Home » Posts tagged 'inequality' (Page 2)

Tag Archives: inequality

Today’s Contemplation: Collapse Cometh

Today’s Contemplation: Collapse Cometh

As I approach my 7th decade on this planet, I have reached the conclusion that we all interpret the world through mythical narratives; some of our own creation, many (most?) others ‘imposed’ upon us. The ruling class of society conditions us in numerous ways to accept stories that, for the most part, support and prolong their position of power and control.

From hereditary chieftains/monarchs to ‘democratic’ leadership, the ‘elite’ of society maintain a hold over the ‘tribe’ so as to ensure their revenue streams and wealth (some would argue this is a parasitic arrangement since this class returns little in the way of productive value to the system). They use the various tools at their disposal (e.g., education system, media, etc.) to inculcate/predispose us to accepting this arrangement and continuing to control and expand the wealth-generating/extraction systems that arise from everyday human economic interactions.

Power and wealth is concentrated significantly at the top of the pyramid; yet we are constantly exposed to narratives that we not only have agency, but that the ‘elite’ put our needs at the forefront of their policies and decision-making. I strongly believe these are false and propagated to influence/manipulate our thinking and beliefs.

Just like our financial institutions (especially the big banks) who knowingly engage in criminal activity and then receive raps on the wrist with minimal fines when caught (making their brazen thievery well worth it), the ruling class is more than willing to break ‘rules/laws’ (in fact, I would argue they are constantly doing so) because the ‘price’ for doing so is negligible (with the occasional sacrifice made to appease the masses).

I don’t believe there is a ‘solution’ to any of this (unlike most who do because, you know, hope–and reduction of cognitive dissonance) aside from complete sociopolitical collapse–which I would argue will eventually happen as it has for every complex society that has preceded ours. My response to this has been to accept it, and try and remove myself from the Matrix as much as is possible and prepare accordingly.

The world is not as we have been conditioned to believe by the narrative managers who weave the various storylines (read Edward Bernays book Propaganda for interesting insight on this). Awareness of this is a first step towards a better understanding of how messed up this world truly is and, possibly, doing something for your family/community to make it more resilient as the system inevitably declines/collapses.

Weekly Commentary: Precarious World

Weekly Commentary: Precarious World

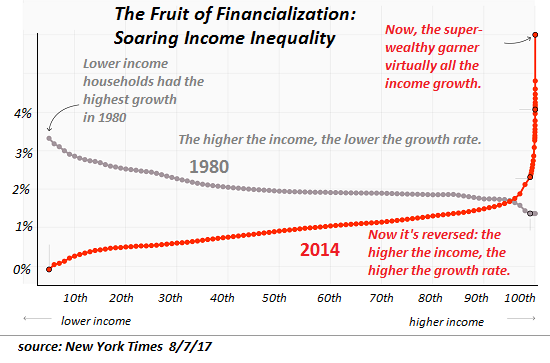

Another fascinating – if not comforting – week. A Friday Wall Street Journal headline: “Big Tech’s Embarrassment of Riches – Amazon, Apple, Facebook and Google all show resilience during pandemic while undergoing congressional scrutiny.” Amazon, Apple, Facebook and Google all reported booming earnings the day following Wednesday appearances by respective CEOs before the House Antitrust Subcommittee hearing. Down the road from Capitol Hill, the FOMC released their post-meeting policy statement. Chairman Powell conducted a virtual press conference where he addressed key issues: “inflation running well below our symmetric 2% objective,” and “inequality as an issue has been a growing issue in our country and in our economy for four decades.”

While it is true that inequality has been building for decades, this trend has worsened markedly since the 2008 crisis. Much more so of late.

Powell: “So [inequality is] a serious economic problem for the United States, but it’s got underlying causes that are not related to monetary policy or to our response to the pandemic. Again, four decades of evidence suggests it’s about globalization, it’s about the flattening out of educational attainment in the United States compared to our other competitor countries. It’s about technology advancing too.”

If we could chart “inequality,” it would at this point be rising parabolically – following the trajectory of the Fed’s balance sheet. I had been assuming Fed holdings would at some point be getting a lot larger. It seemed clear inequality would only get worse. COVID dramatically accelerated both trends.

Bubble analysis is these days as fruitful as ever. We’re in the waning days of a multi-decade super-cycle. Bubble markets have become extraordinarily distorted and increasingly disorderly. Protracted deep structural maladjustment has fostered pervasive Bubble Economy Dynamics. Aggressive monetary inflation and central bank market interventions – primary contributors to financial and economic Bubbles – are being deployed to hold Bubble collapse at bay. And we’re now witnessing the initial consequences of desperately throwing massive stimulus at speculative market Bubbles and a Bubble Economy.

…click on the above link to read the rest of the article…

LEE CAMP: The Secret Reason Billionaires Love a Pandemic

LEE CAMP: The Secret Reason Billionaires Love a Pandemic

You see, there has been a class war going on for years – perpetrated by the rich (who aren’t smarter or better) against everyone else.

We live in a time when there are more billionaires walking around than ever before. (They don’t actually walk. They have someone do that for them.) And one can’t deny billionaires are billionaires because they’ve worked harder than anyone else—roughly 300 times harder than an average worker. They are smarter, cleverer, more intuitive and show more initiative than anyone else, too. That’s why they’re billionaires and we’re not. That’s why they will always be billionaires and we will never be. That’s why we can all see ourselves in the reflection on Jeff Bezos’ bald head and yet can never touch it.

‘Deportmental ditties : and other verses;’ Graham, Harry, 1874-1936. London : Mills & Boon 1900. (University of Toronto)

Now, I must say—everything stated in the first paragraph is utterly false. No part of it is true (except the part about the walking). Most billionaires don’t work harder, don’t think harder, and don’t know more. They have nothing over your average person except: a) luck b) sometimes inheriting a fortune and c) being more sociopathic. So I guess you could say they’re extraordinary on the sociopathy front. They are more willing to crush other humans to get what they want and thereby they are more able to get what they want.

All of this might slightly explain why a vein bulges in my forehead when I read that billionaires are doing better than ever during this global viral outbreak that has killed hundreds of thousands.

…click on the above link to read the rest of the article…

The Great Reset – The Final Battle Against Marxists

The Great Reset – The Final Battle Against Marxists

The rising civil unrest is starting to take notice of Bill Gates and his consortium hell-bent on changing the world economy. They have used the coronavirus as a ploy to shut down the world economy all for their Climate Change Agenda. There is a mountain of circumstantial evidence that points to Fauci funding the creation of this virus and transferring it to the Wuhan lab where neither China nor the United States leaked it, but this consortium which has planned this Event 201 on how to destroy the world economy and rebuild it from scratch. They are already introducing Guaranteed Basic Income, assuming they can wipe out over 300 million jobs and then pay people to sit home and watch TV, where they recreate the world in their own image which they are promoting as the Great Reset.

This has all been planned and it is being promoted by the infamous Davor — World Economic Forum. These people are all elitists who would never walk among us who they consider the great unwashed. They have unleashed domestic violence on the world and encouraged all the suicides by imprisoning people, and stripping them of all human rights. Their view is that the world is overpopulated, so thinning the herd to save the planet is justified and not genocide. Countries like Thailand saw their tourist trade collapse and countless food lines, all for a fake virus. These people have used the press to terrorize the people to achieve their goal to recreate the world economy as “greener, smarter, and fairer.” The World Economic Forum is promoting a Marxist agenda with a 50-page manifesto organized by the communist Thomas Piketty. The Forum promotes a new Marxist world, calling upon Piketty’s “urgent new message on how to fight inequality” where they want to attack anyone with wealth. Their proposal for Europe is to increase taxation by 400%!

…click on the above link to read the rest of the article…

Inequality On Rise – Many Of 99% Dirt Poor As Rich Gain

Inequality On Rise – Many Of 99% Dirt Poor As Rich Gain

Inequality has soared over the last several months with billionaires seeing huge gains in their wealth while many people are getting slammed. Much of the adverse effect on the average American has so far been masked by trillions of dollars flowing from the government in the way of temporary stimulus checks. The covid-19 crisis and how it has been handled by the governments and the central banks have resulted in creating a twilight-zone economy. The moment the current $600 a week federal unemployment benefits run out at the end of July, many people will find they are caught in a financial vise with few options. Getting that unemployment money is the biggest reason many people who’ve lost jobs are able to keep a roof over their heads. Knowing many of these people are not going back to work is a big problem. You are not alone if you are having difficulty reconciling the growing divide between Wall Street markets that seem totally ignoring economic reality.

Many market watchers and pundits are troubled and confounded by the recent market action. Several explanations exist with each one having some validity but great uncertainty remains. In a manipulated environment such as we have today where markets are propped up and manipulated with no true price discovery, all investments have become risky. The markets are reflecting a V-shaped recovery that Citigroup warns may be far too optimistic.

A slew of new investors, most inexperienced, have stepped into the breach and bought the dip under the impression it will lead to prosperity. This is evident in the area of the most shorted stocks which are on such a rant as those most negative on the economy are forced to capitulate to a soaring market. This is occurring while Citi writes its model still shows that a greater than 70% probability of a down market in the next 12 months remains.

…click on the above link to read the rest of the article…

Weekly Commentary: Global Bubbles are Deflating

Weekly Commentary: Global Bubbles are Deflating

“Bubble” is commonly understood to describe a divergence between overvalued market prices and underlying asset values. And while price anomalies are a typical consequence, they are generally not among the critical aspects of Bubbles. I’ll start with my basic definition: A Bubble is a self-reinforcing but inevitably unsustainable inflation.

Bubbles, at their core, are fueled by Credit – or “Credit inflation.” Asset inflation and speculative asset price Bubbles are a common upshot. At their core, Bubbles are mechanisms of wealth redistribution and destruction.

The more protracted the Bubble period, the greater the maladjustment to underlying financial and economic structures. And the longer the Bubble inflation, the greater the wealth disparities and underlying social and political strain. While Bubble-related inequalities reveal themselves more prominently later in the up-cycle, the scope of wealth destruction only becomes apparent as the Bubble finally succumbs. As Dr. Richebacher always stressed, there’s no cure for Bubbles other than not allowing them to inflate. The catastrophic policy failure over the past 20 years has been the determination to aggressively inflate out of post-Bubble stagnation.

Bubbles can have profound geopolitical impacts as well. The inflation of Bubbles and corresponding booming economies promote the view of an expanding global economic “pie”. The inflating Bubble phase is associated with cooperation, integration and solidarity. The backdrop shifts late in the Bubble phase, as inequities and maladjustment become more discernible. Bursting Bubbles mark a radical redrawing of the geopolitical landscape. The insecurities and animosities associated with a shrinking economic pie see a rise of nationalism and “strongman” leadership. The backdrop drifts toward fragmentation, disintegration and conflict.

…click on the above link to read the rest of the article…

The Pandemic Is Deepening America’s Many Divides

The Pandemic Is Deepening America’s Many Divides

And so we’ve reached the precarious state of disunion in which the only thing the warring elites can agree upon is that the Federal Reserve should rescue their private wealth, regardless of cost or consequences.

America’s divides are proliferating and deepening by the day. The key political and economic divides predate the pandemic, but the pandemic is acting as a catalyst, creating new divides and exacerbating existing ones.

Let’s start with the politicization and subsequent polarization of re-opening the economy. In a reasonably sane, coherent society, this issue would be subject to common sense debates about risks, trade-offs, policies, responses to new data, etc.

But American society is neither sane nor coherent, so what should be a non-partisan debate was immediately politicized, to the absurd extreme that “progressives” must favor continuing strict lockdowns lest they be accused of being “conservative.”

The erosion of middle ground and the disappearance of de-politicized policy debates is a clear sign that a society is doomed to disintegration not just of the social order but the political and economic orders.

Author Peter Turchin has described the disintegrative stage in his book Ages of Discord, in which he modeled a Political Stress Index comprised in part of these three dynamics:

1. Stagnating real wages due to oversupply of labor.

2. Overproduction of parasitic elites.

3.Deterioration of central state finances.

The pandemic has catalyzed the oversupply of labor and the deterioration of central state finances, and illuminated America’s vast overproduction of parasitic elites, most of whom feed off various cartels and monopolies or the financial system, which has been saved yet again from gravity by the super-wealthy’s most important protector, the Federal Reserve.

The pandemic has created new divides that highlight existing extremes of inequality. Those Americans in poor health and in jobs that cannot be performed at home are at greater risk than healthy Americans who can work at home.

…click on the above link to read the rest of the article…

Rabobank: It Is Understandable Why Some Are Wondering When We Get Hyper-inflation And Currency Collapse

Rabobank: It Is Understandable Why Some Are Wondering When We Get Hyper-inflation And Currency Collapse

With so much liquidity being thrown into so many markets by so many so fast, it is perhaps understandable that some are wondering when we get inflation, hyper-inflation, and/or currency collapse. However, given we are riddled with World War Two analogies at the moment, allow me to do two Churchill impressions: “Never was so much owed by so many to so few” – and “Never was so much owned by so few.” (Yes, one does not need to read Piketty to know that wealth and income inequality under the Pharaohs was even more unfair than it has been trending under every US President since Nixon, but you hopefully get the point.)

In short, global debt levels are at records and rising – which is where some see the inflation coming from; and yet wealth and income inequality are also at staggering levels – and rising as mind-blowing liquidity flows not into many pockets but into relatively few.

For all of the staggering scale of fiscal stimulus packages–20% of GDP in Japan, 15% and rising in the UK, and who even knows in the US?–ask yourself this: is the ordinary working family feeling better or worse off right now? Unemployment is soaring but you are lucky enough to get furloughed with 80% pay – isn’t that a 20% pay cut? And is a pay-rise now waiting for you in 2021? And good luck if you own a small business as most of most of the fiscal packages we see are going out in loan support to larger firms. Yet if you give USD1m to a private firm whose revenue has collapsed by USD1m, is this actually stimulus at all? It leaves you at an expensive stand-still – and also means more debt to carry post virus, dragging growth lower.

…click on the above link to read the rest of the article…

The Prophet

The Prophet

Oh how I miss George Carlin. Yes he was mainly known as a stand up comedian, but he was more than that, much more. He was a social critic, he challenged that status quo, he dared to go where society wasn’t prepared to go: Look at ourselves critically. He did it with biting humor, masterful oration and a directness digging into core truths that were not only uncomfortable at times, but needed to be heard and said.

His voice has fallen silent as he passed away a few years ago and I’m sorry to say: We don’t have anyone like George today. I didn’t agree with everything George said and I don’t need to, nor does anybody else, but his talent was to make us think and to view the world with a different perspective and yes he was a prophet.

He saw long ago where this was all heading. The political charades and manufactured dramas that are sold to the public as choice, the illusion of choice as the agendas have long been in play.

“What do they want?” he asked. “More for themselves and less for everybody else.”

He spoke of the owners of this country, the owners that control everything, the media, what to believe what to think, and the great business and lobbying interests that spend billions of dollars lobbying for ever more benefits for themselves.

And lobby they do:

And boy did they succeed. Under the mantle of populism and draining the swamp they got themselves the biggest tax cuts in corporate history, a historic killing:

Wall Street celebrated and celebrates to this day.

Wealth inequality skyrocketing for years and now trillion dollar deficits as far as the eye can see and debt through the roof:

…click on the above link to read the rest of the article…

Dissatisfaction with democracy reaches all-time high

Dissatisfaction with democracy reaches all-time high

A new report by the recently established Centre for the Future of Democracy at the University of Cambridge has found that dissatisfaction with democracy has reached an all-time global high. Westminster-style democracies (the UK, Australia, Canada, New Zealand and the US) typically fare particularly badly in terms of democratic faith, with the proportion of citizens dissatisfied with the performance of their democracy doubling since the 1990s. In the UK, this proportion increased by around a fifth since then.

The global financial and economic crisis and growing within-country regional inequality are of course important factors behind decreasing satisfaction with democracy. But the Centre’s report also suggests that ‘satisfaction with democracy is lower in majoritarian “winner-takes-all” systems than in consensus-based, proportionally representative democracies’. The antagonistic and adversarial mentality inherent in the outdated First Past the Post voting system found in majoritarian, Westminster-style democracies contributes to polarisation and tribalism, making citizens less willing to compromise and to accept the mandate of rival political parties or viewpoints. By contrast, New Zealand is the only Westminster-style democracy to have avoided the trend of ever-increasing public discontent, likely as a result of having introduced a fairer voting system in the 1990s.

These findings highlight the perilous state of our democracy, with ever-deepening citizen dissatisfaction and disengagement

These findings highlight the perilous state of our democracy, with ever-deepening citizen dissatisfaction and disengagement, but sadly they do not come as a surprise. Edelman’s annual trust barometer found that trust in institutions is the lowest it’s ever been in the UK – we’re penultimate in their league table of trust, just one spot ahead of Russia. Similarly, a BMG poll for the ERS in December 2019 found that 85 per cent of people thought democracy could be improved ‘quite a lot’ or ‘a great deal’, with 80 per cent of people feeling they have ‘not very much’ or ‘no influence’ over decision-making.

…click on the above link to read the rest of the article…

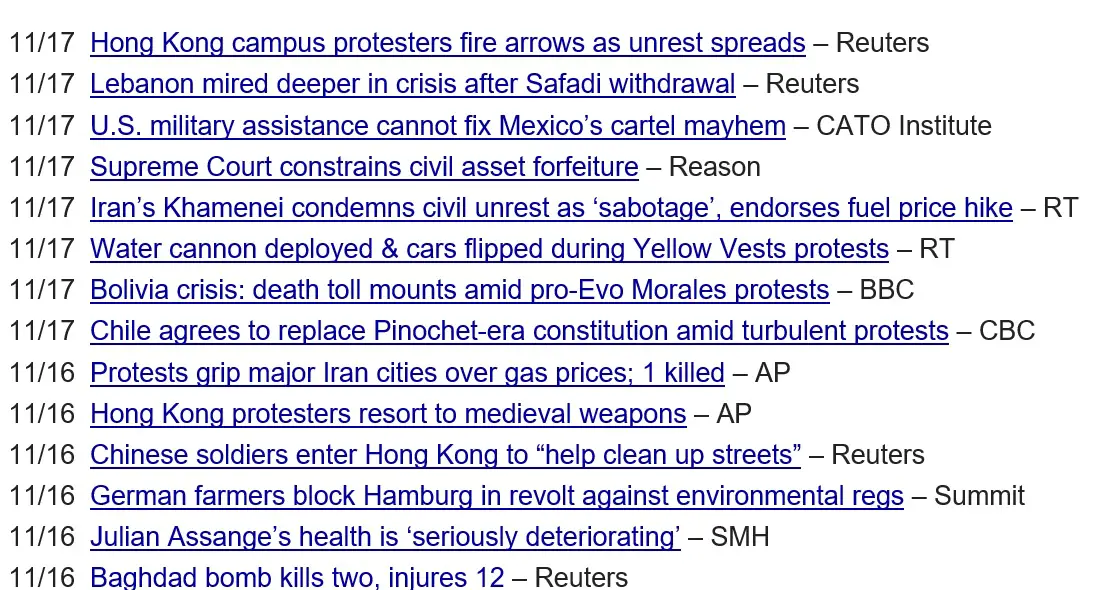

Civil Unrest Is The New Normal Out There

Civil Unrest Is The New Normal Out There

This is getting ridiculous. Every few days another country blows up, as their citizens take to the streets with little warning and no apparent interest in a quick settlement. Here’s the first part of the “War…Civil Unrest” section of today’s DollarCollapse.com links list. As you can see the peasants have grabbed their pitchforks and besieged their betters on four continents over a wide range of issues, which implies that the stated cause in each case is just an excuse.

The real grievance is the sense that an unresponsive elite are sucking up all the available wealth, leaving the vast majority with (at best) zero upward mobility and at worst a return to the servitude their parents only recently escaped. To test the truth of this, watch what happens when a chastened government caves on the initial issue — and instead of heading back home the protesters ramp it up.

Who even remembers what pulled France’s Yellow Vests into the streets? The Macron government has spent months apologizing and offering big new spending programs aimed at the protesters’ stated concerns. Yet today’s headline is about water cannons and flipped cars. Hong Kong repealed the law that ignited its riots back in June, yet today the story is protesters shooting police with arrows (!) and Chinese soldiers deploying to help “clean up the streets.” Uh huh.

Why is this happening now? Because artificially easy money enriches the people who own the stocks, bonds and real estate that rise in value when interest rates go down. This expands the already painfully wide gap between rich and poor and turns the already high level of background resentment into a powder keg. Then it’s just a matter of a provocation. And there’s always another provocation coming.

…click on the above link to read the rest of the article…

Household Leverage Ratios By Wealth Distribution

Household Leverage Ratios By Wealth Distribution

We are just starting play with the wealth distribution data and will have much more coming your way. What we have seen so far is shocking.

The distribution of wealth has deteriorated significantly over the past 20 years and is now so skewed toward the top that average U.S. household wealth is close to $1 million, though the median household wealth is only around $70k.

In fact, the aggregate level of wealth of the bottom 50 percent peaked in Q1 2000, the height of the dot.com bubble, and is down almost 10 percent in nominal terms. Whereas, the aggregate wealth level of the top 1 percent is up almost 120 percent over the same period.

If I brought a number or a forecast like that to my manager when I was a very young economist working on the World Bank’s capital flows model back in the day, he would say,

“You are forecasting revolution.”

Note the relative leverage ratio of the bottom 50 percent. For several quarters after the GFC the bottom 50 percent, not all households but in aggregate, were technically insolvent, where debt levels were greater than the value of assets ( > 100 percent on the chart).

These data put the current political climate and debate around debt forgiveness in context. They also reflect the two-speed U.S. economy.

Stay tuned for some more shocking data.

Long pitchforks.

The Pivot Point

The Pivot Point

The massive economic shock following the banking collapse of 2007–8 is the direct cause of the crisis of confidence which is affecting almost all the institutions of western representative democracy. The banking collapse was not a natural event, like a tsunami. It was a direct result of man-made systems and artifices which permitted wealth to be generated and hoarded primarily through multiple financial transactions rather than by the actual production and sale of concrete goods, and which then disproportionately funnelled wealth to those engaged in the mechanics of the transactions.

It was a rotten system, bound to collapse. But unfortunately, it was a system in which the political elite were so financially bound that the consequences of collapse threatened their place in the social order. So collapse was prevented, by the use of the systems of government to effect the largest ever single event transfer of wealth from the poor to the rich in the course of human history. Politicians bailed out the bankers by using the bankers’ own systems, and even permitted the bankers to charge the public for administering their own bailout, and charge massive interest on the money they were giving to themselves. This method meant that the ordinary people did not immediately feel all the pain, but they certainly felt it over the following decade of austerity as the massive burden of public debt that had been loaded on the populace and simply handed to the bankers, crippled the public finances.

The mechanisms of state and corporate propaganda kicked in to ensure that the ordinary people were told that rather than having been robbed, they had been saved. In the ensuing decade the wealth disparity between rich and poor has ever widened, to the extent that this week the BBC announced the UK now has 151 billionaires, in a land where working people resort to foodbanks and millions of children are growing up in poverty.

…click on the above link to read the rest of the article…

Unrealistically Great Expectations

Unrealistically Great Expectations

Our expectations have continued ever higher even as the pie is shrinking..

Let’s see if we can tie together four social dynamics: the elite college admissions scandal, the decline in social mobility, the rising sense of entitlement and the unrealistically ‘great expectations’ of many Americans.

As many have noted, the nation’s financial and status rewards are increasingly flowing to the top 5%, what many call a winner-take-all or winner-take-most economy.

This is the primary source of widening wealth and income inequality: wealth and income are disproportionately accruing to the top slice of earners and owners of productive capital.

This concentration manifests in a broad-based decline in social mobility: it’s getting harder and harder to break into the narrow band (top 5%) who collects the lion’s share of the economy’s gains.

Historian Peter Turchin has identified the increasing burden of parasitic elites as one core cause of social and economic collapse. In Turchin’s reading, economies that can support a modest-sized class of parasitic elites buckle when the class of elites expecting a free pass to wealth and power expands faster than what the economy can support.

The same dynamic applies to productive elites: as I have often mentioned, graduating 1 millions STEM (science, technology, engineering, math) PhDs doesn’t magically guarantee 1 million jobs will be created for the graduates.

Such a costly and specialized education was once scarce, but now it’s relatively common, and this manifests in the tens of thousands of what I call academic ronin, i.e. PhDs without academic tenure or stable jobs in industry.

This glut is a global: I’ve known many people with PhDs from top universities in the developed world who have struggled to find a tenured professorship or a high-level research position anywhere in the world.

In other words, what was once a surefire ticket to status, security and superior pay is no longer surefire.

No wonder wealthy parents are so anxious to fast-track their non-superstar offspring by hook or by crook.

There is an even larger dynamic in play. As I explained here recently, the economic pie is shrinking, not just the pie of gains that can be distributed but the pie of opportunity.

Torches and Pitchforks

Torches and Pitchforks

The front page of our local paper struck a chord:

The subject of wealth inequality has been on my mind ever since I started writing Slope fourteen years ago. I’ve written countless posts on it, and even dedicated a SocialTrade page to it, but a quick summary of my disposition could be boiled down to a few personal points:

- Although I didn’t know it at the time, my childhood was in an era of relative wealth equality in the United States, pretty much the most even playing field in its history;

- Average folks like my Dad made $35,000 per year; the “rich” people in town made $50,000;

- The houses of the average and the rich were pretty much the same, although the rich had Buicks instead of Fords and could afford maids who came to clean the house each day; but that was about it.

My own adulthood, of course, is like a different universe. Normal people live in $7 million houses. Rich people live in $25 million houses and have other residences scattered around the planet. The difference between rich and poor in my youth was a short hop; in my current life, it’s a chasm.

My view is that the increasing disparity between rich and poor has, for decades, largely been non-disruptive to society as a whole, principally because the lower classes have been placated enough, by way of the proverbial bread and circuses, not to cause any waves. Sure, there have been little movements here and there, such as Occupy Wall Street, but they have attracted fringe groups and fizzled out in weeks, if not days.

The aforementioned SocialTrade page is packed with charts like the one below, which shows just how hosed the lower classes are, but again, the rich are pretty much getting away with it with no consequence.

…click on the above link to read the rest of the article…