Below we consider how modern currency policy may not be so good for, well, the people…

This is why gold inevitably enters the conversation, for unlike policy makers, this old pet rock garners more trust.

Gold, of course, loves chaos, tanking currencies and cornered, debt-soaked nations, the numbers of which rise with each passing day.

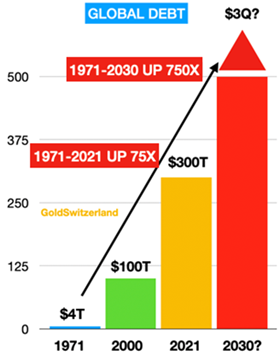

We see currency debasement as mathematically and historically inevitable, though we have no clue (no one really does) as to the precise date, trigger or time the already teetering fiat money systems fall over the global debt cliff.

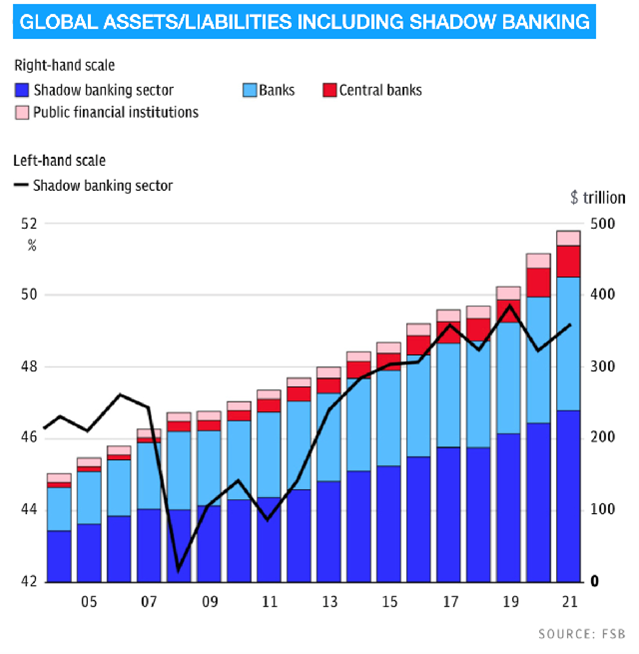

We only know that the $300+T cliff is here, and that nations are racing toward it at historical speed, with equally historical consequences.

Physical gold holders, however, enjoy a certain and calm advantage: They don’t need to be precise timers; simply patient owners.

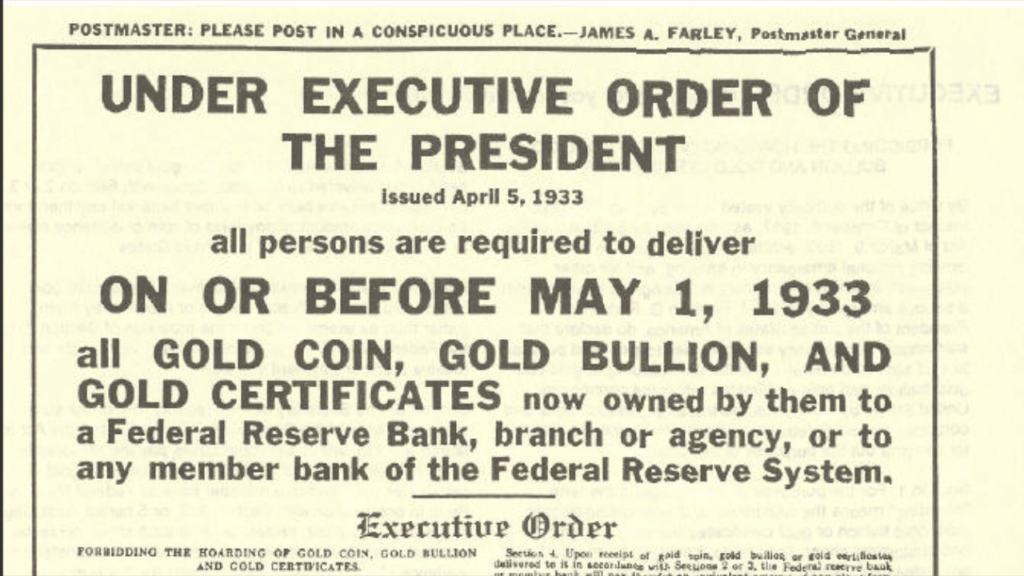

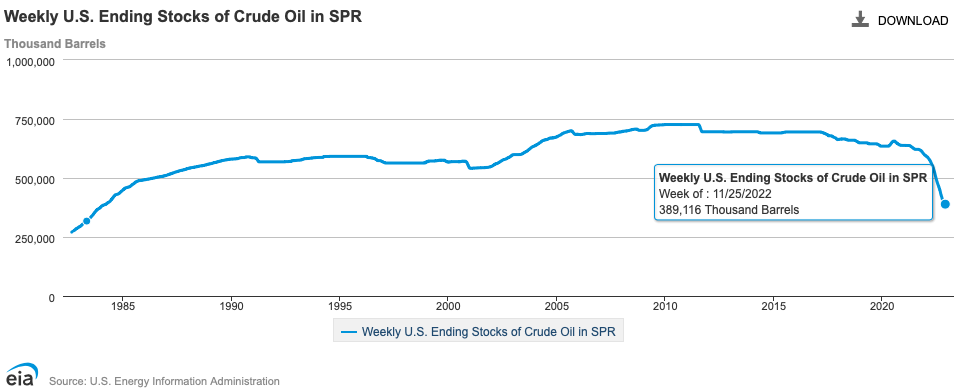

As for more signs of the move toward weakening currencies in general, and a weakening USD in particular, let’s look at some more history and current facts.

Hot vs. Financial Wars: Today’s Evidence, Tomorrow’s Polices

As headlines change with daily Western biases regarding the military war in Ukraine, America’s financial war with the East (i.e., China) will continue into the next generation.

It’s no secret to me, or many others, moreover, that the war in the Ukraine is a US proxy war against Russia, in which Ukraine (and its citizens) are merely a convenient battering ram against Putin.

That’s just my opinion, but we’ve seen this “freedom” movie before. Many times, and in many countries, none of which ended with much “freedom” …

But as to financial wars, they too are just an extension of politics by another means, and with the growing waves of de-dollarization rising in speed and height following the predictable ripple of effects of the 2022 sanctions against Russia…

…click on the above link to read the rest…