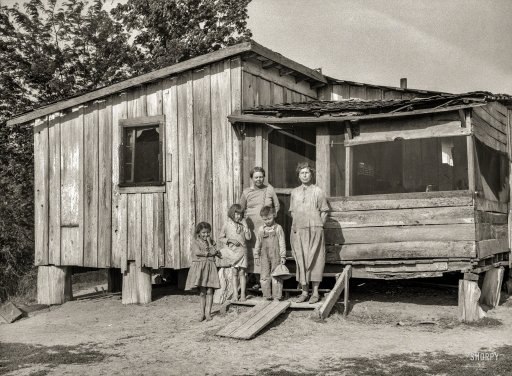

As we near the 10-year financial crisis anniversary, I would approach back slapping with caution. The key issue today is not whether central bank post-Bubble reflationary policies avoided a repeat of the Great Depression. Rather, did the unprecedented concerted – and protracted – global central bank response increase the likelihood of a more destabilizing future crisis – one where the dark forces of global depression might prove difficult to escape?

I’m not interested in bashing the BIS. They strive to have a balanced approach. Yet when reading through their insightful annual report it’s apparent that major holes remain in the contemporary central banking analytical framework. To their Credit, they do recognize the unprecedented buildup of global debt and imbalances. In my view, however, they fail to appreciate how central bankers these days continue fighting the last war.

…click on the above link to read the rest of the article…