It was another day of utter carnage on Wall Street. The Dow was down another 364 points, the S&P 500 broke below 1900, and the Nasdaq had a much larger percentage loss than either of them. The Russell 2000 has now fallen 22 percent from the peak, and it has officially entered bear market territory. After 13 days, this remains the worst start to a year for stocks ever, and trillions of dollars of stock market wealth has already been wiped out globally. Meanwhile, junk bonds continue their collapse. JNK got hammered all the way down to 33.06 as bond investors race for the exits. In case you were wondering, this is exactly what a financial crisis look like.

It was another day of utter carnage on Wall Street. The Dow was down another 364 points, the S&P 500 broke below 1900, and the Nasdaq had a much larger percentage loss than either of them. The Russell 2000 has now fallen 22 percent from the peak, and it has officially entered bear market territory. After 13 days, this remains the worst start to a year for stocks ever, and trillions of dollars of stock market wealth has already been wiped out globally. Meanwhile, junk bonds continue their collapse. JNK got hammered all the way down to 33.06 as bond investors race for the exits. In case you were wondering, this is exactly what a financial crisis look like.

Many of the “experts” had been proclaiming that “things are different this time” and that stocks could defy gravity forever.

Now we seeing that was not true at all.

So how far could stocks ultimately fall?

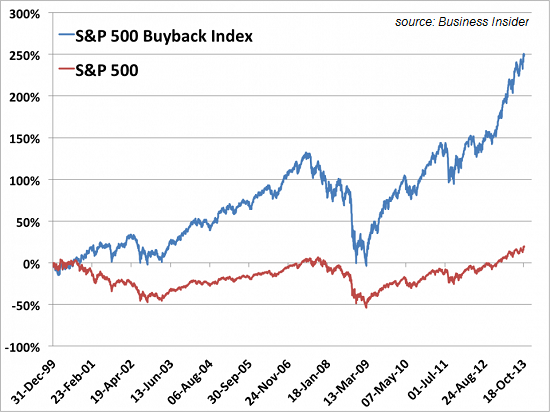

I have been telling my readers that stocks still need to fall about another 30 percent just to get to a level that is considered to be “normal” be historical standards, but the truth is that they could eventually fall much farther than that.

Just this week, Societe Generale economist Albert Edwards made headlines all over the world with his prediction that we could see the S&P 500 drop by a total of 75 percent…

If I am right and we have just seen a cyclical bull market within a secular bear market, then the next recession will spell real trouble for investors ill-prepared for equity valuations to fall to new lows. To bottom on a Shiller PE of 7x would see the S&P falling to around 550.

…click on the above link to read the rest of the article…