That’s the Red Ponzi at work in China and its replicated all across the land in similar wasteful investments in unused or under-used shopping malls, factories, coal mines, airports, highways, bridges and much, much more.

But the point here is that China is not some kind of one-off aberration. In fact, the less visible aspects of the credit ponzi exist throughout the global economy and they are becoming more visible by the day as the Great Deflation gathers force.

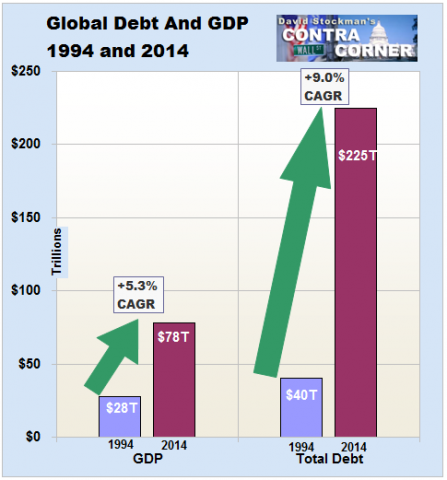

As we have regularly insisted, there is nothing in previous financial history like the $185 trillion of worldwide credit expansion over the last two decades. When this central bank fueled credit bubble finally reached its apogee in the past year or so, global credit had expanded by nearly 4X the gain in worldwide GDP.

Moreover, no small part of the latter was simply the pass-through into the Keynesian-style GDP accounting ledgers of fixed asset investment (spending) that is destined to become a write-off or public sector white elephant (wealth destruction) in the years ahead.

The credit bubble, in turn, led to booming demand for commodities and CapEx. And in these unsustainable eruptions layers and layers of distortion and inefficiency cascaded into the world economy and financial system.

…click on the above link to read the rest of the article…