World reserve status allows for amazing latitude in terms of monetary policy. The Federal Reserve understands that there is constant demand for dollars overseas as a means to more easily import and export goods. The dollar’s petro-status also makes it essential for trading oil globally. This means that the central bank of the US has been able to create fiat currency from thin air to a far higher degree than any other central bank on the planet while avoiding the immediate effects of hyperinflation.

Much of that cash as well as dollar denominated debt (physical and digital) ends up in the coffers of foreign central banks, international banks and investment firms where it is held as a hedge or used to adjust the exchange rates of other currencies for trade advantage. As much as one-half of the value of all U.S. currency is estimated to be circulating abroad.

World reserve status along with various debt instruments allowed the US government and the Fed to create tens of trillions of dollars in new currency after the 2008 credit crash, all while keeping inflation under control (sort of). The problem is that this system of stowing dollars overseas only lasts so long and eventually the consequences of overprinting come home to roost.

The Bretton Woods Agreement of 1944 established the framework for the rise of the US dollar and while the benefits are obvious, especially for the banks, there are numerous costs involved. Think of world reserve status as a “deal with the devil” – You get the fame, you get the fortune, you get the hot girlfriend and the sweet car, but one day the devil is coming to collect and when he does he’s going to take EVERYTHING, including your soul.

…click on the above link to read the rest of the article…

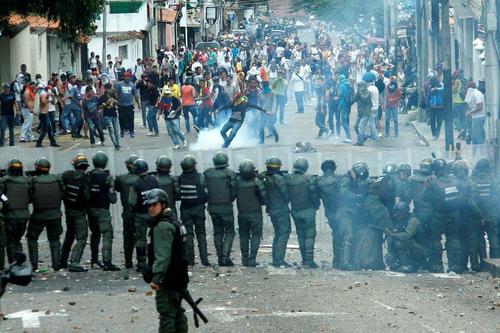

(Photo credit: Dalati Nohra/Handout via Reuters)

(Photo credit: Dalati Nohra/Handout via Reuters)