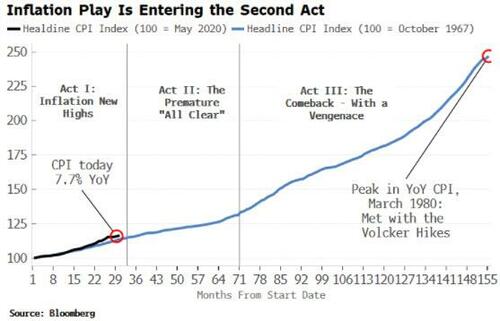

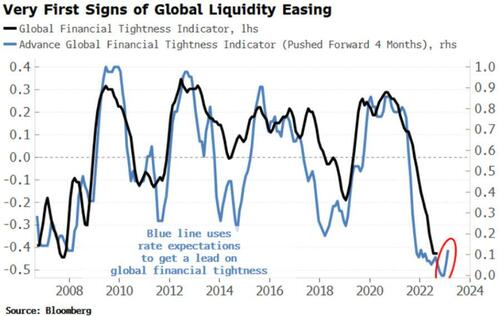

In the period between 1981 and 2022, the economy was lubricated by a combination of ever-rising debt, falling interest rates, and the growing use of Quantitative Easing. These financial manipulations helped to hide the rising cost of fossil fuel extraction after 1970. Even more money supply was added in 2020. Now central bankers are trying to squeeze the excesses out of the system using a combination of higher interest rates and Quantitative Tightening.

After central bankers brought about recessions in the past, the world economy was able to recover by adding more energy supply. However, this time we are dealing with a situation of true depletion; there is no good way to recover by adding more energy supplies to the system. Instead, the only way the world economy can recover, at least partially, is by squeezing some non-essential energy uses out of the system. Hopefully, this can be done in such a way that a substantial part of the world economy can continue to operate in a manner close to that in the past.

One approach to making the economy more efficient in its energy use is by greater regionalization. If countries can start trading almost entirely with nearby neighbors, this will reduce the world’s energy consumption…

…click on the above link to read the rest…

NEW YORK – The world economy is lurching toward an unprecedented confluence of economic, financial, and debt crises, following the explosion of deficits, borrowing, and leverage in recent decades.

In the private sector, the mountain of debt includes that of households (such as mortgages, credit cards, auto loans, student loans, personal loans), businesses and corporations (bank loans, bond debt, and private debt), and the financial sector (liabilities of bank and nonbank institutions). In the public sector, it includes central, provincial, and local government bonds and other formal liabilities, as well as implicit debts such as unfunded liabilities from pay-as-you-go pension schemes and health-care systems – all of which will continue to grow as societies age.

Just looking at explicit debts, the figures are staggering. Globally, total private- and public-sector debt as a share of GDP rose from 200% in 1999 to 350% in 2021. The ratio is now 420% across advanced economies, and 330% in China. In the United States, it is 420%, which is higher than during the Great Depression and after World War II.

Of course, debt can boost economic activity if borrowers invest in new capital (machinery, homes, public infrastructure) that yields returns higher than the cost of borrowing. But much borrowing goes simply to finance consumption spending above one’s income on a persistent basis – and that is a recipe for bankruptcy..

…click on the above link to read the rest…