Photo Source SPACES Gallery | CC BY 2.0

“Out of the frying pan, into the fire” is an apt description of our current place in history. No matter what you think of globalization, I believe we’ll soon discover that capitalism without it is much, much worse.

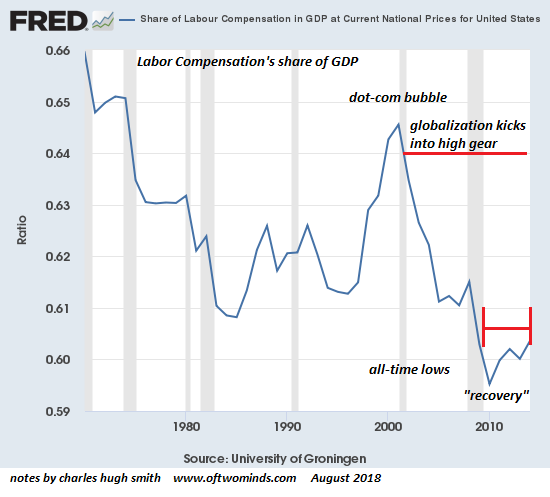

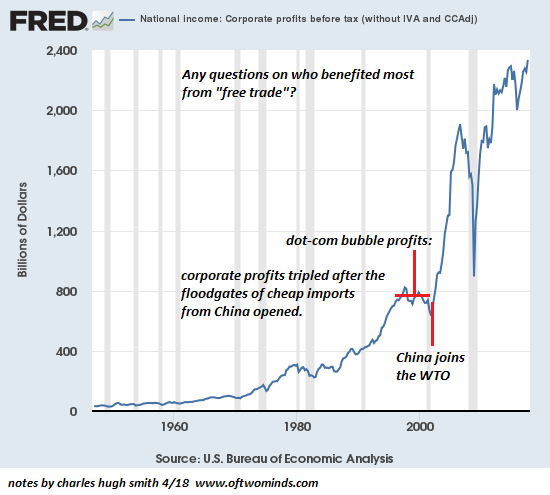

No one needs to convince establishment economists, politicians and pundits that the absence of globalization and growth spells trouble. They’ve pushed globalization as the Viagra of economic growth for years. But globalization has never been popular with everyone. Capitalism’s critics recognize that it generates tremendous wealth and power for a tiny fraction of the Earth’s seven billion people, makes room for some in the middle class, but keeps most of humanity destitute and desperate, while trashing the planet and jeopardizing human survival for generations to come.

Around the world, social movements believe “Another World Is Possible!” when neoliberal globalization is replaced by a more democratic, equitable, Earth-friendly society. They assume that any future without globalization is bound to be an improvement. But now it appears that this assumption may be wrong. In fact, future generations may someday look back on capitalism’s growth phase as the dynamic days of industrial civilization, a naïve time before anyone realized that the worst was yet to come.

The Return of Scarce Oil and Peak Debt

Today, rising energy prices and ballooning debt are poised to strangle the global economy once again. These suffocating conditions brought the economy to its knees in 2008. Afterward, fracking helped increase the supply and lower the price of oil and gas temporarily. Meanwhile, debt-dependent cash infusions in the form of bailouts, low interest rates, corporate tax cuts and leveraged stock buy-backs were injected into the economy to prop up stock prices and profit margins. [1]

…click on the above link to read the rest of the article…

This Isn’t Your Grandfather’s (1960s) Inflation Scare

March 14, 2018

This Isn’t Your Grandfather’s (1960s) Inflation Scare

As soon as the GOP followed its long-promised tax cuts with damn-the-deficit spending increases (who cares about the kids, right?), you knew to be ready for the Lyndon B. Johnson reminders.

And it’s worth remembering that LBJ pushed federal spending higher, pushed his central bank chairman against the wall (figuratively and, by several accounts, also literally) and eventually pushed inflation to post–Korean War highs.

Inflation kept climbing into Richard Nixon’s presidency, pausing for breath only during a brief 1970 recession (although without falling as Keynesian economists predicted) and then again during an attempt at wage and price controls that ended badly. Nixon’s controls disrupted commerce, angered businesses and consumers, and helped clear a path for the spiraling inflation of the mid- and late-1970s.

So naturally, when Donald Trump and the Republicans pulled off the biggest stimulus years into an expansion since LBJ’s guns, butter and batter the Fed chief, it should make us think twice about inflation risks—I’m not saying we shouldn’t do that.

But do the 1960s really tell us much about the inflation outlook today, or should that outlook reflect a different world, different economy and different conclusions?

I would say it’s more the latter, and I’ll give five reasons why.

1—Technology

I’ll make my first reason brief, because the deflationary effects of technology are both transparent and widely discussed, even if model-wielding economists often ignore them. When some of your country’s largest and most impactful companies are set up to help consumers pay lower prices, that should help to, well, contain prices.

…click on the above link to read the rest of the article…