Home » Posts tagged 'david haggith' (Page 2)

Tag Archives: david haggith

Epocalypse Ahead on Highway to Hell for Global Economy and US Stock Market

Epocalypse Ahead on Highway to Hell for Global Economy and US Stock Market

First I said I believed the US stock market would plunge in January, but I also said that January would not be the biggest drop, but just the first plunge that begins a global economic collapse: the big trouble for the economy and the stock market, I said, would show up in “early summer.” That’s when the stock market crash that began in January would take its second big leg down, and global economic cracks would become big enough that few could deny them.

(Now I’ll add a prediction — that even worse will unfold in the fall and early winter … unless summer becomes so bad that central banks rapidly reverse course on unwinding their balance sheets and raising interest; but I think they will stay their promised courses into the fall and winter and headlong into a global economic crisis.)

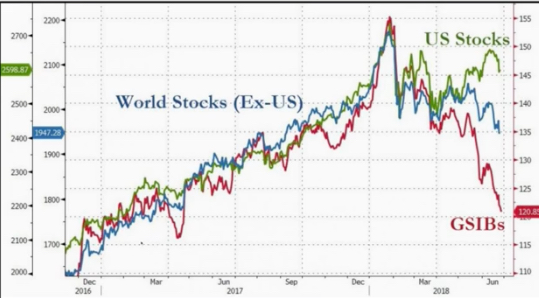

The stock market did plunge in January and on into February, with the Dow eventually taking its largest single-day point drop in its long history. That drop busted the Trump Rally, and the market never recovered, leaving US stocks (and stocks all over the world) shattered in “correction territory” for half a year. With a half a year for perspective now, here is a look back what that event did:

Global Stocks (except US), US stocks, and too-big-to-fail bank stocks. Where did the market trend abruptly change for all?

I’ve waited patiently through the first half of the year to talk in depth about how my January prediction faired because I felt we need many months in order to discern whether a trend has really been broken.

…click on the above link to read the rest of the article…

Return of the Euro Crisis: Italy Quakes, Rest of the World Shakes and Merkel’s Empire Breaks

Return of the Euro Crisis: Italy Quakes, Rest of the World Shakes and Merkel’s Empire Breaks

Europe’s many fault lines are spreading once again, bringing the endless euro crisis saga back in 3-D realism. Italy gained a new anti-establishment government last week, even as Spain elected a new Socialista government that could crack Catalonia off from the rest of Spain. All of Europe fell under Trumpian trade-war sanctions and threatened their own retaliation. And Germany’s most titanic bank got downgraded to the bottom of the junk-bond B-bin.

Europe’s many fault lines are spreading once again, bringing the endless euro crisis saga back in 3-D realism. Italy gained a new anti-establishment government last week, even as Spain elected a new Socialista government that could crack Catalonia off from the rest of Spain. All of Europe fell under Trumpian trade-war sanctions and threatened their own retaliation. And Germany’s most titanic bank got downgraded to the bottom of the junk-bond B-bin.

The Italian shakeup caused US bond prices to soar (yields to drop) in a flight of capital from European bonds, yet US stock investors took this invasion of troubles from foreign shores as good enough news to end the week on a positive note. The NASDAQ especially never looked happier, though financials feared contagion. As a result, the contrast between tech stocks and financials burst upward to its highest peak since the top of the dot-com frenzy:

While Europe’s troubles apparently sounded like great news to US stock investors, the Italian crisis caused EU bank stocks in aggregate to take one of their largest avalanches in history, ending in a one-week cliffhanger at their lowest level in two-and-a-half years. Deutsche Bank, Germany’s titan of global finance, ended looking like the spawn twin of the Lehman Brothers:

Deutsche Bank appears to be leading the way into a full blown euro crisis like Lehman Bros did in the US financial crisis.

In one week, Europe with its impossible euromess moved back into position of being the world’s chief menace. The Eurozone is a house of cards with many exits, each with their own name, as I’ve written about frequently in the past, and it’s time to pay the never-ending euro crisis some attention once again.

Quitaly looks like next Brexit in everlasting euro crisis

…click on the above link to read the rest of the article…

Federal Reserve Hesitates on QE Unwind / Balance Sheet Reduction

Federal Reserve Hesitates on QE Unwind / Balance Sheet Reduction

Is the Federal Reserve’s Great Unwind already coming unwound? I thought it would be good to check up on Federal Reserve balance sheet reduction since the Fed is supposed to be up and running on the move out of quantitative easing this month. It should be fascinating to see what progress the Fed is making as it happily applauds its own successful recovery.

Is the Federal Reserve’s Great Unwind already coming unwound? I thought it would be good to check up on Federal Reserve balance sheet reduction since the Fed is supposed to be up and running on the move out of quantitative easing this month. It should be fascinating to see what progress the Fed is making as it happily applauds its own successful recovery.

The Federal Reserve balance sheet reduction that didn’t happen

After all, the Federal Reserve’s End of Quantitative Easing Didn’t Happen last time they said it would. It turned out the Fed actually planned to continue QE at a gradual level by reinvesting matured assets. Nevertheless, the mere announcement in 2013 that it would terminate QE in 2014 created the infamous “Taper Tantrum.” The Fed hadn’t said anything back then that I was able to find about reinvesting the funds in its balance sheet until after they supposedly stopped QE in the fall of 2014. It turned out the stop was not a quite a full stop.Unwinding its balance sheet is likely to prove to be the Fed’s Gordian knot.

Federal Reserve balance sheet reduction that didn’t happen … again … so far

So, here we are, and so far there is no reduction. It is now three years since the Fed “ended quantitative easing,” and its balance sheet is still holding around the $4.5 trillion mark where QE was supposed to end. Now that’s gradual! It’s taken three years just for the Fed to say it is going to start reducing the balance; so, let’s see how that balance sheet reduction is going for them now that it has supposedly started:

…click on the above link to read the rest of the article…

Here’s You and Here’s the Top Ten Percent

Here’s You and Here’s the Top Ten Percent

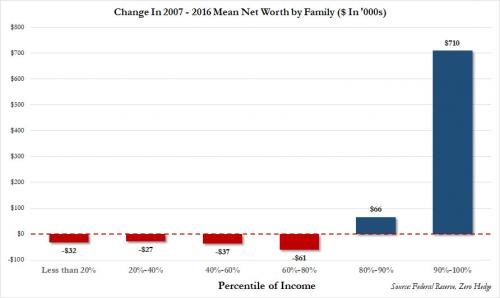

In a nutshell, here is a graph that summarizes everything you need to know about the unsustainable US economy. Unless you’re in the top ten percent of income producers in the nation — or, at least, living in their neighborhood — you are living in a dingy bedroom economy that has only seen its net worth decline since the Great Recession began. Those who are in the top ten percent, on the other hand, profited astronomically from the Great Recession. It’s the best thing that ever happened to them, and you helped them do it with tax-backed or even tax-funded bailouts and by allowing them a perpetual cycle of savings on their capital gains.

In a nutshell, here is a graph that summarizes everything you need to know about the unsustainable US economy. Unless you’re in the top ten percent of income producers in the nation — or, at least, living in their neighborhood — you are living in a dingy bedroom economy that has only seen its net worth decline since the Great Recession began. Those who are in the top ten percent, on the other hand, profited astronomically from the Great Recession. It’s the best thing that ever happened to them, and you helped them do it with tax-backed or even tax-funded bailouts and by allowing them a perpetual cycle of savings on their capital gains.

Clearly the only ones who “recovered” are at the top

Insanity is repeating the same thing over and over and expecting different results

Now you can see how those bailouts have trickled down to you as well as how capital-gains tax breaks have trickled down. Are you now going to go for Trump’s third-and-greatest-ever round of trickle-down economics?

Lower taxes for corporations may be a good idea (why tax the economic engines and rob them of fuel) if they also come with the end of loopholes (corporate welfare) and with a provision that the corporation cannot be engaged in any corporate buybacks during that tax year or the following. (Without that provision, lower corporate taxes will just fuel useless stock buybacks, making the rich richer, but doing nothing to grow the corporation and grow jobs).

Capital-gains tax breaks, on the other hand, have always been a terrible idea. The notion that such breaks cause people to reinvest their tax savings into creating new factories and jobs is not only proven wrong by thirty-plus years of history (see chart above for just the last decade of decline), but it is ludicrous in concept (even without historic proof):

…click on the above link to read the rest of the article…

Yawning Debt Trap Proves the Great Recession is Still On

Yawning Debt Trap Proves the Great Recession is Still On

While David Stockman stated early this year with resolute certainty that the debt ceiling debate would blow congress up and send the nation reeling over the financial precipice, I avoided jumping on the debt-ceiling bandwagon. While I was convinced major rifts in the economy would start to show up in the summer, I was not convinced they would have anything to do with the debt ceiling debate. If there is anything you can be certain of this in endless recovery-mode economy, it is that the US will just keep pushing its bags of bonds up a hill until it can finally push no more. So, I figured another punt down the road was more likely.

While David Stockman stated early this year with resolute certainty that the debt ceiling debate would blow congress up and send the nation reeling over the financial precipice, I avoided jumping on the debt-ceiling bandwagon. While I was convinced major rifts in the economy would start to show up in the summer, I was not convinced they would have anything to do with the debt ceiling debate. If there is anything you can be certain of this in endless recovery-mode economy, it is that the US will just keep pushing its bags of bonds up a hill until it can finally push no more. So, I figured another punt down the road was more likely.

The Debt Ceiling Debate that Didn’t Happen

The reason I didn’t think that debate would blow apart is that Republicans have more than once experienced the political reality that comes from taking the nation to the brink of default or of shutting down government. Each time that kind of thing has happened, it has hurt Republicans far more than it has hurt Democrats. I doubted establishment Repubs (the majority) had the stomach to take us through another credit downgrade, though I’ve noted such an event was possible.

Unsurprisingly to me, then, Congress did the only thing it seems to be capable of any more and just kicked that can a little further down the road with hardly a kerfuffle about it. Hurricane Harvey made things a lot easier for congress to kick the can again by providing a good excuse to dodge that unwanted debate on the basis of massive human suffering that truly did need tending to. Much-talked-about government shutdown put off for a better time

…click on the above link to read the rest of the article…

Fed Official Confesses Fed Rigged Stock Market — Crash Certain

Fed Official Confesses Fed Rigged Stock Market — Crash Certain

In a dynamite interview, Richard Fisher, former president and CEO of the Federal Reserve Bank of Dallas, gave what may be the biggest confession you’ll ever see and hear from a Federal Reserve insider: the Federal Reserveknowingly “front ran” the US stock market recovery (i.e., manipulated the market) and created a huge asset bubble. Fisher expresses certainty that the “juiced” stock market will come down and is coming down now that the Fed has taken its foot off the accelerator … and that it has a long way yet to go.

While that is no news to readers here whose eyes are wide open, a “market put” has been denied by the Fed and by many market advisors. That the market was an overinflated bubble created by the Fed has been denied, too; but Fisher clearly and gleefully admits the Fed created a bubble that will have to deflate now that the Federal Reserve’s stimulus is off.

As one of the members of the Federal Reserve’s FOMC (the Federal Open Market Committee, which sets US monetary policy), Richard Fisher participated in and voted on all of the Fed’s policies of zero interest and quantitative easing, so he has inside knowledge of all the discussions behind the scenes at the Fed.

Here are the significant quotes from Richard Fisher on CNBC’s video:

What the Fed did — and I was part of that group — is we front-loaded a tremendous market rally, starting in 2009.

It’s sort of what I call the “reverse Whimpy factor” — give me two hamburgers today for one tomorrow.

I’m not surprised that almost every index you can look at … was down significantly. [Referring to the results in the stock market after the Fed raised rates in December.]

Basically, we had a tremendous rally, and I think there’s a great digestive period that is likely to take place now, and it may continue.

…click on the above link to read the rest of the article…

![By Kikuyu3 (Own work) [CC BY-SA 4.0 (http://creativecommons.org/licenses/by-sa/4.0)], via Wikimedia Commons](http://thegreatrecession.info/blog/wp-content/uploads/Hommage_to_the_Gordian_knot-300x225.jpg)