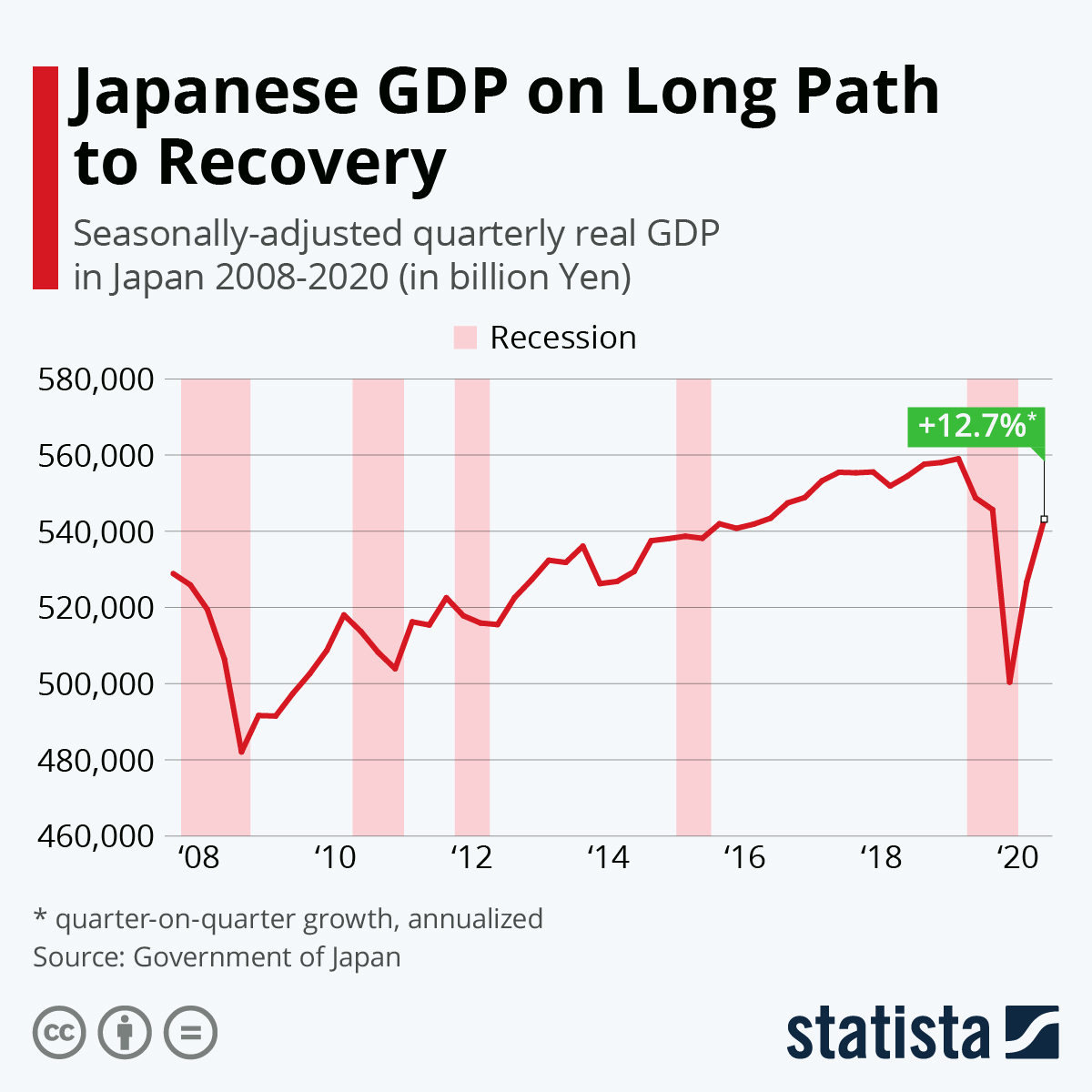

The financial system has entered uncharted waters and it would be wise to take nothing for granted. To assume the economy will move forward without a glitch in such an environment is extremely optimistic. With time, things change and evolve, this transformation can be seen in both society and the economy. We are constantly bombarded with charts showing where things are going based on historical references but a question we must ask is just how relevant today’s comparisons are with prior economic cycles?Over the decades we have moved from an agricultural-based society to an industrial-centered economy where manufacturing and services have become the dominant way of making a living. Now, we are rapidly moving in the direction of technology becoming the main driver of the economy and it is creating a huge cultural change. The economy is again undergoing a metamorphosis. Over time, we tend to forget or minimize in our minds that throughout history the growing pains flowing from such a change tend to batter society from every direction. These transformations also create a great deal of noise making it difficult to understand what is happening.

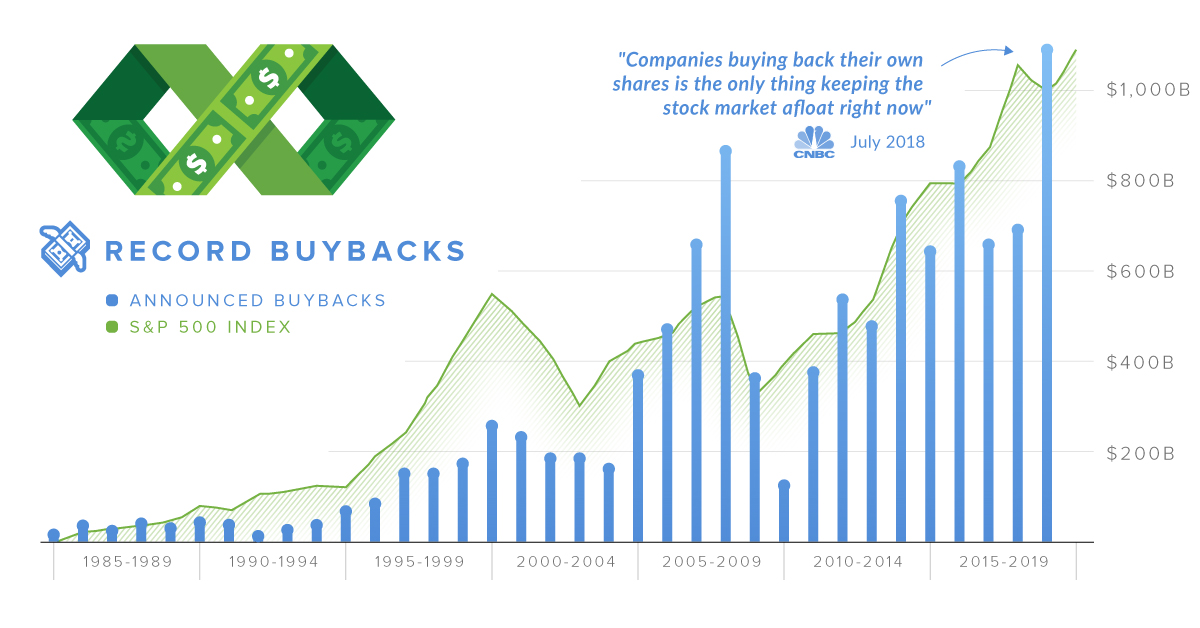

Please consider the possibility the important adjustments the economy must make are lagging far behind our current “financial culture” or that the economy has evolved in a way that simply no longer works. Much of this has yet to become apparent to the masses and is masked by institutions papering over problems. A tradition of optimism has served mankind well, however, it has become clear something seems to be broken or out of kilter. It does not help that things like stock buybacks and outright fraud are creating a situation that could at any minute spin out of control. Making matters worse is that the general population is oblivious to this, and conditioned to accept whatever they are told. To many people, this is the new normal.

…click on the above link to read the rest of the article…