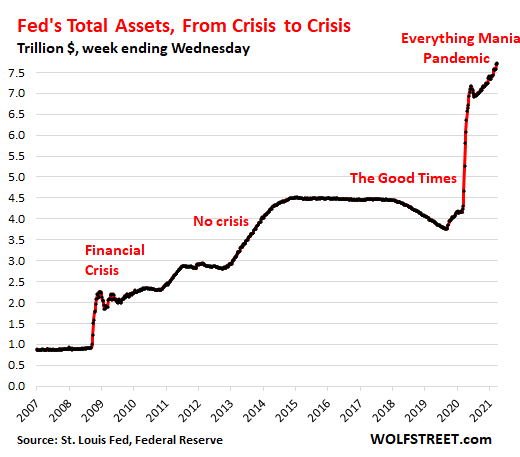

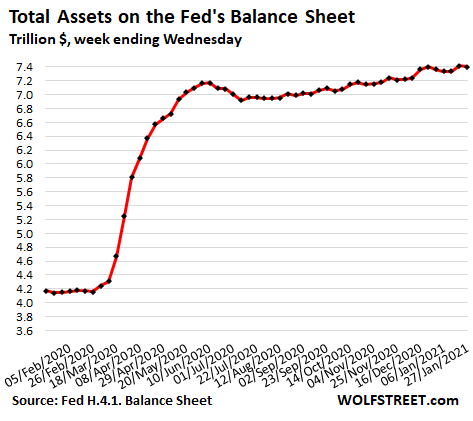

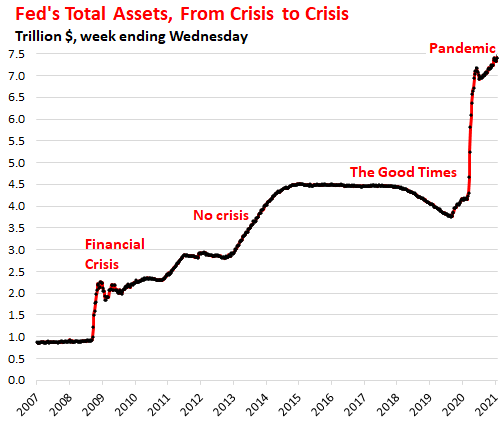

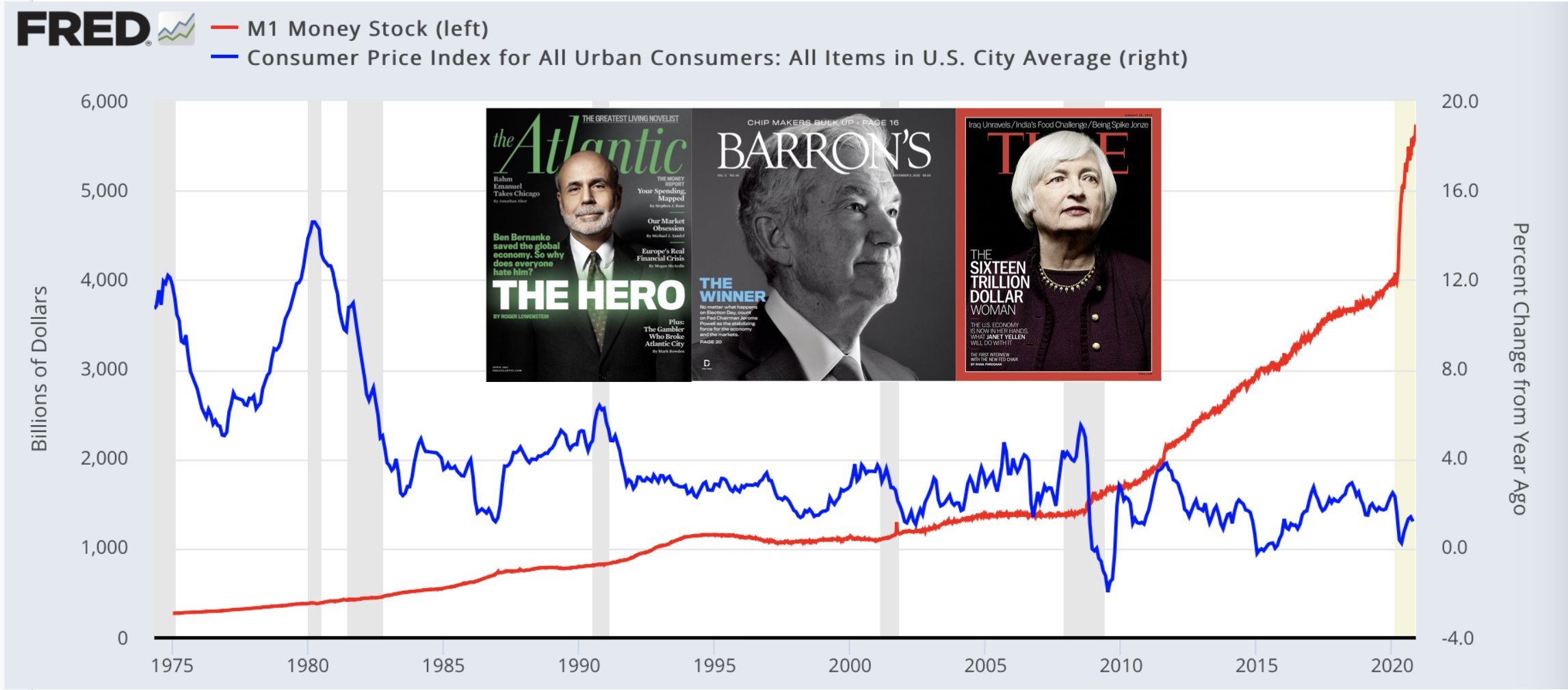

It’s a crazy situation the Fed backed into as tsunami of liquidity goes haywire, banking system strains under $4 trillion in reserves, and General Treasury Account gets drawn down.

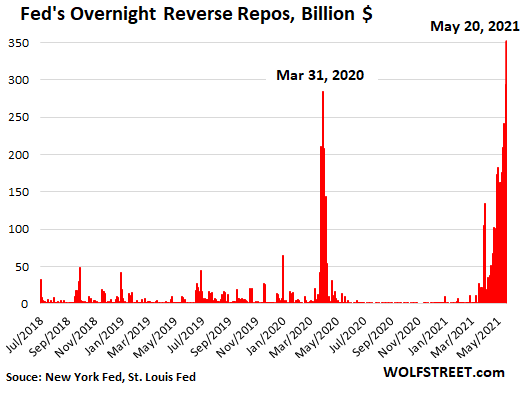

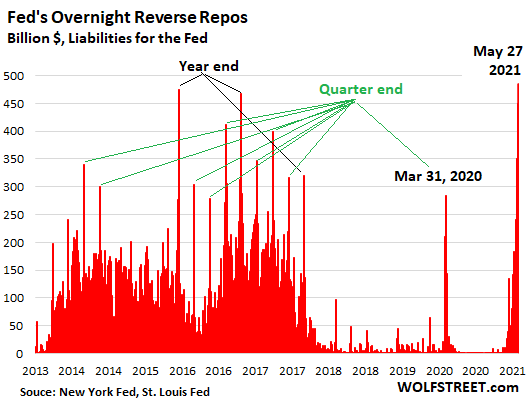

This morning, the Fed sold a record $485 billion in Treasury securities via overnight “reverse repos” to 50 counterparties, beating the prior record set on December 31, 2015. These overnight reverse repos will mature and unwind tomorrow morning. Today, yesterday’s $450 billion in overnight reverse repos matured and unwound, and were more than replaced with this new batch of $485 billion in overnight reverse repos.

Reverse repos are liabilities on the Fed’s balance sheet. They’re the opposite of repos, which are assets. With these reverse repos, the Fed is selling Treasury securities to counterparties and is taking their cash, thereby massively draining liquidity from the market – the opposite effect of QE.

In past years of large reserves following QE, banks shed reserves via reverse repos, reducing reserves on the balance sheet and increasing their Treasury holdings, to dress up their balance sheet at the end of the quarter, and particularly at the end of the year. Reverse repos declined after the Fed started reducing its assets during Quantitative Tightening in 2018 and 2019. But the current record spike is taking place in the middle of the quarter, a sign that the enormous amount of liquidity is going haywire:

This is a crazy situation that the Fed backed into.

Even as liquidity is going haywire, and as the Fed trying to deal with it via reverse repos, the Fed is still buying about $120 billion per month in Treasury securities and mortgage-backed securities, thereby adding liquidity.

…click on the above link to read the rest of the article…