Donald Trump is the epitome of irrational exuberance.

You might remember that phrase from the 1990s. Alan Greenspan, the head of the Federal Reserve at the time, was describing how the tech boom was creating a bubble by generating enthusiasm way out of proportion to the actual value of the new companies.

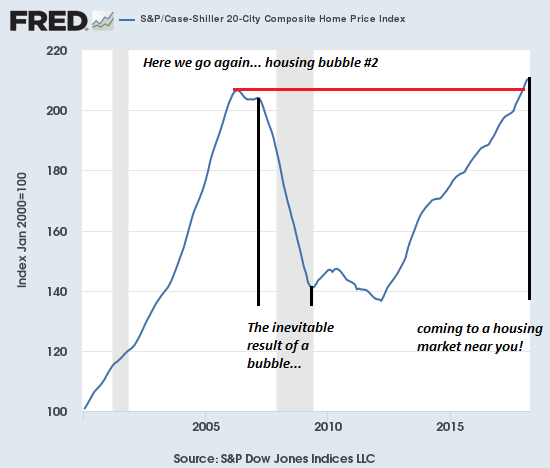

Such an unwarranted economic boom was hardly something new, so it was easy to predict what would happen next. Periods of irrational exuberance — whether the dot-com expansion, Dutch tulipmania in the 17th century, or the housing bubble in America of the 2000s — have always led to a sudden crash and a serious hangover.

And now, here we go again.

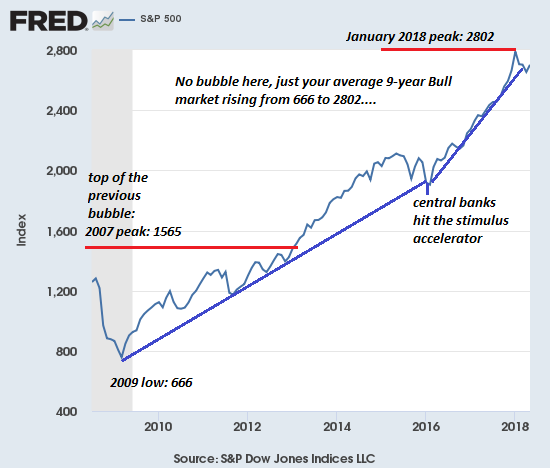

Trump, always exuberant when talking about himself and his putative accomplishments, loves to boast about how well the American economy is chugging along. The stock market reached its all-time high at the end of August. In its second quarter this year, U.S. economic growth was 4.1 percent. Unemployment remains below 4 percent, and inflation remains moderate. Even wages are going up.

Irrationality enters the picture because there’s little if any connection between the president’s policies and the outcomes he lauds (since these trends began before he took office). Also, the prosperity that has resulted from this economic expansion has largely been enjoyed by the wealthier sectors of society. Finally, Trump’s economic fever dream is fueled by an enormous and growing amount of debt.

When it comes to irrational exuberance, it’s never if there will be a bust but when. On the tenth anniversary of the financial collapse of 2008, it’s worth looking at the potential pinpricks that will pop Trump’s hot-air balloon and send America crashing back to earth.

Mountains of Debt

…click on the above link to read the rest of the article…