Inflation Expectations Solidly On The Rise

|

| Expectations Can Drive Inflation |

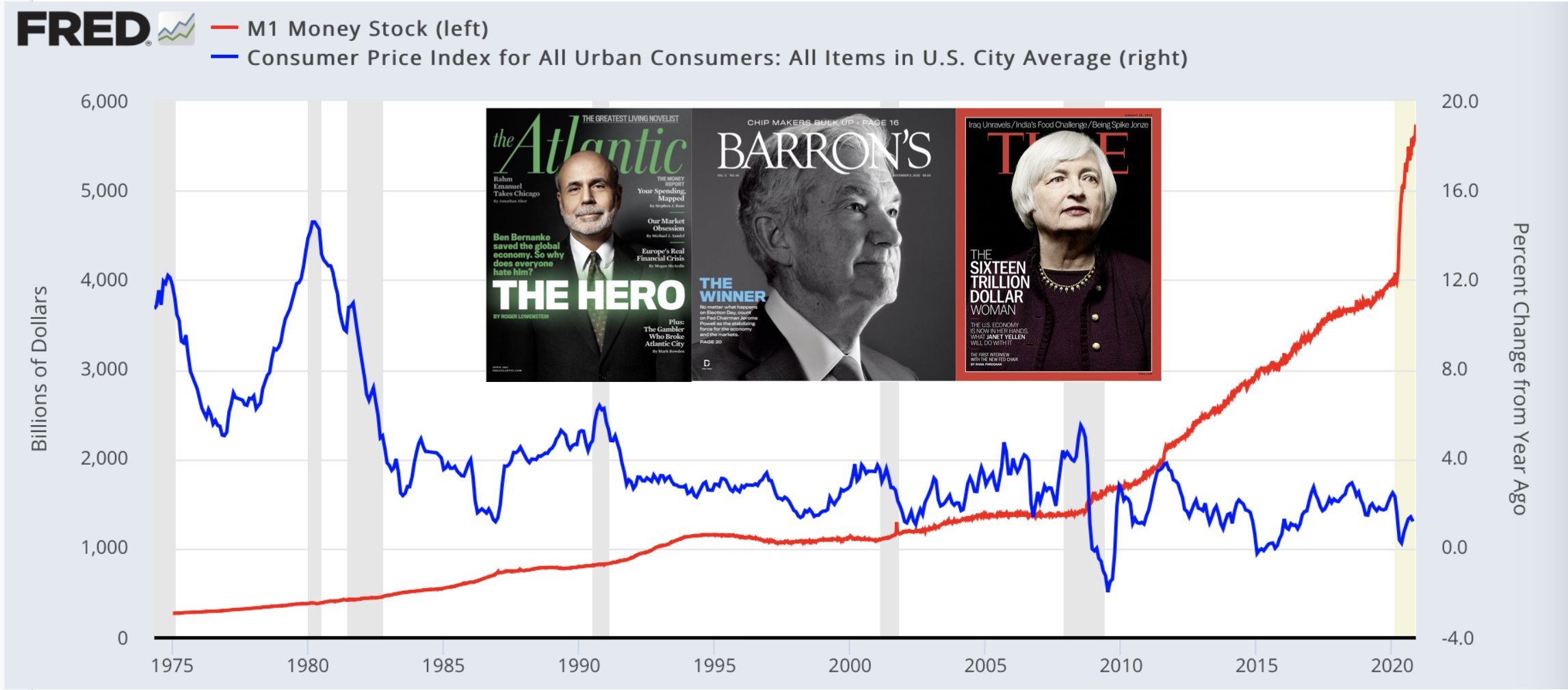

Inflation expectations appear to be solidly on the rise and that spells big problems for the financial system. For years the central banks across the world have claimed deflation has driven or allowed their QE policies to remain. This is central to their ability to stimulate. The moment inflation begins to take root or becomes apparent much of their flexibility in policy is lost. The 2% inflation target central banks have deemed optimum is not valid. This argument is becoming harder to make since many people now feel so much money pouring into the financial system is beginning to move inflation higher.

Up until now, the law of diminishing returns has required larger and larger amounts of stimulus to be thrown at the financial system each time the economy begins to turn down. The continued appointment of dovish and easy money advocates to positions in high finance does little to reinforce confidence in the fiat currencies on which we rely. The rising value and interest in precious metals and cryptocurrencies such as bitcoin stand as evidence investors are seeking alternatives to the fiat currencies issued by nations and central banks.

|

| At Some Point Inflation Will Raise Its Ugly Head |

In the past, I have put forth the idea that inflation could rule the day even if central banks are unable to keep the wheels on the bus and the economy collapses. This powerful force of inflation coupled with slow economic growth is known as stagflation. Like inflation, it can devastate those improperly invested when it moves onto play. It is important to remember the cost of all commodities, goods, and services do not move and the same rate or even necessarily in the same direction.

…click on the above link to read the rest of the article…