Many of us would rather not think about the possibility of President Trump getting reelected, but there is little doubt that he is thinking about it.

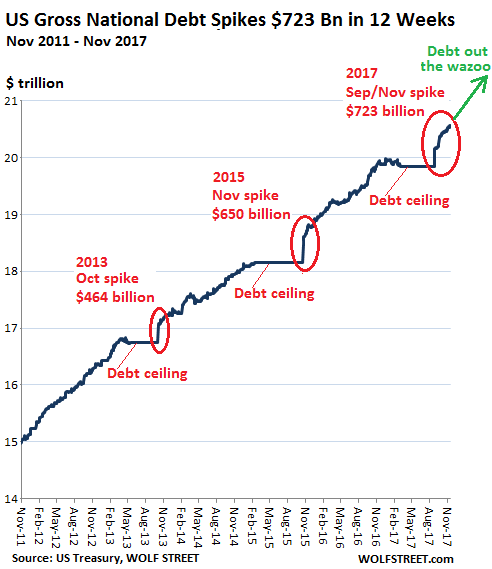

If Trump is serious about winning reelection, he may want to reconsider the sort of people he is appointing to the Federal Reserve. Virtually all political experts agree that a central factor in a president’s reelection prospects is the state of the economy in the year he or she is running. But Trump is appointing people who are likely to support rapid increases in interest rates, which very well could slow economic growth.

Unfortunately, most Americans don’t pay much attention to the Fed. People usually perceive its decisions about interest rates and inflation as affecting only Wall Street and big investor types. But the Fed has an enormous impact on the lives of ordinary workers. When it chooses to raise interest rates, as it has been doing for the last 15 months, it is making a conscious decision to slow the economy.

Higher interest rates discourage people from buying new cars and homes. Fewer home owners refinance mortgages. Businesses and state and local governments are less likely to borrow to invest in new factories, equipment and infrastructure. When growth slows, the economy has fewer jobs. The unemployment rate could stop falling and even rise. People with jobs also are worse off because they have less bargaining power in a weaker labor market. Their wages rise less rapidly and may not keep up with inflation.

The Fed and its leadership should matter to all of us, in other words.

Until the beginning of February, the central bank was led by Janet L. Yellen. Over the previous 15 months, Yellen, an Obama appointee, went along with four interest rate hikes, but she was much more cautious about rate increases than many other economists.

…click on the above link to read the rest of the article…