The soothingly low mortgage delinquency rate is a deceptive indicator: the New York Fed weighs in.

Mortgage delinquencies at all commercial banks in the US inched down to 3.14% in the second quarter, the lowest since Q2 2007, according to the Federal Reserve. But after those soothingly low delinquency rates in 2007, something happened. By Q3 2008, the delinquency rate hit 5.2%, and in Q4 2009, it went over 10%, and stayed in the double-digits until Q1 2013. This was the mortgage crisis. And we’re a million miles away from it, thank God. Or are we?

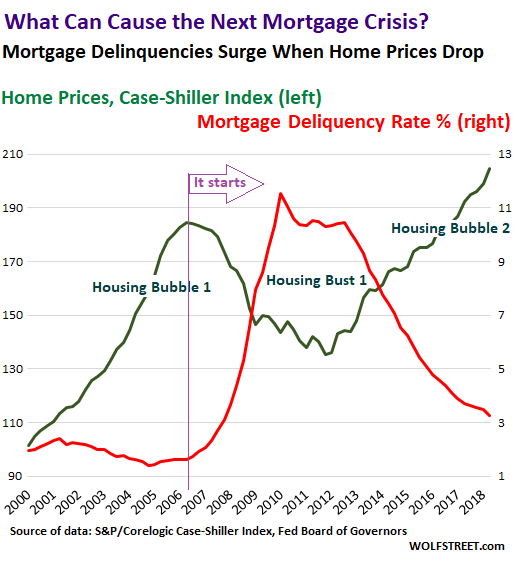

This chart compares home prices in the US (green, left scale) to delinquency rates (red, right scale). Delinquency rates started surging after home prices started falling. The inflection point is marked by the vertical purple line, labeled “it starts”:

Home prices began falling in 2006. By 2008, some homeowners were seriously “underwater” – they owed more on their house than the house was worth. When they ran into financial trouble because they were in over their heads, or because one of the breadwinners in the household lost their jobs, or because they’d lied on their mortgage application and never had enough income to begin with, or because they were investors who couldn’t make the math work out anymore, or whatever, they were stuck.

In a rising housing market, they would just sell the home and pay off the mortgage. But they couldn’t sell their home because it was worth less than the mortgage, and default was the only option.

The chart above shows the relationship between home prices and delinquencies. In a rising housing market, delinquencies will always be low but are not an indicator of future default risks. But home prices are an indicator of default risk.

…click on the above link to read the rest of the article…