France’s supermajor Total is warning that the world could find itself with a shortfall of supply of 10 million barrels per day (bpd) between now and 2025, due to continued underinvestment in the industry, the OPEC+ pact, and cracks in the U.S. shale business model.

“There is a risk of supply crunch in the mid-term,” Helle Kristoffersen, President, Strategy and Innovation at Total, said on the company’s Q4 earnings call this week.

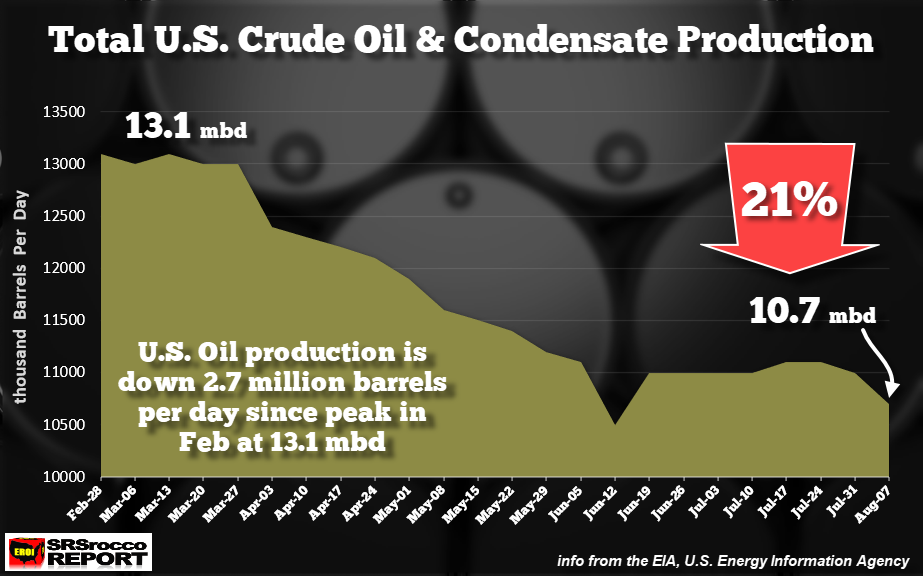

“We have seen in 2020 how OPEC managed to bring back market discipline. We’ve seen the cracks in the US shale model, and we’ve seen a continued underinvestments in the oil industry as a whole,” Kristoffersen said.

The market needs new oil projects, considering the fact that many producing oilfields will see natural declines in production, the executive said.

“And that’s true, even if you take very cautious view on short-term demand recovery and on future demand levels,” Kristoffersen added, noting that “a 10 million barrels per day gap in supply between now and 2025, that’s a massive shortfall of supply to cover in just a very few number of years.”

Last year, the coronavirus accelerated a structural decline in upstream oil investments as all E&P firms, oil supermajors, U.S. shale producers, and national oil companies alike, slashed capital expenditures in the wake of the price crash.

Investments in new oil supply have now slumped to a more-than-a-decade low.

OPEC+ currently has a lot of spare capacity that could come on stream when demand recovers. But sustained investments in oil and gas will be needed to meet global consumption of oil, which the world will continue to need, peak demand or not, analysts and forecasters warn.

“The world may be sleepwalking into a supply crunch, albeit beyond 2021. A recovery in oil demand back to over 100 million b/d by late 2022 increases risk of a material supply gap later this decade, triggering an upward spike in price,” says Simon Flowers, Chairman and Chief Analyst at Wood Mackenzie.