World GDP in current US dollars is in some sense the simplest world GDP calculation that a person might make. It is calculated by taking the GDP for each year for each country in the local currency (for example, yen) and converting these GDP amounts to US dollars using the then-current relativity between the local currency and the US dollar.

To get a world total, all a person needs to do is add together the GDP amounts for all of the individual countries. There is no inflation adjustment, so comparing GDP growth amounts calculated on this basis gives an indication regarding how the world economy is growing, inclusive of inflation. Calculation of GDP on this basis is also inclusive of changes in relativities to the US dollar.

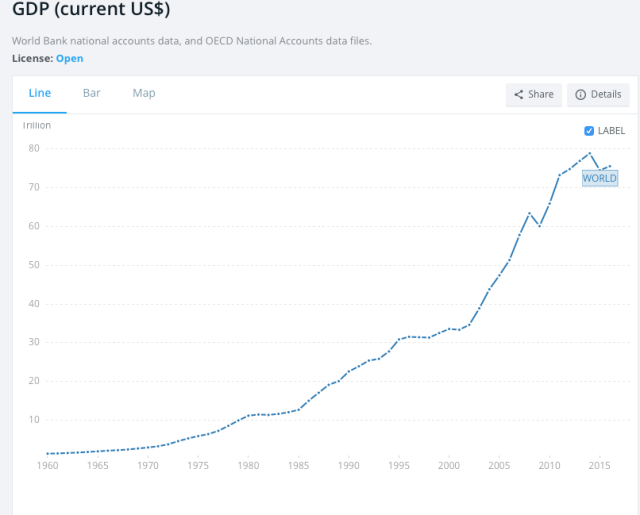

What has been concerning for the last couple of years is that World GDP on this basis is no longer growing robustly. In fact, it may even have started shrinking, with 2014 being the peak year. Figure 1 shows world GDP on a current US dollar basis, in a chart produced by the World Bank.

Figure 1. World GDP in “Current US Dollars,” in chart from World Bank website.

Since the concept of GDP in current US dollars is not a topic that most of us are very familiar with, this post, in part, is an exploration of how GDP and inflation calculations on this basis fit in with other concepts we are more familiar with.

As I look at the data, it becomes clear that the reason for the downturn in Current US$ GDP is very much related to topics that I have been writing about. In particular, it is related to the fall in oil prices since mid-2014 and to the problems that oil producers have been having since that time, earning too little profit on the oil they sell.

…click on the above link to read the rest of the article…