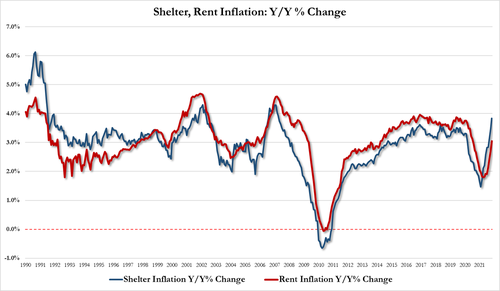

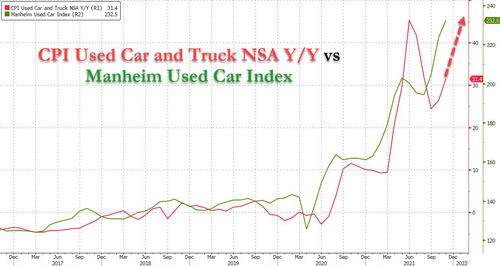

With investors closely eyeing two major data releases this week on inflation—one on producer input costs and the other on consumer prices—Wells Fargo analysts say it’s unlikely sticker-shock-weary consumers will see relief as the persistent supply-side crunch will “keep fanning the flames on inflation in the near term.”

On Tuesday, the Labor Department will release data for October’s producer price index (PPI), which tends to front-run consumer inflation data as at least some production costs get passed on to consumers. Economists expect a year-over-year rise of 8.7 percent in the PPI inflation measure, which would be the highest reading in the history of the series. Last month’s PPI came in at 8.6 percent, a record high.

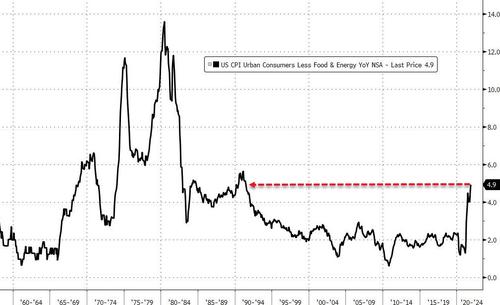

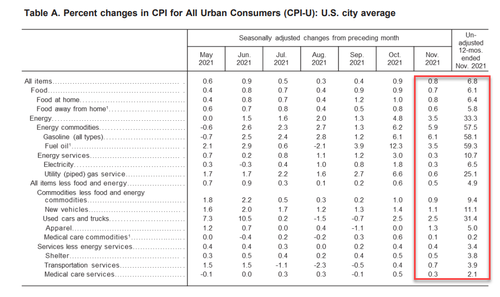

And on Wednesday, the Labor Department will issue figures for October’s consumer price index (CPI), a key measure of inflation from the perspective of end consumers of goods and services. Consensus forecasts predict a year-over-rise of 5.3 percent in the CPI inflation gauge for October, with the prior month’s rise amounting to 5.4 percent, near a 30-year high.

On a month-over-month basis, CPI is expected to clock in at 0.5 percent, according to consensus forecasts released by FXStreet, though Wells Fargo analysts expect inflation was running hotter.

“Consumer Price Index report for the month of October is unlikely to offer much of a reprieve on the inflation front,” Wells Fargo analysts wrote in a note, in which they predict a 0.6 percent month-over-month increase in the CPI index. “If realized, this would put headline CPI inflation at 5.9 percent year-over-year.”

…click on the above link to read the rest of the article…