A privacy expert tasked with protecting personal data within a Google-backed smart city project has resigned as her pro-privacy guidelines would largely be ignored by participants.

“I imagined us creating a Smart City of Privacy, as opposed to a Smart City of Surveillance,” Ann Cavoukian, the former privacy commissioner of Ontario, wrote in a resignation letter to Google sister company Sidewalk Labs.

“I felt I had no choice because I had been told by Sidewalk Labs that all of the data collected will be de-identified at source,” she added.

Cavoukian was an acting consultant involved in the plan by Canada’s Waterfront Toronto to develop a smart city neighborhood in the city’s Quayside development. She had created an initiative called Privacy by Design that aimed to ensure citizens’ personal data would be protected.

Once it became apparent that citizen privacy could not be guaranteed, Cavoukian decided it was time to leave the project:

But then, at a Thursday meeting, Cavoukian reportedly realized such anonymization protocols could not be guaranteed. She told the Candian news outlet that Sidewalk Labs revealed at that meeting that their organization could commit to her guidelines, but other involved groups would not be required to abide by them.

Cavoukian realized third parties could possibly have access to identifiable data gathered through the project. “When I heard that, I said, ‘I’m sorry. I can’t support this. I have to resign because you committed to embedding privacy by design into every aspect of your operation,’” she told Global News. – Gizmodo

Being touted as “the world’s first neighborhood built from the internet up,” the Google designed smart city is set to deploy an array of cameras and sensors that detect pedestrians at traffic lights or alert cleanup crews when garbage bins overflow, reports The Globe and Mail.

…click on the above link to read the rest of the article…

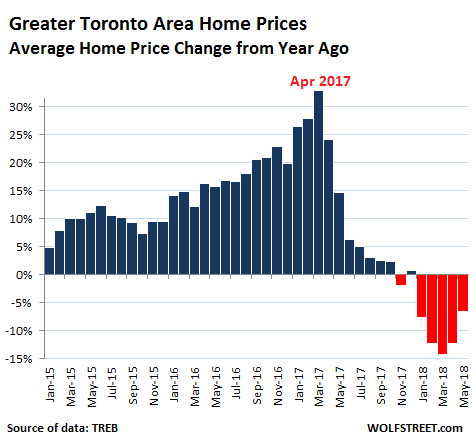

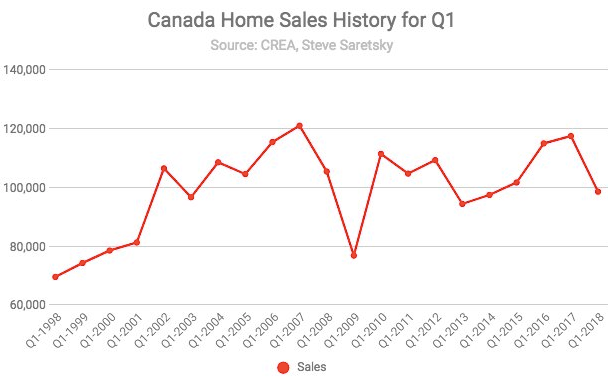

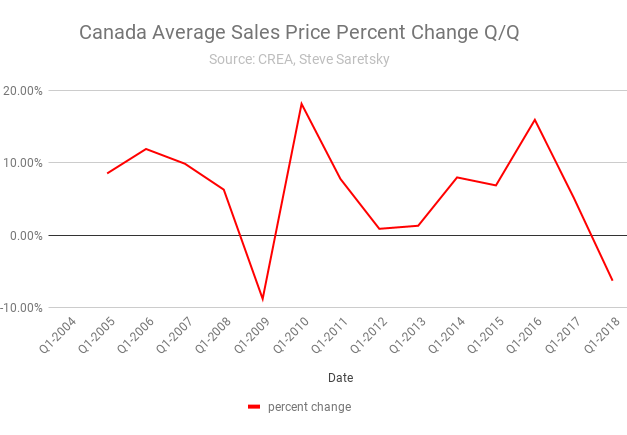

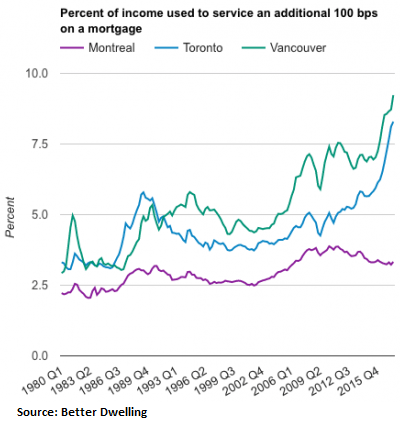

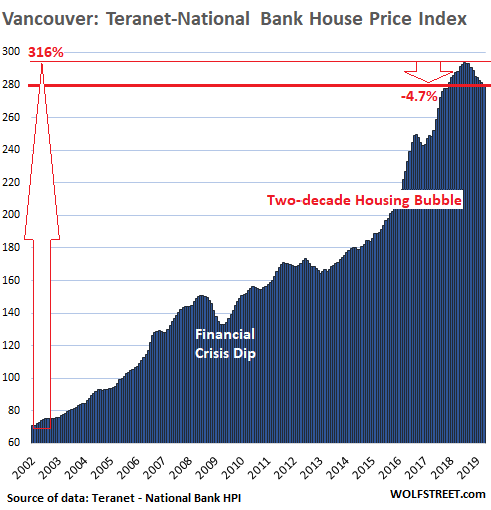

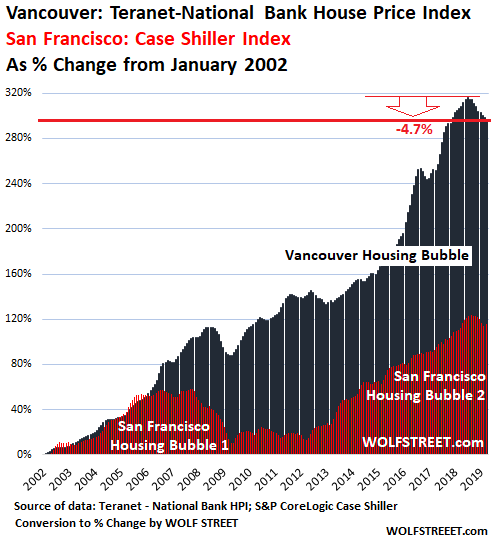

CMHC believes home buyers may have experienced a fear of missing out, citing that homebuyers measure the value of a home through rule of thumb mechanisms like, “it’s a hot market, I can’t miss out, it’s really tight right now-will have to revise our budget if we want to get in” all of which are phrases pushing homebuyers to overvalue an investment.

CMHC believes home buyers may have experienced a fear of missing out, citing that homebuyers measure the value of a home through rule of thumb mechanisms like, “it’s a hot market, I can’t miss out, it’s really tight right now-will have to revise our budget if we want to get in” all of which are phrases pushing homebuyers to overvalue an investment.