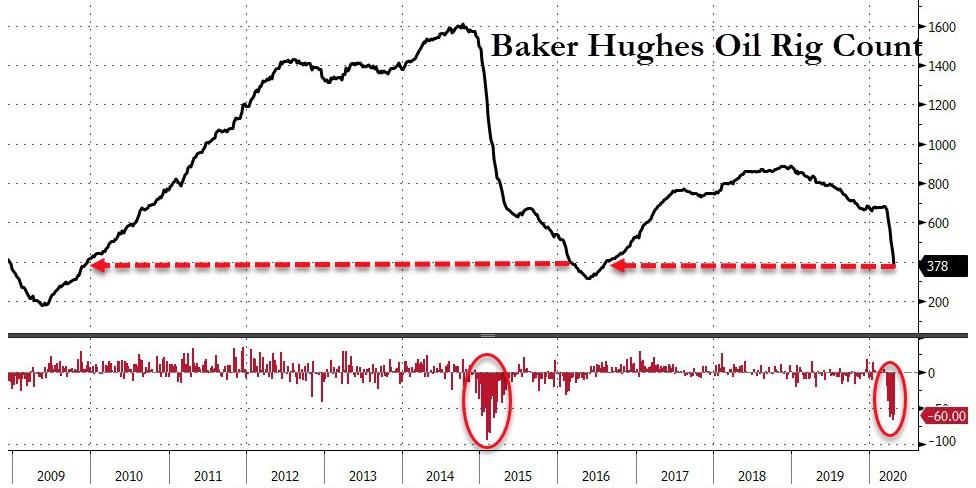

Baker Hughes reported a decreased number of active oil and gas rigs in the United States on Friday. Oil and gas rigs decreased by 8 rigs, according to the report, with the number of active oil rigs falling by 5 to 858 this week, while the number of gas rigs dipped by 2, hitting 187.

The oil and gas rig count now stands at 1,046—up 96 from this time last year, with the number of oil rigs accounting for 94 of that 96.

Canada gained 14 oil and gas rigs for the week, 11 of which were gas rigs. Canada’s oil and gas rig count is now up just 5 year over year. Oil rigs are up by 24 year over year in Canada, while the number of gas rigs are down by 19.

The biggest loser by basin this week was Granite Wash, which lost 3 rigs. The only basin to gain rigs this week were Cana Woodford (+2), and Utica (+1). The Permian basin, which saw neither an increase or a decrease this week, and Cana Woodford, saw the biggest increases year over year. Cana Woodford now has 12 more rigs than this time last year, while the Permian has 102 rigs more than this time last year.

WTI crude was trading down on Friday afternoon while Brent crude was trading up—widening the WTI discount to Brent. WTI was trading down 0.18% (-$0.12) at $68.12 at 12:34 pm EDT. Brent crude was trading up 0.25% (+$0.18) at $72.76 per barrel.

Both benchmarks are trading significantly down week on week as the market treads carefully after OPEC committed to increasing production in order to more closely stick to its production cut agreement after months of under producing, and despite US production that this week, for the first time, hit a new psychologically important high of 11 million bpd, after hovering at 10.9 million bpd for multiple weeks.

…click on the above link to read the rest of the article…