Home » Posts tagged 'financial crisis' (Page 2)

Tag Archives: financial crisis

Underneath the Surface Trouble Is Brewing Once Again

Underneath the Surface Trouble Is Brewing Once Again

Larry McDonald, publisher of the investment research service The Bear Traps Report, warns that this crisis is far from over. He spots growing tensions in the credit markets and thinks that large public borrowers like Italy and New York State are in need of massive bailouts.

Stocks have staged an impressive comeback. Since the lows of March, the S&P 500 has gained almost 30%. Despite that, Larry McDonald would not be surprised if new turmoil soon arose.

“In March 2008 for instance, after the failure of Bear Stearns, the Fed acted aggressively and we had a big relief rally. But then came Lehman,” says the renowned investment strategist.

Mr. McDonald knows what he’s talking about. As a former vice-president of distressed debt trading at Lehman Brothers he witnessed the meltdown of the global financial system first hand. Today, he runs the The Bear Traps Report, an independent investment research service for institutional investors.

In this in-depth interview with The Market/NZZ, Mr. McDonald warns of rising defaults in the credit markets and points out that large public borrowers such as Italy and New York State are going to need bailouts of historic proportions. However, he spots opportunities in the metals and mining sector.

Mr. McDonald, despite a grim economic picture, investors are getting confident that the worst of the pandemic is behind us. What’s your take on the financial markets?

Equity markets have priced in a lot of love from the Federal Reserve. The Fed has done a lot to ease financial conditions, and the amount of liquidity is amazing. Since late February, they’ve done more in terms of balance sheet expansion than nearly two years of action in 2008 to 2010. They’ve clearly pumped up asset prices.

…click on the above link to read the rest of the article…

THE WOLF STREET REPORT: Nothing’s Fixed – What’s Behind the Corporate Debt Bailout

THE WOLF STREET REPORT: Nothing’s Fixed – What’s Behind the Corporate Debt Bailout

Over the past two years, nobody knew what would trigger the next financial crisis, but just about everyone knew it would involve the record pile of corporate debt. And so it happened. Now the Fed fixed it…

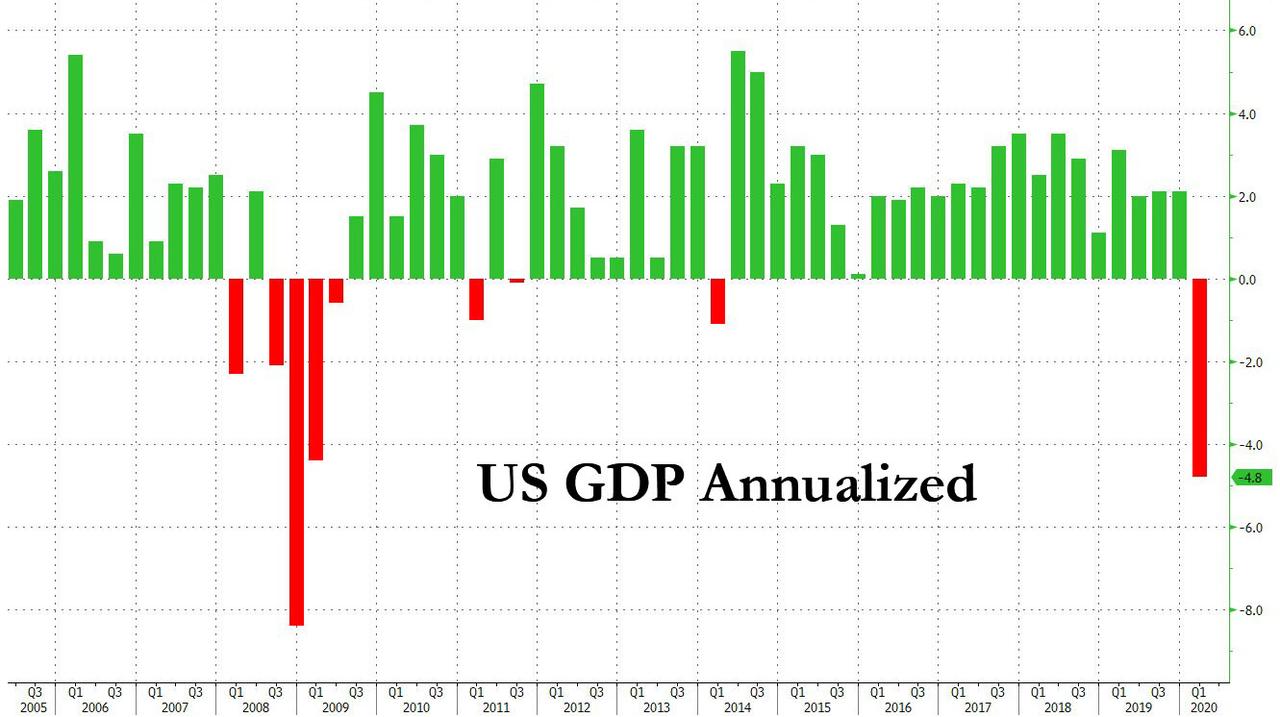

Recession Begins: Q1 GDP Plunges 4.8%, Biggest Drop Since The Financial Crisis

Recession Begins: Q1 GDP Plunges 4.8%, Biggest Drop Since The Financial Crisis

With news that the Gilead Remdesivir trial had reportedly met its primary endpoint hitting “coincidentally” just seconds before the Q1 GDP print, and with newswires initially reporting the GDP erroneously as a positive 4.8% print, it was clear that the real number would be a disaster, and sure enough moments later newswires reversed and reported that Q1 GDP was in fact, a worse than expected negative 4.8%, the biggest drop since March of 2009, and officially marking the start of the US recession.

Perhaps in response to demands from the White House, the BEA was quick to note that “the decline in first quarter GDP was, in part, due to the response to the spread of COVID-19, as governments issued “stay-at-home” orders in March. This led to rapid changes in demand, as businesses and schools switched to remote work or canceled operations, and consumers canceled, restricted, or redirected their spending. The full economic effects of the COVID-19 pandemic cannot be quantified in the GDP estimate for the first quarter of 2020 because the impacts are generally embedded in source data and cannot be separately identified.”

Developing

Let the Institutional Innovation Begin! (Part I)

Let the Institutional Innovation Begin! (Part I)

In corvid-19, neoliberal capitalism has met a formidable foe. The pandemic has shown just how fragile and dysfunctional the market/state order — as a production apparatus, ideology, and culture — truly is. Countless market sectors are now more or less collapsing with a highly uncertain future ahead. With a few notable exceptions, government responses to the virus range from ineffectual to self-serving to clownish.

While politicians clearly hope that massive government bailouts will restore the economy, it’s important to recognize that this is not just a financial crisis; it’s a social and political crisis as well. Many legacy market systems – generously subsidized and propped up by state power – are not really trusted or loved by people. Do Americans really want to give $17 billion to scandal-ridden Boeing while letting the post office go bankrupt? It is too early to declare that the old forms will never return, and we do need to remember that the authoritarian option is dangerously close. But it is clear that the future will have a very different pattern.

To me, one thing is obvious: searching for the rudiments of a New Order should be our top priority once emergency needs are taken care of. We need to identify and cultivate new patterns of peer provisioning and place-based governance, especially at the local and regional levels. We need new types of infrastructures and new narratives that understand the practical need for open-source civic and economic engagement.

This is not only necessary to help us deal with climate change and inequality; it is a preemptive necessity for fortifying democracy itself. Reactionary forces are already poised to try to restore a pre-pandemic “normal.” “Prepare for the Ultimate Gaslighting,” writes filmmaker Julio Vincent Gambuto in a wonderful essay on Medium.

…click on the above link to read the rest of the article…

Peter Schiff: This Is a Financial Crisis

Peter Schiff: This Is a Financial Crisis

A lot of people in the mainstream still insist this isn’t a financial crisis like we saw in 2008. They say this is just a self-inflicted shutdown of the economy. Since we decided to shut it down, we can decide to start it back up again. Peter Schiff begs to differ. In his podcast, he explains that this is absolutely a financial crisis and it’s going to be worse than 2008.

Stocks fell yesterday (April 15) on dour economic news and the financials led the plunge. In fact, even during the stock market rally on Monday, the financials lagged. Peter called them the Achilles Heel in that Monday surge.

This is significant because the financial sector is the key to the US economy.

They shouldn’t be, but they are, because we have a bubble economy. We have an economy based on credit, based on debt. So, not people spending the money they earned, but spending the money they didn’t earn but they borrowed.”

This becomes clear when you look at the consumer debt numbers. Americans were already leveraged up to their eyeballs before coronavirus spurred a government lockdown of the economy.

What is at the heart of the bubble, other than the Federal Reserve which is pumping all the blood through the body of the economy, but it’s pumping it through the heart of the banking sector. So, when you’re seeing this cardiac arrest in the banking sector, this is a sign that there’s trouble brewing here when the banks are having so much trouble.”

Why are banks in trouble? Because people are defaulting on their loans. In fact, there was already trouble in the subprime markets before COVID-19. Both subprime credit card and auto loan defaults were rising. That will only increase with millions of people suddenly unemployed.

…click on the above link to read the rest of the article…

Unprecedented Demand Destruction Marks The Return Of The Super Contango

Unprecedented Demand Destruction Marks The Return Of The Super Contango

These days, every corner of the oil market is “unprecedented”—from the demand destruction to the supply surge and the resulting glut. The oil futures curve is no exception and is also in a state never seen before. This is the super contango, the market situation in which front-month prices are much lower than prices in future months, pointing to a crude oil oversupply and making storing oil for future sales profitable.

The last time a super contango appeared on the market was during the previous glut of 2015. During the peak of the 2008-2009 financial crisis, the super contango hit a record—the discount at which front-month futures traded compared to longer-dated futures was at its highest ever.

The double supply-demand shock of the past month threw the oil futures market into another super contango. And this super contango is already beating previous records.

The super contango is representative of the state of the oil market right now: the growing glut with shrinking storage capacity as oil demand craters, OPEC’s leader and the world’s top exporter, Saudi Arabia, intent on further cratering the market with a supply surge beginning this month. Storage costs are surging, and so are costs for chartering tankers to store oil at sea for future sales when traders expect demand to recover from the pandemic-hit plunge.

The market structure flipped into contango in early February, when the Chinese oil demand slump in the coronavirus outbreak led to lower estimates for oil consumption. A month and a half later, oil consumption is set to plunge by 20 million bpd, or 20 percent, this month. Add to this the Saudi supply surge, and here we have what analysts expect to be the largest glut the oil market has ever seen.

…click on the above link to read the rest of the article…

Don’t Wait For the Storm to Pass–Learn to Dance in the Rain!

DON’T WAIT FOR THE STORM TO PASS – LEARN TO DANCE IN THE RAIN!

Whoever doesn’t learn to dance in the rain will struggle to survive the virtually non-stop storms that the world will experience in the next few years. The abrupt downturn in the global economy, triggered but not caused by coronavirus, came as a lightning bolt out of the blue. Thus, most people are paralysed and will fall helplessly as the world unwinds 100 years of mismanagement and excesses, caused primarily by bankers, both central and commercial.

2006-9 WAS JUST A REHEARSAL

I have for years warned about the enormous risks in the financial system that inevitably would lead to a collapse. As the bubble continued to grow for over ten years since the 2006-9 crisis, very few understood that the last crisis was just a rehearsal with none of the underlying problems resolved. By printing and lending $140 trillion since 2006, the problem and risks weren’t just kicked down the road but made exponentially greater.

So here we are in the spring of 2020 with debts, unfunded liabilities and derivatives of around $2.5 quadrillion. This is a sum that is impossible to fathom but if we say that it is almost 30x global GDP, it gives us an idea what the world and central banks will have to grapple with in the next few years.

THERE WILL BE NO V OR U RECOVERY

No one should believe for one moment that once CV is gone we will experience a V shaped recovery. There will be no V, there will be no U and nor will we see a hockey stick recovery. What few people understand, including the so called experts, is that there will be no recovery at all. An extremely rapid decline of the world economy has just started and will be devastating in the next 6-12 months, whether CV ends soon or not.

…click on the above link to read the rest of the article…

Rickards: It’ll Get Worse it Before It Gets Better

Rickards: It’ll Get Worse it Before It Gets Better

We’re well into the coronavirus pandemic at this point. As of this writing, there are 360,765 reported infections and 15,491 deaths worldwide.

Over the next few days, you may be certain that those numbers will be significantly higher.

That’s how pandemics work. The cases and fatalities don’t grow in a linear fashion; they grow exponentially.

It’s widely acknowledged that this pandemic will get much worse before it gets better. There’s no doubt about that.

It didn’t take long for the coronavirus crisis to turn into an economic and financial crisis.

The Worst Collapse Since the Great Depression

The U.S. is falling into the worst economic collapse since the Great Depression in 1929. This will be worse than the dot-com collapse of 2000–01 and worse than the Great Recession and global financial crisis of 2008–09.

Don’t be surprised to see second-quarter GDP drop by 10% or more and for the unemployment rate to race past 10% on its way to 15% or higher.

The questions for economists are whether the lost output will be permanent or temporary and whether U.S. growth will return to trend or settle on a new path that is below the pre-virus trend.

Some lost expenditure may just be a timing difference. If I plan to buy a new car this month and decide not to buy it until August, that’s just a timing difference; the sale is not permanently lost.

But if I don’t go out for dinner tonight and then do go out a month from now, I’m not going to order two dinners. The skipped dinner is a permanent loss.

Unfortunately, 70% of the U.S. economy is based on consumption and the majority of that consists of services rather than goods. This suggests that much of the coronavirus impact will consist of permanent losses, not timing differences.

…click on the above link to read the rest of the article…

A Shaky Foundation

A Shaky Foundation

And so castles made of sand fall in the sea, eventually.

– Jimi Hendrix

There’s a widespread belief out there that the U.S. and the global economy in general is on much sounder footing ever since the financial crisis of a decade ago. Unfortunately, this false assumption has resulted in widespread complacency and elevated levels of systemic risk as we enter the early part of the 2020s.

All it takes is a cursory amount of research to discover nothing was “reset” or fixed by the government and central bank response to that crisis. Rather, the entire response was just a gigantic coverup of the crimes and irresponsible behavior that occurred, coupled with a bailout designed to enrich and empower those who needed and deserved it least.

Everything was papered over in order to resuscitate a failed paradigm without reforming anything. Since it was all about pretending nothing was structurally wrong with the system, the response was to build more castles of sand on top of old ones that had unceremoniously crumbled. The whole event was a huge warning sign and opportunity to change course, but it was completely ignored. Enter novel coronavirus.

I’ve been concerned about the coronavirus outbreak from the start, and have been tweeting about it consistently for well over a month.

One thing I’ve learned from this coronavirus response thus far is institutions will never do the right thing fast enough in a situation like this to prevent a true global disaster when that day arrives.

We have no idea what’s actually happening with this thing, yet planes are landing from China all over the world. We may very well avoid a global disaster here, but if we do it’ll be because of luck.

…click on the above link to read the rest of the article…

The Collapse Of This Historic Correlation Suggests A Major Crisis Is Imminent

The Collapse Of This Historic Correlation Suggests A Major Crisis Is Imminent

A lot of digital ink has been spilled in recent days over the perplexing reversal of the Yen, which for years was seen by the market as a “flight to safety” trade (as unexpected crisis events would prompt capital repatriation into Japan or so the traditional explanation went), only to suffer a major selloff in the past week as it suddenly started trading not as a funding currency for risk-on FX pairs, but as a risk asset itself.

To us, the reversal is far less perplexing than some smart people make it out to be: with Japan now effectively in a recession following the catastrophic Q4 GDP print which crashed 6.3% annualized, validated by today’s just as terrible PMI report…

.. and with Japan now set to suffer a major hit due to the coronavirus epidemic spreading like wildfire across the region, it is only a matter of time before the BOJ follows the ECB and Fed in reversing what has been years of QE tapering, and either cuts rates further into negative territory or expands its QQE (with yield control), and starts buying equities (although with the central bank already owning more than 80% of all ETFs, one wonders just what risk assets are left for the central bank to buy). Needless to say, both of these would have an adverse impact on the yen, and potentially lead to destabilization in the Japanese bond market which for years has defied doom-sayers, but it will only take one crack in the BOJ’s confidence for Japan’s entire house of cards to fall apart. That said, we are not there quite yet.

Furthermore, after the bizarre move in the prior two days, overnight the JPY appears to regain some normalcy, when it traded as it should (i.e., it was once again a risk-off proxy), with the USDJPY sliding during the two major “risk-off” events overnight.

World Bank Warns “Wave Of Debt” Could Unleash Historic Crisis, Crush The Global Economy

World Bank Warns “Wave Of Debt” Could Unleash Historic Crisis, Crush The Global Economy

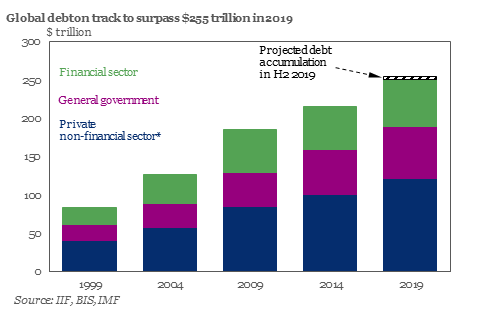

Something happens to the world’s “really smart people” when the topic of debt is discussed: they become blabbering idiots.

Consider that last month we reported that according to the Institute of International Finance, global debt has now hit $250 trillion and is expected to rise to a record $255 trillion at the end of 2019, up $12 trillion from $243 trillion at the end of 2018, and nearly $32,500 for each of the 7.7 billion people on planet. “With few signs of slowdown in the pace of debt accumulation, we estimate that global debt will surpass $255 trillion this year,” the IIF said in the report.

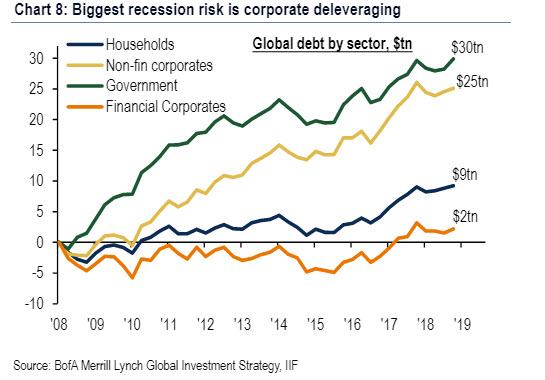

Separately, Bank of America recently calculated that since the collapse of Lehman, government debt has increased by $30tn, corporates debt by $25tn, household by $9tn, and financial debt by $2tn; And with central banks expected to support government debt, BofA warns that “the biggest recession risk is disorderly rise in credit spreads & corporate deleveraging.”

Where the “really smart people” come in, is the periodic return every couple of years of the naive assumption that despite this relentless increase in global debt, central banks can tighten financial conditions and the world can sustain higher interest rates. What ends up happening is that after a few quarters of “reflation” – which ironically and circularly is critical to inflate the debt away – markets realize that higher rates on this mountain of debt are unsustainable, risk assets tumble and central banks are forced to unleash another wave of easing, in the process further Japanifying first Europe, and then the entire world.

…click on the above link to read the rest of the article…

“The Fed Hasn’t Expanded Its Balance Sheet At This Speed Since The Financial Crisis”

“The Fed Hasn’t Expanded Its Balance Sheet At This Speed Since The Financial Crisis”

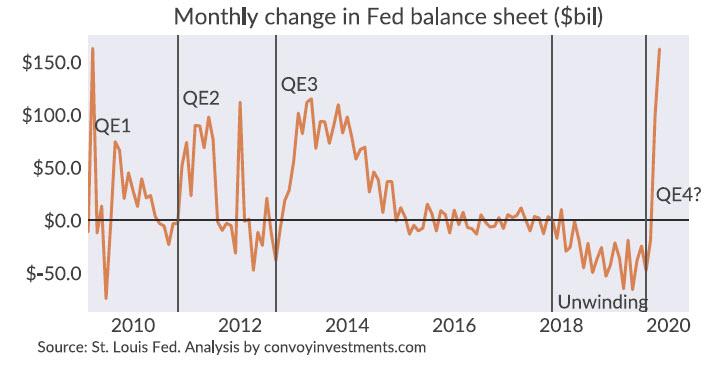

The Fed’s balance sheet is expanding at a faster rate than during QE1, QE2 or QE3.

* * *

Submitted by Howard Wang of Convoy Investments

Has QE4 begun? The $1.2 trillion per month hole in the repo market.

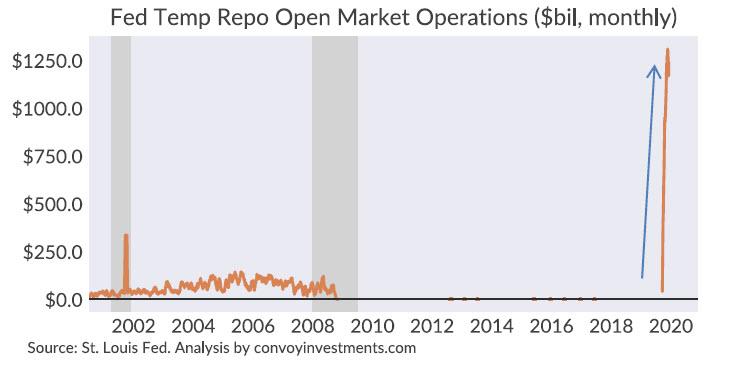

In the two months since the repo market blow up, the Fed has been making repo open market operation purchases at a rate of $1.2 trillion per month.

Below is the monthly rate of Fed open market purchases since 2000. In the era of QE and ample reserves, the Fed has not touched open market operations for more than 10 years before 2019. Prior to that, the highest rate of open market operations we saw in history was roughly $300 billion/month briefly after the September 11 attacks, with long‐term averages of around $50 billion/month. To say the current rate of $1.2 trillion/month is unprecedented would be an understatement

The planned QE unwinding has hit a brick wall and the Fed balance sheet is now expanding at a rate matched only briefly by QE1, and faster than QE2 or QE3.

Is this a temporary rescue of the repo market or the start of a sustained QE4? To answer that question, we must look at how monetary policy has evolved since the Financial Crisis.

1. Pre‐2008, scarce reserves regime:

- Total reserves: small (<$50 billion)

- Excess reserves: none

- Interest on excess reserves: 0%

- Managing interest rates: to increase rates, Fed sells securities on the open market and reduces supply of reserves, vice versa to decrease rates.

- Banks: regulations are lax and risk tolerance is high

- Treasury department: carefully manages its cash flows to not impact the total reserve levels.

2. 2008‐2019, ample reserves regime:

- Total reserves: large ($trillions)

- Excess reserves: large ($trillions)

- Interest on excess reserves: positive at around Fed funds rate

…click on the above link to read the rest of the article…

The Economic Crisis of 2008 Did Not End, It Has Been in Remission

The Economic Crisis of 2008 Did Not End, It Has Been in Remission

There have been many articles appearing in recent months suggesting that the economy might go into a recession within the next year. Many have focused on whether the Federal Reserve should cut interest rates to stop this from happening. There also has been a lot of speculation as to the effect that an economic downturn will have on the 2020 Presidential elections. I have not seen anyone talk about how today’s high stock prices will likely cause an economic collapse.

There have been numerous suggestions coming at things from the opposite direction, making the case that a recession will likely cause stock prices to fall hard. But I view that way of thinking about things as a holdover from the Buy-and-Hold Era. If stock price changes are caused by rational assessments of economic developments, it would make sense that economic bad times would cause stock prices to fall. But I believe that Shiller’s research showing that valuations affect long-term returns is legitimate research. If that is so, then high stock prices are caused by irrational exuberance and the inevitable disappearance of irrational exuberance causes trillions of dollars of consumer spending power to leave the economy, causing a contraction.

If that’s the way things work, the economic crisis of 2008 never came to an end. Employment numbers improved and businesses stopped going under. So, in a surface sense, economic conditions certainly improved. But the economic numbers improved only when CAPE levels returned to the dangerous levels that applied prior to the onset of the crisis. We pumped up stock prices to make people less fearful of spending but at the cost of insuring that a follow-up price crash would be coming in not too long a time.

…click on the above link to read the rest of the article…

“Close To A Standstill”: IMF Warns Global Growth Will Be Cut To Lowest Since Lehman

“Close To A Standstill”: IMF Warns Global Growth Will Be Cut To Lowest Since Lehman

Don’t expect any good news next week when the IMF holds its annual meeting and releases its latest World Economic Outlook report due on October 15.

According to the IMF’s new head, Bulgarian Kristalina Georgieva, the monetary fund will again cut its growth forecast for both 2019 and 2020; as a reminder back in July, the IMF again cut its projection for 2019 GDP growth to 3.2% this year and 3.5% next year, its fourth downgrade since last October, and the lowest since the financial crisis amid ever-escalating trade war. In fact, according to Georgieva, who apparently was brought in to take the blame for Lagarde’s disastrous legacy, global trade growth “is close to a standstill”, which last time we checked was 0%.

It means we are about about to have a new entry in the “worst since Lehman” category.

By now it is no secret to anyone that everyone – global institutions, economists and investors – have blamed the U.S.-China tariff war as the main reason for slowing global growth (and catalyst behind upcoming QE). The trade tensions have partly caused manufacturing to tumble and weakened investment, creating a “serious risk” of spillover to other areas of the economy like services and consumption, Georgieva said on Tuesday according to Bloomberg.

“The global economy is now in a synchronized slowdown,” she said, noting that the fund estimates that 90% of of the world is seeing slower growth. This is a huge change to the global economy from two years ago, when growth was accelerating across three-quarters of the globe in a synchronized upswing.

…click on the above link to read the rest of the article…