From Brandon Smith

As I predicted just after the 2016 presidential election, a sordid theater of blame has exploded over the state of the U.S. economy, with fingers pointing everywhere except (in most cases) at the true culprits behind the crash. Some people point to the current administration and its pursuit of a trade war. Others point to the Federal Reserve, with its adverse interest rate hikes into economic weakness and its balance sheet cuts.

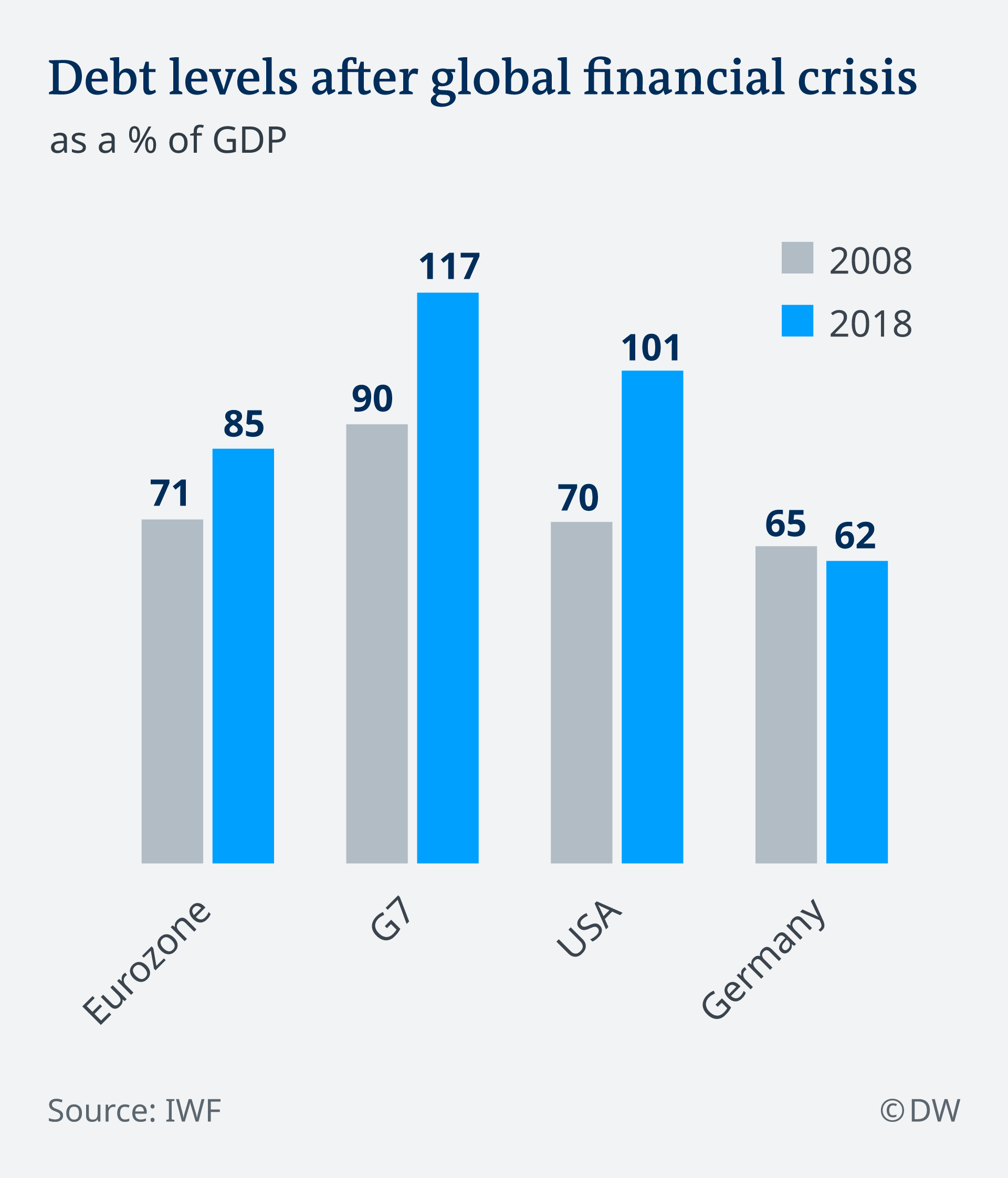

Some blame the Democrats for doubling the national debt under the Obama Administration and creating massive trade and budget deficits. And others look towards Republicans for not yet stemming the continually increasing national debt and deficits.

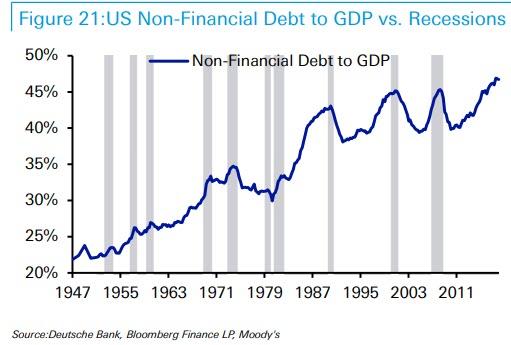

In today’s economic landscape, the debt issue is absolutely critical. While it is often brought up in regards to our fiscal uncertainty, it is rarely explored deeply enough.

I believe that economic crisis events are engineered deliberately by the financial elite in order to create advantageous conditions for themselves. To understand why, it is important to know the root of their power.

Without extreme debt conditions, economic downturns cannot be created (or at least sustained for long periods of time). According to the amount of debt weighing down a system, banking institutions can predict the outcomes of certain actions and also influence certain end results. For example, if the Fed were to seek out conjuring a debt based bubble, a classic strategy would be to set interest rates artificially low for far too long. Conversely, raising interest rates into economic weakness is a strategy that can be employed in order to collapse a bubble. I believe that it is what launched the Great Depression, it is what ignited the crash of 2008, and it is what’s going on today.

…click on the above link to read the rest of the article…