the collapse of production during the lockdown, it was the lowest output value since 2013 and was back where it had been in 2006:

Motor vehicle and parts manufacturing started hitting new highs in 2014 on an annual basis and continued to grow and peaked in 2018, before dipping in 2019 and plunging in 2020. This year promises to be rough too.

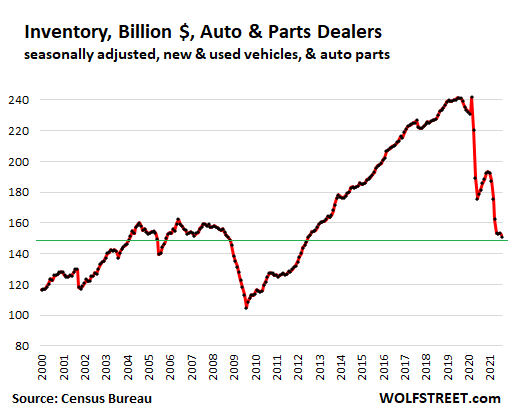

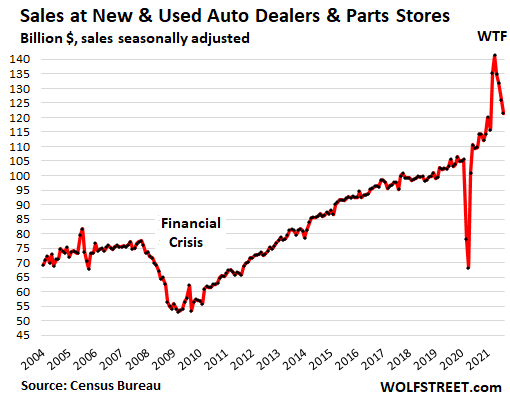

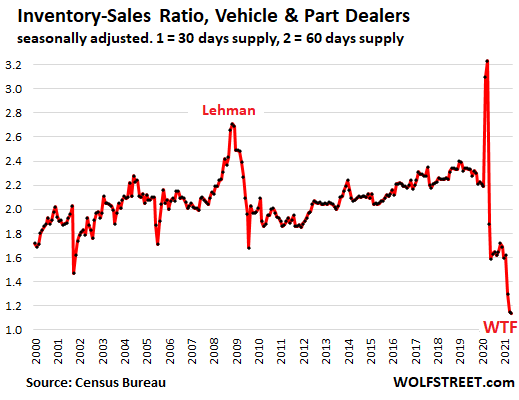

Unlike the Great Recession collapse of production of motor vehicles and parts – which was driven by a collapse in demand that caused GM and Chrysler and many component makers to file for bankruptcy – the drop in production this year was driven by supply shortages. The drop in production, amid strong demand, has caused inventories at auto dealers to be essentially depleted.

In an effort to keep their plants running, automakers have built large numbers of nearly finished vehicles that are missing a part of two and were put on storage lots until those parts arrive. Then the finished vehicles are shipped to dealers. In Q3, GM shipped over 68,000 of those vehicles to dealers.

…click on the above link to read the rest of the article…