Home » Posts tagged 'jerome powell' (Page 4)

Tag Archives: jerome powell

The Fed is Lying to Us

The Fed is Lying to Us

“When it becomes serious, you have to lie”

The recent statements from the Federal Reserve and the other major world central banks (the ECB, BoJ, BoE and PBoC) are alarming because their actions are completely out of alignment with what they’re telling us.

Their words seek to soothe us that “everything’s fine” and the global economy is doing quite well. But their behavior reflects a desperate anxiety.

Put more frankly; we’re being lied to.

Case in point: On October 4, Federal Reserve Chairman Jerome Powell publicly claimed the US economy is “in a good place”. Yet somehow, despite the US banking system already having approximately $1.5 trillion in reserves, the Fed is suddenly pumping in an additional $60 billion per month to keep things propped up.

Do drastic, urgent measures like this reflect an economy that’s “in a good place”?

The Fed’s Rescue Was Never Real

Remember, after a full decade of providing “emergency stimulus measures” the US Federal Reserve stopped its quantitative easing program (aka, printing money) a few years back.

Mission Accomplished, it declared. We’ve saved the system.

But that cessation was meaningless. Because the European Central Bank (ECB) stepped right in to take over the Fed’s stimulus baton and started aggressively growing its own balance sheet — keeping the global pool of new money growing.

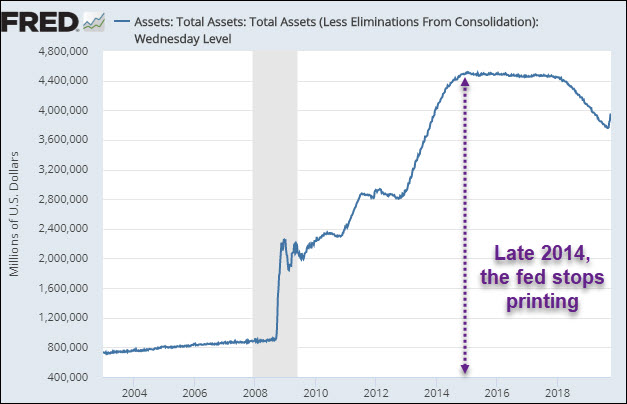

Let’s look at the data. First, we see here how the Fed indeed stopped growing its balance sheet in 2014:

And we can note other important insights in this chart.

For starters, you can clearly see how in 2008, the Fed printed up more money in just a few weeks than it had in the nearly 100 years of operations prior.

…click on the above link to read the rest of the article…

Is Powell Playing Fed Games?

Is Powell Playing Fed Games?

The Federal Reserve will be adding assets to its balance sheet again, but Powell insists it’s not “quantitative easing”

The Federal Reserve will be adding assets to its balance sheet again, but Powell insists it’s not “quantitative easing”James GorrieWRITEROctober 10, 2019 Updated: October 10, 2019Share

Apparently, the “repo market” purchases by the Federal Reserve we discussed earlier this week —which don’t count as quantitative easing (QE)—were just the beginning of the new, non-quantitative easing but money printing period.

Fed “repos,” you may recall, are now necessary to boost weak overnight liquidity reserves of the big banks and don’t permanently expand the Fed’s balance sheet, unless they go on forever, in which case they would be QE. Now they are more of a short-term bail-out.

It’s Time for “Non-Quantitative Easing”

But in his Tuesday speech, Federal Reserve Chairman Jerome Powell explained that for the first time in five years, the “time is now upon us” for the Fed to resume buying U.S Treasury bills and bonds. That means that come November, the American economy will officially enter into another period of quantitative easing, you know, the Fed buying assets to expand its balance sheet.

Or not.

Typically, when the Federal Reserve buys Treasury assets, it’s because of weakness, either in the economy or in the financial system. A weakness that needs to be papered over by money printing, expanding the Fed’s balance sheet and bank reserves. Or the Fed buys other assets that nobody wants to buy at a decent price, like the purchases of mortgage backed securities (MBS) it conducted after the financial crisis.

…click on the above link to read the rest of the article…

Peter Schiff: Negative Interest Rates Are Boneheaded

Peter Schiff: Negative Interest Rates Are Boneheaded

Donald Trump has been badgering Federal Reserve Chairman Jerome Powell for months, begging for lower interest rates. Yesterday, he took things to another level, saying that the “boneheads” at the Fed need to push rates into negative territory.

In his podcast, Peter Schiff said negative interest rates are boneheaded.

Trump used a pair of tweets to push for negative interest rates.

The Federal Reserve should get our interest rates down to ZERO, or less, and we should then start to refinance our debt. INTEREST COST COULD BE BROUGHT WAY DOWN, while at the same time substantially lengthening the term. We have the great currency, power, and balance sheet………The USA should always be paying the the lowest rate. No Inflation! It is only the naïveté of Jay Powell and the Federal Reserve that doesn’t allow us to do what other countries are already doing. A once in a lifetime opportunity that we are missing because of ‘Boneheads.’

Peter said he can’t think a more boneheaded thing to do than to push interest rates negative.

Trump is basically saying negative rates would allow the federal government to refinance its debt. It could roll over short-term debt into longer termed bonds and lock up the low rates. But as Peter pointed out, interest rates are already near historic lows.

If President Trump actually cared about refinancing the national debt and lengthening the maturity of the debt – the duration – and locking in these low interest rates, lock them in! They’re already super low.”

Peter said if the Fed did cut rates to zero or lower, he thinks yields on long-term bonds would actually start to go up because the market would begin factoring in higher inflation.

…click on the above link to read the rest of the article…

Federal Reserve Chair Jerome Powell Insists There Won’t Be A Recession When All The Evidence Suggests Otherwise

Federal Reserve Chair Jerome Powell Insists There Won’t Be A Recession When All The Evidence Suggests Otherwise

It’s happening again. Just like last time around, the head of the Federal Reserve is telling us that there won’t be a recession even though all of the evidence suggests otherwise. Just before the recession of 2008, Federal Reserve Chair Ben Bernanke told the country that “the Federal Reserve is not currently forecasting a recession”, and shortly thereafter we plunged into the worst economic downturn since the Great Depression of the 1930s. This time, it is Federal Reserve Chair Jerome Powell that is attempting to prop things up by making positive statements that are not backed up by reality. Speaking to a group at the University of Zurich, Powell insisted that the Fed is “not at all” anticipating that there will be a recession…

Federal Reserve Chairman Jerome Powell said Friday that he doesn’t “at all” expect the U.S. to enter a recession, though he hinted the central bank will likely cut interest rates as expected this month.

“Our main expectation is not at all that there will be a recession,” Powell said in a panel discussion at the University of Zurich.

Meanwhile, things are literally falling apart all around us. Just a few days ago, I put together a list of 28 data points that clearly indicate that a recession is imminent, and since then we have gotten even more bad news.

For instance, we just learned that Fred’s will be filing for bankruptcy and closing more than 500 stores…

Discount merchandise retailer and pharmacy chain Fred’s filed for Chapter 11 bankruptcy Monday with plans to close all of its stores.

The company plans to liquidate its assets, punctuating a swift collapse of its operations that involved a cascading series of store closures in recent months.

…click on the above link to read the rest of the article…

Powell “Not Forecasting a Recession”

Powell “Not Forecasting a Recession”

In a speech today in Zurich Switzerland, Jerome Powell stated the Fed is not forecasting a recession.

YouTube Video of Zurich Conference

The Fed has never forecast a recession, even after they have started.

It reminds me of Bernanke’s denials on the housing bubble.

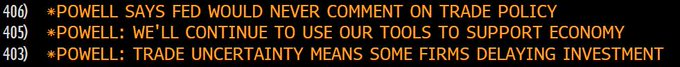

No Comment on Trade?

1st and 3rd appear a bit opposing.

Everything’s Fine

The Economy is great. The only thing adding to “uncertainty” is the Fake News!

Accurate Reader Comment

“Not only has the Fed never forecast a recession they’ve never forecast a crash or bubble. But that hasn’t stopped them from telling us we don’t have a bubble or crash on the horizon.”

Powell Doesn’t Change His Tune… And Rabobank Sees Fed Cutting To Zero

Powell Doesn’t Change His Tune… And Rabobank Sees Fed Cutting To Zero

- The tone of Fed Chairman Powell’s remarks in Zurich was similar to that of his speech in Jackson Hole. Powell repeated the statement that the Fed will ‘act as appropriate to sustain the expansion,’ which indicates that he is leaning toward a September rate cut.

- Earlier today, the Employment Report for August showed that the weakness in the manufacturing sector and business investment has spread to employment growth. This strengthens the case for an insurance cut in September, although Powell said that the labor market remained in quite a strong position.

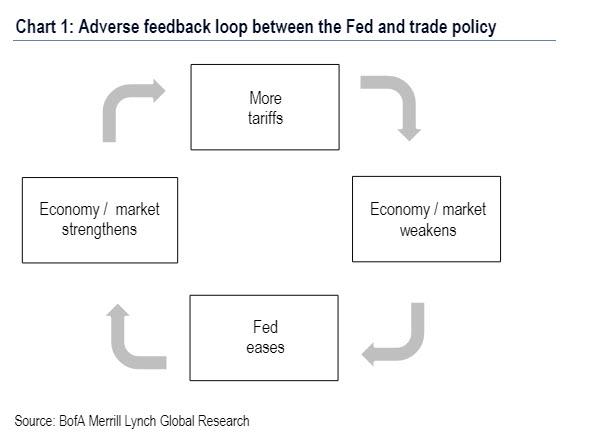

- In our view the feedback loop between trade policy and monetary policy is likely to lead to another insurance cut, probably in October. Meanwhile, the inverted yield curve points to a recession in 2020 that will force the Fed to cut rates all the way to zero before the end of 2020.

Powell doesn’t change his tune

Fed Chairman Jerome Powell did not bring a prepared speech to the SNB event at the University of Zurich today, instead he took part in a moderated Q&A with SNB President Thomas Jordan on the economic outlook and monetary policy. Powell said that the US economy is still in a good place and the most likely outlook remains favorable. However, there are the significant risks to the outlook: global economic growth, uncertainty about trade policy and persistently low inflation. He said that ‘As we move forward, we’re going to continue to watch all of these factors, and all the geopolitical things that are happening, and we’re going to continue to act as appropriate to sustain this expansion.’

…click on the above link to read the rest of the article…

In Unprecedented, Shocking Proposal, BOE’s Mark Carney Urges Replacing Dollar With Libra-Like Reserve Currency

In Unprecedented, Shocking Proposal, BOE’s Mark Carney Urges Replacing Dollar With Libra-Like Reserve Currency

After Jerome Powell’s neutral-to-slightly-dovish-but-mostly-boring speech on Friday morning, investors could be forgiven for suspecting that this year’s Fed-sponsored gathering in Jackson Hole might be disappointingly dull (especially with all that’s going on in Trump’s twitter feed, the escalating trade war and escalating geopolitical unrest).

Then along came former Goldman banker and current (outgoing) BOE governor, Mark Carney, who in his lunchtime address laid out a shocking, radical proposal – perhaps the most stunning thing to ever be unveiled at Jackson Hole – urging to replace the US Dollar with a “Libra-like” reserve currency in a dramatic revamp of the global monetary, financial and economic order.

While it was unclear if Carney was focusing on Libra as the new reserve currency, or simply was hoping to find something against which the dollar could be devalued, the proposal was clearly shocking as it suggests that the central bank quiet acceptance of cryptocurrencies (especially in Japan) has been what many have speculated all along: a “currency” against which fiat money can be devalued in hopes of sparking fiat hyperinflation that inflates away record amounts of fiat debt.

Of course, such a new system would bring about the end of US hegemony, and effectively end the dollar-based global financial system, dramatically scaling back the US’s influence in the global economy, and making rising powers like China and Russia critical players an increasingly multipolar world…. especially if they propose a gold-backed dollar alternative to the world. That this would quickly emerge as the new reserve currency – together with whatever stablecoin/crypto central bankers deign to be the dollar’s replacement – goes without saying.

…click on the above link to read the rest of the article…

This Is The Same Pattern The Fed Followed Before The Great Depression

This Is The Same Pattern The Fed Followed Before The Great Depression

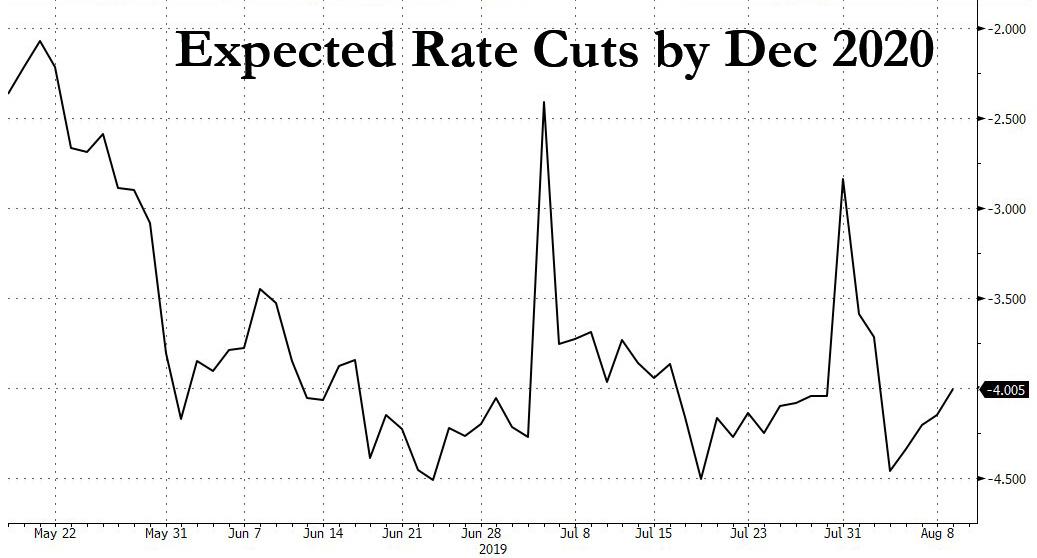

There is immense confusion surrounding July’s Federal Reserve meeting and the rather insane aftermath that has been spurred on in the trade war. The Fed’s latest rate decision of a mere .25 bps cut was seen as “disappointing”, this was then followed by Jerome Powell’s public statements making it clear that this was only a mid-year “adjustment”, and that it was not the beginning of a rate cutting cycle and certainly not the beginning of renewed QE. This shocked the investment world, which was expecting far more accommodation from the Fed after 7 months of built up expectations that the central bank was about to unleash the stimulus punch bowl again.

The question that very few people are asking, though, is why didn’t they? What is stopping them? Everyone from daytraders to the president wants them to do it, yet they continue to keep liquidity conditions tight. In fact, they even dumped another $36 billion in assets from their balance sheet in July. Why?

Keep in mind that the latest Fed decision does two things: First, it is an indirect admission that the U.S. is entering recession territory. Second, it is also an admission that the Fed doesn’t plan to do anything about it, at least, not until it’s too late. In other words, all those people who thought the central bank was about to kick the can on the current crash in economic fundamentals were wrong. As I have been predicting for many months, the Fed has no intention of trying to delay the effects of negative conditions any longer. The crash is now a reality that the mainstream will have to accept.

…click on the above link to read the rest of the article…

Powell Rate Cut Unleashes Volatility Tsunami

Powell Rate Cut Unleashes Volatility Tsunami

It wasn’t supposed to work this way.

In the rate cut playbook envisioned by Trump, Powell’s July 31st rate cut was supposed to send stocks higher while crushing the dollar. However, when the FOMC announce a “mid-cycle”, 25bps cut, the outcome was not only a surge in the dollar but also a surge in volatility not seen so far this year.

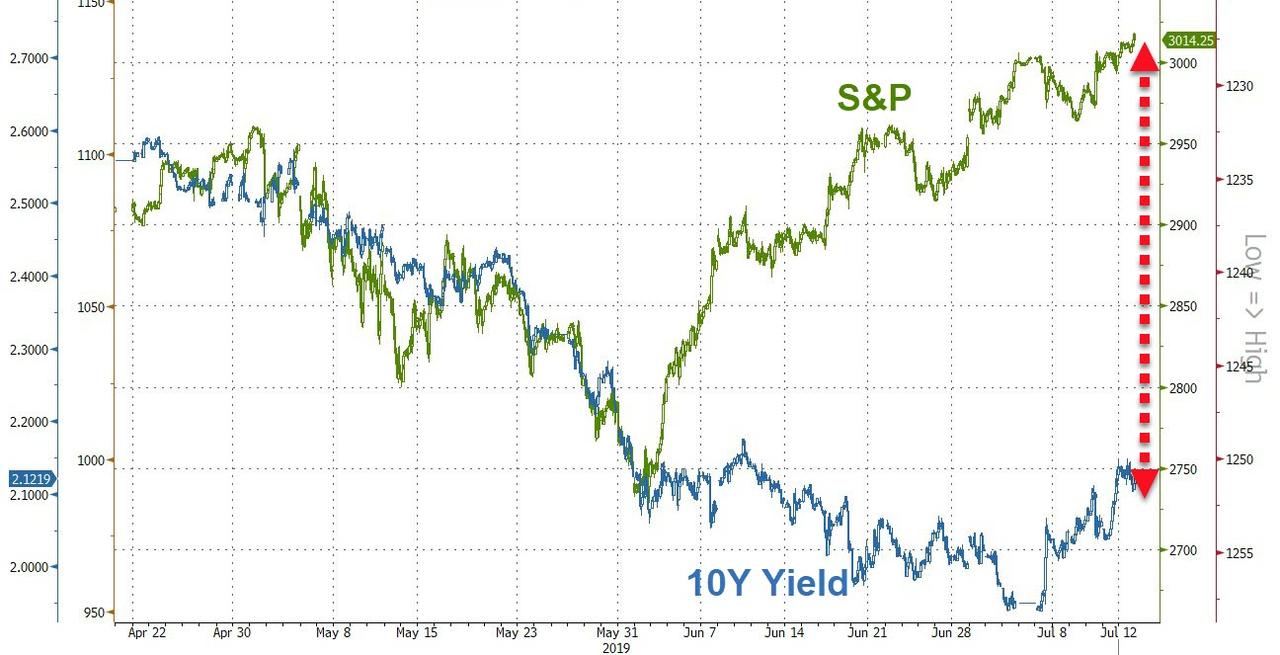

The sequence of events is familiar to all by now: at first, Powell’s rate cut spooked the market which had been expected either a 50bps cut, or an explicit promise of an easing cycle. It got neither, and neither did Trump, who the very next day realized that with the Fed now explicitly focusing on global uncertainties, read trade war, as a catalyst for future rate cuts as demonstrated by the following infamous chart…

…. decided to escalate the trade war with China by announcing 10% tariffs on the remaining $300BN in Chinese imports, sending stocks and bond yields plunging, and the market pricing in as much as 100bps of more rate cuts in 12 months, forcing Powell to cut far more than just another 25bps or so as the Fed Chair suggested in the July FOMC meeting.

China immediately retaliated by devaluing the Yuan below 7.00 for the first time since 2008 and halting US ag imports, which in turn prompted the US Treasury to declare China a currency manipulator. Meanwhile, China’s yuan devaluation means the White House is set to unveil even higher tariffs, resulting in an even weaker yuan, and so on, in a toxic feedback loop that may soon escalate the trade and currency war into an all-out shooting war.

…click on the above link to read the rest of the article…

If The Federal Reserve Cuts Interest Rates Now, It Will Be An Admission That A Recession Is Coming

If The Federal Reserve Cuts Interest Rates Now, It Will Be An Admission That A Recession Is Coming

So there is a lot of buzz that the Federal Reserve is about to cut interest rates – and it might actually happen. We’ll see. But if it does happen, it will directly contradict the carefully crafted narrative about the economy that the Federal Reserve has been perpetuating all this time. Fed Chair Jerome Powell has repeatedly insisted that the U.S. economy is in great shape even when there has been a tremendous amount of evidence indicating otherwise. And of course President Trump has been repeatedly telling us that this is “the greatest economy in the history of our country”, but now he is loudly calling for the Federal Reserve to cut interest rates as well. Something doesn’t seem to add up here. If the U.S. economy really was “booming”, there is no way that the Fed should cut interest rates. Right now interest rates are already low by historical standards, and theoretically it is during the “boom” times that interest rates should be normalized. But if the U.S. economy is actually slowing down and heading into a recession, then a rate cut would make perfect sense. And if that is the reality of what we are facing, then the economic optimists have been proven dead wrong, and people like me that have been warning of an economic slowdown have been proven right.

If the talking heads on television are correct, we’ll probably see a rate cut. In fact, apparently there are some people that are even pushing “for a 50 basis point cut”…

…click on the above link to read the rest of the article…

Why Powell Fears a Gold Standard

Why Powell Fears a Gold Standard

Chairman Powell’s testimony last week was closely scrutinized not just for its economic implications but also for its political overtones. Powell cited “trade tensions” as cause for concern about the strength of the global economy. He clearly seemed to be blaming President Trump’s tariffs.

But if the tariffs are what ultimately move the Fed to cut rates, Trump will have finally gotten what he wants out of Powell. In recent weeks, Trump has stepped up his attacks on the central bank, calling it the biggest problem facing the economy, floating the idea of firing Powell, and suggesting his administration would match China’s and Europe’s “currency manipulation game.”

Although many presidents before have pursued currency interventions and quibbled with Fed chairmen over interest rate policy, none have ever done it as openly and directly as the current one. Fed apologists in the media and in Congress view the central bank’s “independence” as being under assault.

The notion that the Fed ever was or could be independent of politics is a fanciful one. When a small group of people — appointed and confirmed by politicians — are empowered to make decisions that can make or break markets, economies, and elections, politics will inevitably intrude.

Fed chairman Jerome Powell may sincerely want to make monetary policy without regard to politics. But when political forces exert themselves on the Fed, he finds himself in an impossible catch-22. If he fails to cut rates, then the central bank risks becoming seen as the enemy of half the country as President Trump makes it his foil at campaign rallies. If Powell does what the President wants, then Democrats will accuse him of succumbing to political pressure from the White House.

…click on the above link to read the rest of the article…

Weekly Commentary: Central Banker to the World

Weekly Commentary: Central Banker to the World

July 11 – Bloomberg (Rich Miller): “Federal Reserve Chairman Jerome Powell is starting to sound a bit like he’s the world’s central banker. In Congressional testimony this week, he repeatedly cited a slower global economic expansion in laying out the case for easier U.S. monetary policy. ‘There’s something going on with the growth around the world, particularly around manufacturing and investment and trade,’ he told the House Financial Services Committee… as he all but promised an interest-rate cut at the end of this month.”

Chairman Powell was decisive. While not directly announcing an imminent cut, he essentially pre-committed to reducing rates at the July 31st meeting. Record stock prices don’t matter. Booming corporate Credit is no issue. June’s big gain in payrolls and a 3.7% unemployment rate are not part of the decision function. A Friday afternoon Bloomberg headline resonated: “A Stock Market Dying to Know What Powell Knows About the Economy.”

The so-called “insurance” rate cut is all about the global environment, with monetary policy’s traditional domestic focus relegated to history. The reduction will be justified by “crosscurrents,” “uncertainties” and below-target inflation. But is the global economy really in such bad shape to warrant preemptive monetary stimulus during a period of market ebullience? What Does Powell – and his cadre of global central bankers – Know?

China’s GDP is expected to expand between 6.0% and 6.5% this year. While slowing, growth throughout EM is forecast between three and four percent. Nothing to write home about, but euro zone GDP is expected to exceed 1.0% this year. Japan could see 3.0% 2019 GDP growth. Bank American Merrill Lynch today lowered their forecast for 2019 global GDP growth to 3.3% from 3.6%. Deserving of even lower rates and more QE?

…click on the above link to read the rest of the article…

“It’s Time To Say Goodbye To The Rally In Everything”

“It’s Time To Say Goodbye To The Rally In Everything”

It was nice while it lasted but the “Rally in Everything” inspired by the dovish Federal Reserve is likely coming to an end — thanks to the dovish Federal Reserve.

U.S. bonds and stocks have climbed together for most of 2019 as expectations for Fed easing led yields lower and underpinned equities.

Chair Jerome Powell threw a wrench in the works last week by actually putting the central bank on a path toward cutting interest rates.

It may be counter-intuitive, but a likely rate cut this month means long-term Treasuries are vulnerable. That’s because what the central bank ultimately wants is faster inflation, which will eat into demand for long-duration assets.

St. Louis Fed President James Bullard, who showed foresight by voting for a reduction in June, summed it up by saying he would like “to make modest moves to try to re-center inflation and inflation expectations at our 2% target.”

The 10- year TIPS break-even rates, the bond market’s measure of inflation expectations, are starting to reverse a two-month decline. Up to about 1.77% Friday from 1.62% in mid-June, they still have a way to go to get to 2%.

The June CPI report last week also seemed to vindicate Powell’s earlier assessment that some of the recent slowdown in inflation was transitory — the core rate of 2.1% matched the highest this year.

The Fed will likely be easing at a time when the broader economy, though slowing, is still chugging along. As Atlanta Fed President Raphael Bostic said “the aggregate numbers look pretty good.”

Long bonds, those most sensitive to inflation, are already suffering. A 30-year Treasury sale last week was a flop and yields rose to the highest since May. Meanwhile, the S&P 500 and Dow Jones Industrial Average both set record highs last week.

Stocks and bonds are beginning to move out of sync — look for the decoupling to continue.

Bizarro World: The Herd Has Truly Gone MadYou’re not crazy. The world we now live in is

Bizarro World: The Herd Has Truly Gone MadYou’re not crazy. The world we now live in is

Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.

~ Charles Mackay (1841)

Like me, you may often feel gobsmacked when looking at the world around you.

How did things get so screwed up?

The simple summary is: the world has gone mad.

It’s not the first time.

History is peppered with periods when the minds of men (and women) deviated far from the common good. The Inquisition, the Salem witch trials, the rise of the Third Reich, Stalin’s Great Purge, McCarthy’s Red Scares — to name just a few.

Like it or not, we are now living during a similar era of self-destructive mass delusion. When the majority is pursuing — even cheering on — behaviors that undermine its well-being. Except this time, the stakes are higher than ever; our species’ very existence is at risk.

Bizarro Economics

Evidence that the economy is sliding into recession continues to mount.

GDP is slowing. Earnings warnings issued by publicly-traded companies are at a 13-year high. The most reliable recession predictor of the past 50 years, an inverted US Treasury curve, has been in place for the past quarter.

Yet the major stock indices hit all-time highs earlier this week. And every one of the 38 assets in the broad-based asset basket tracked by Deutsche Bank was up for the month of June — something that has never happened in the 150 years prior to 2019.

It has become all-too clear that markets today are no longer driven by business fundamentals. Only central bank-provided liquidity matters. As long as the flood of cheap credit continues to flow (via rock-bottom/negative interest rates and purchase programs), keeping cash-destroying companies alive and enabling record share buybacks, all boats will rise.

…click on the above link to read the rest of the article…

Markets Might Hafta Grapple with “Patient”: Fed Rate Cut in July After This Inflation?

Markets Might Hafta Grapple with “Patient”: Fed Rate Cut in July After This Inflation?

Not a rate-cut economy.

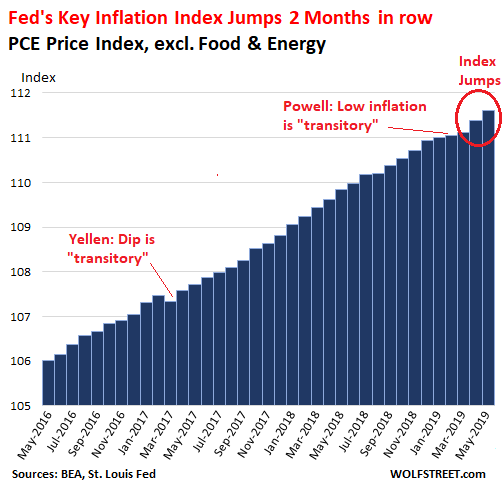

The inflation index that the Fed has anointed to be the yardstick for its inflation target – the PCE price index without the volatile food and energy components – rose 0.19% in May from April, according to the Bureau of Economic Analysis this morning. This increase in “core PCE” was near the top of the range since 2010. It followed the 0.25% jump in April, which had been the third largest increase since 2010:

Fed Chair Jerome Powell, at the press conference following the no-rate-hike FOMC meeting last week, gave a clear and succinct summary of the US economy. It was mostly in good shape, he said, in particular where it mattered the most: “All of the underlying fundamentals for the consumer-spending part of the economy, which is 70% of the economy, are quite solid,” he said.

He acknowledged that there were some problems, including the slowdown in manufacturing and the current bust in the vast US oil-and-gas sector, and that the Fed would be watching for further deterioration in the economy, before it would take action. But “low” inflation was another matter.

Sustained “low” consumer-price inflation – as the Fed defines it – worries the Fed, though it’s a godsent for consumers. If inflation, as measured by the core PCE price index, drops in a sustained manner below the Fed’s pain threshold, wherever that may be, the Fed would likely adjust monetary policy no matter what the economy does.

The Fed’s “symmetric” target is a 2% annual increase in the core PCE index, meaning the increase can fluctuate some above or below the target without causing the Fed to act.

…click on the above link to read the rest of the article…