Home » Posts tagged 'mises institute'

Tag Archives: mises institute

Biden’s Inflation Narrative Dies as Price Growth Rises to a Seven-Month High

Biden’s Inflation Narrative Dies as Price Growth Rises to a Seven-Month High

“…we can expect the administration and the regime in general to continue gaslighting the public and claiming that greedy capitalists cause inflation.”

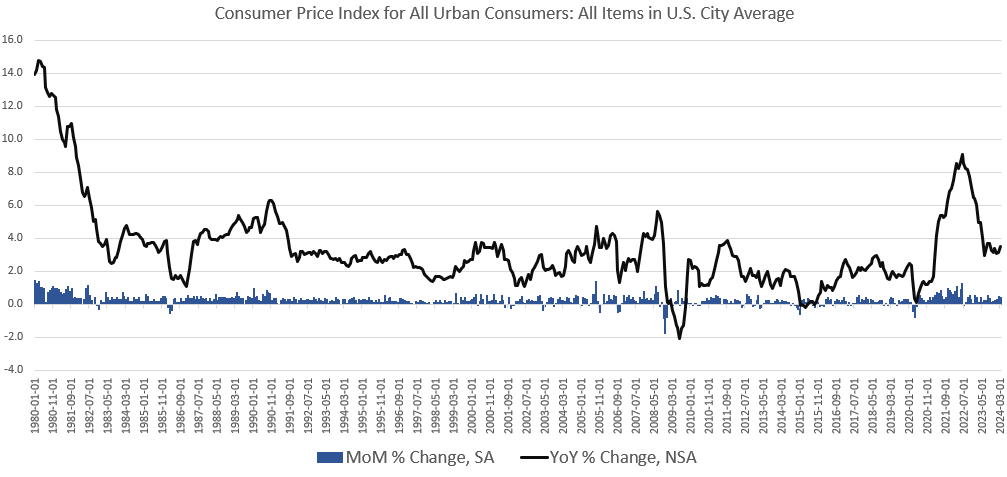

According to the Bureau of Labor Statistics’ latest price inflation data, CPI inflation in March rose to a seven-month high, and price inflation hasn’t proven nearly as transitory as the regime’s economists have long predicted.

According to the BLS, Consumer Price Index (CPI) inflation rose 3.5 percent year over year during March, without seasonal adjustment. That’s the thirty-seventh month in a row of inflation well above the Fed’s arbitrary 2 percent inflation target.

Month-over-month inflation was flat with the CPI rising by 0.4 percent from February to March, with seasonal adjustment. Month-to-month growth had also been 0.4 percent from January to February.

The ongoing price increases largely reflect growth in prices for food, services, electricity, and shelter.

For example, prices for “food away from home” were up 4.2 percent in March over the previous year. Gasoline prices rose 1.3 percent over the period, but electricity surged to 5.0 percent. Prices for “services less energy services” rose 5.4 percent, year over year, while shelter rose 5.7 percent over the period.

Some specific categories were well above even this in year-over-year price inflation. For example:

- Car insurance prices: up 22.2%

- Car repair prices: up 11.6%

- Transportation prices: up 10.7%

- Hospital services prices: up 7.5%

- Homeowners’ prices (“Owners’ equivalent rent”): up 5.9%

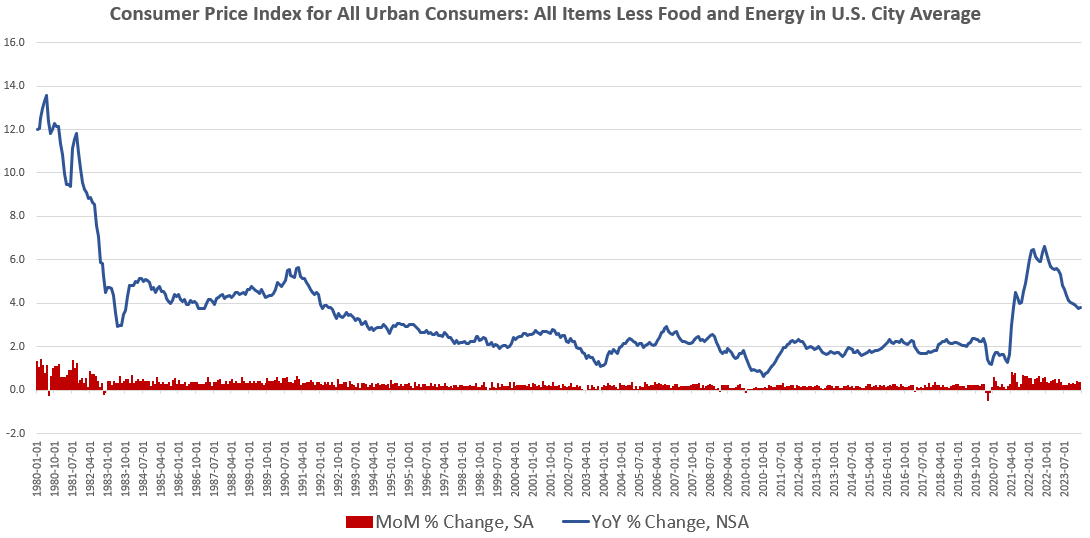

Removing volatile energy and food prices from the index, we find price inflation nonetheless remains stubbornly high. So-called core CPI growth remains almost double the “two-percent target”—at 3.8 percent—keeping price inflation growth near thirty-year highs. In other words, core CPI is a long way from returning to “normal.” Moreover, March’s month-over-month increase remains at 0.4 percent, which is the largest increase recorded in any month since April 2023.

Biden Blames Corporate Greed

…click on the above link to read the rest of the article…

The Fraud Inherent in Fractional Reserve Banking

The Fraud Inherent in Fractional Reserve Banking

“Our current banking system is not free market capitalism.”

Suppose you bring a fur coat to a dry cleaner and later discover that the owner allowed his wife to wear it before cleaning it (an episode from Seinfeld). Or suppose you gave your car keys to a hotel valet and was told he lent your car to teenagers who took it for a joyride while you were sleeping at the hotel. You would not be too happy and for good reason. When you surrendered your clothes or your car keys, it was a bailment. You retained ownership and gave the clothes or car keys for safekeeping. In no shape or form did you surrender ownership of the items or lend out your property.

Suppose you lived in the eighteenth century and had a hundred ounces of gold. It’s heavy, and you do not live in a safe neighborhood, so you decide to bring it to a goldsmith for safekeeping. In exchange for this gold, the goldsmith gives you ten tickets on which are clearly marked as claims against a total of ten ounces. Now, gold is heavy and burdensome to carry, so in a short period of time, those claims will start circulating in place of gold. This is the creation of near monies. This doesn’t mean you have given up your ownership claims on gold but have instead used a simpler way of transferring ownership on this gold.

Of course, the gold now just sits in the vault, and no one usually comes to get some of it or even checks that it is still there. Quickly, the goldsmith realizes there is an easy, fraudulent way to get rich: just lend out the gold to someone else by creating another ten tickets…

…click on the above link to read the rest of the article…

The Coming Collapse of the Global Ponzi Scheme

The Coming Collapse of the Global Ponzi Scheme

It won’t be long before governments around the world, including the one in Washington, self-destruct.

Strong words, but anything less would be naïve.

As economist Herbert Stein once said, “If something cannot go on forever, it has a tendency to stop.” Case in point: fiat money political regimes. Interventionist economies of the West are in a fatal downward spiral, comparable to that of the Roman Empire in the second century, burdened with unsustainable debt and the antiprosperity policies of governments, especially the Green New Deal.

In the global Ponzi scheme, thin air and deceit substitute for sound money. As hedge-fund manager Mitch Feierstein wrote in Planet Ponzi, “You don’t solve a Ponzi scheme; you end it.” Charles Ponzi and Bernie Madoff

made some of their investors a whole lot poorer, but the world didn’t come crashing down as a result.

For that—for a Ponzi scheme that would threaten to bankrupt capitalism across the entire Western world—you need people much smarter than Ponzi or Madoff. You need time, you need energy, you need motivation. In a word, you need Wall Street.

But Wall Street alone doesn’t have the strength to deliver a truly cataclysmic outcome. If your ambition is to create havoc on the largest possible scale, you need access to a balance sheet running into the tens of trillions. You need power. You need prestige. You need a remarkable willingness to deceive. In a word, you need Washington.

As Gary North wrote in a brief review of Feierstein’s book, “The central banks have colluded with the national governments in order to fund huge increases of national debt, beyond what can ever be paid off. In other words, [Feierstein] has described government promises as part of a gigantic international Ponzi scheme.”

…click on the above link to read the rest…

A Pyrrhic End to 130 Years of Vicious Bad Money and Banking Crises

A Pyrrhic End to 130 Years of Vicious Bad Money and Banking Crises The original vicious circle starts with inflationary interventions in an up-to-then well-anchored monetary regime. Consequent asset inflation spawns a banking crisis. That leads to the installation of anticrisis safety structures (one illustration is a novel or enhanced lender of last resort). Alongside a possible monetary regime shift, these damage the money’s anchoring system. A great asset inflation emerges and leads on to an eruption of another banking crisis, devastating in comparison with the first.

The original vicious circle starts with inflationary interventions in an up-to-then well-anchored monetary regime. Consequent asset inflation spawns a banking crisis. That leads to the installation of anticrisis safety structures (one illustration is a novel or enhanced lender of last resort). Alongside a possible monetary regime shift, these damage the money’s anchoring system. A great asset inflation emerges and leads on to an eruption of another banking crisis, devastating in comparison with the first.

An array of additional safety structures is put in place which makes the now-bad money worse than before. After a long and variable lag, a long and violent monetary storm means the safety structures fail, a banking crisis again erupts but this time milder than the previous.

Then a further tinkering with the safety structures causes money to deteriorate even more in quality. Another shift in monetary regime coincidentally does much additional damage. Consequently, in time, a new crisis erupts much worse than the last one.

The safety engineers do more work, causing yet more damage to the mechanisms essential to sound money. But now the safety structures are so pervasive and strong across the banking industry that there is widespread belief that bank crisis eruptions will be smaller or, more likely, totally repressed.

Subsequent events demonstrate those beliefs to be hollow. There is a new round of safety structure elaboration leading to further monetary deterioration. Regime officials declare the end of bank crises.

The cumulative economic cost of this vaunted triumph over bank crisis is an advance of monopoly capitalism and monetary statism that throttles the essential dynamism of free market capitalism. Malinvestment becomes cumulatively larger. Living standards in general suffer. The severely ailing money which subsists is beyond any cure except the most radical.

…click on the above link to read the rest…

You Think the Global Economy Is Brightening? Beware: The Big Hit Is Yet to Come

You Think the Global Economy Is Brightening? Beware: The Big Hit Is Yet to Come

Relief is spreading among economic analysts and stock market experts. Energy prices are decreasing noticeably. The energy supply this winter seems secure; in Europe, government support for consumers and producers is available if needed. China is turning away from its zero-covid policy, and production is ramping up again. High goods price inflation is still a major concern for consumers and producers, but central banks are delivering at least some interest rate hikes to hopefully reduce currency devaluation. So should we bid farewell to crisis and recession worries? Unfortunately, no.

Because there is an overall economic development that is tantamount to a storm but remains unnamed by many experts and investors. And that is the global contraction of the real money supply. What does that mean? The real money supply represents the actual purchasing power of money. For example: You have ten dollars, and one apple costs one dollar. So with your ten dollars, you can buy ten apples. If the apple price increases to, say, two dollars per piece, the purchasing power of the ten dollars falls to five apples. It becomes obvious that the real money supply is determined by the interplay between the nominal money supply and the prices of goods.

The real money supply in an economy can decrease when the nominal money supply goes down or goods prices rise. This is exactly what is currently happening around the world. The chart below shows the annual growth rate of the real money supply in the Organization for Economic Cooperation and Development (OECD) from 1981 to October 2022. The real money supply recently contracted by 7.3 percent year on year. There has never been anything like this before. What is the reason?

…click on the above link to read the rest…

Why the End of the Petrodollar Spells Trouble for the US Regime

Why the End of the Petrodollar Spells Trouble for the US Regime

On January 17, the Saudi minister of finance, Mohammed Al-Jadaan, announced that the Saudi state is open to selling oil in currencies other than the dollar. “There are no issues with discussing how we settle our trade arrangements, whether it is in the US dollar, whether it is the euro, whether it is the Saudi riyal,” Al-Jadaan told Bloomberg TV.

If the Saudi regime does indeed embrace substantial trade in currencies other than the dollar as part of its oil-export business, this would signal a shift away from the dollar as the dominant currency in global oil payments. Or measured another way, this would signal the end of the so-called petrodollar.

But how large of a shift is this? With the increasingly frequent Saudi comments about trading in nondollar currencies, we’ve also seen an increasing number of pundits announcing the “collapse” of the dollar or the imminent implosion of the dollar’s currently outsized global power.

Will a shift away from the dollar in the global oil trade really lead to a big relative decline in the dollar? Probably and eventually. But a number of other dominoes would need to fall first, most especially the domino we call “Eurodollars.”

On the other hand, it would be foolish to simply dismiss the potential end of the Saudi preference for the dollar with hand-waving. The end of the petrodollar would indeed weaken the dollar, even if this would not be a mortal blow in itself. Moreover, it is especially foolhardy to ignore the status of the petrodollar because that status also has geopolitical implications. Saudi comments on the dollar signal that the Saudis no longer consider its alliance with the United States to be as important as it has been since the 1970s…

…click on the above link to read the rest…

The “Barbarous Relic” Helped Enable a World More Civilized than Today’s

The “Barbarous Relic” Helped Enable a World More Civilized than Today’s

One of history’s greatest ironies is that gold detractors refer to the metal as the barbarous relic. In fact, the abandonment of gold has put civilization as we know it at risk of extinction.

The gold coin standard that had served Western economies so brilliantly throughout most of the nineteenth century hit a brick wall in 1914 and was never able to recover, or so the story goes. As the Great War began, Europe turned from prosperity to destruction, or more precisely, toward prosperity for some and destruction for the rest. The gold coin standard had to be ditched for such a prodigious undertaking.

If gold was money, and wars cost money, how was this even possible?

First, people were already in the habit of using money substitutes instead of money itself—banknotes instead of the gold coins they represented. People found it more convenient to carry paper around in their pockets than gold coins. Over time the paper itself came to be regarded as money, while gold became a clunky inconvenience from the old days.

Second, banks had been in the habit of issuing more bank-notes and deposits than the value of the gold in their vaults. On occasion, this practice would arouse public suspicion that the notes were promises the banks could not keep. The courts sided with the banks and allowed them to suspend note redemption while staying in business, thus strengthening the government-bank alliance. Since the courts ruled that deposits belonged to the banks, bankers could not be accused of embezzlement. The occasional bank runs that erupted were interpreted as a self-fulfilling prophecy. If people lined up to withdraw their money because they believed their bank was insolvent, the bank soon would be…

…click on the above link to read the rest…

Are Progressive “Experts” Fallible? Yes, But Don’t Tell Them That

Are Progressive “Experts” Fallible? Yes, But Don’t Tell Them That

It can be argued that the world has reached the sorry state it’s in today largely because academics, politicians, “distinguished experts,” and “recognized authorities” did not have the humility to admit their own mistakes or to at least recognize the limits of their knowledge. Of course, this is far from a new affliction in societies and political systems. Hubris was among the most terrible sins that the ancient Greeks warned against, and there have been too many narcissists in positions of power to count since the emergence of the first organized societies. People who believe they know best, not just for themselves, but everyone else too, are naturally attracted to roles that would allow them to impose their will, their morality, and their values on their neighbors.

However, one also can argue that the problem is much more prevalent today than at any other time in our history. The modern news landscape, both mainstream and social media, the supercharged propaganda machines of all developed nations, and our public education system, ensure that dangerous figures will hardly be challenged by anyone once presented to the public as de facto, “recognized,” and “widely accepted” authorities. This is also true of politicians, but things are infinitely more perilous when it comes to science. The average citizen can more easily question a political stance directly, whereas it can be impossible to judge the merits of a scientific one without detailed and specific knowledge.

Therefore, it is much easier to “sell” any academic, from professors to junior researchers, as an “authority,” one that must be obeyed and never questioned. They can freely give us all advice on how to live our lives, and they can even dictate policy, despite the fact that usually that kind of thing tends to have side effects in areas they have absolutely no clue about…

…click on the above link to read the rest…

The Mainstream Has the Inflation Story Backwards

The Mainstream Has the Inflation Story Backwards

The mainstream blames inflation on “supply chain bottlenecks.” But they have it completely backward. In reality, Federal Reserve-created inflation is causing the supply chain mess.

According to Biden administration talking points, the economy is booming. Americans are flush with cash. And they are demanding lots of goods. The supply chain simply can’t keep up. That’s why we’re seeing empty shelves and rising prices. Transportation Secretary Pete Buttigieg summed up the mainstream mantra.

Demand is up … because income is up, because the president has successfully guided this economy out of the teeth of a terrifying recession.”

White House spokeswoman Jen Psaki told a similar tale. She said we have supply chain problems because “people have more money … their wages are up … we’ve seen an economic recovery that is underway.”

This sounds like a lot of spin. But in one sense, the mainstream is right. As Mises Institute Senior Editor Ryan McMaken pointed out in a recent article on the Mises Wire, they are correct when it comes to consumer demand and spending, even if they got it right for the wrong reason.

As Mihai Macovei showed earlier this month, the global volume of trade and shipping volume in 2021 have actually exceeded prepandemic numbers. For example, in the port of Los Angeles, ‘loaded imports’ and ‘total imports’ for the 2020–21 fiscal year (ending June 30, 2021) were both up when compared to the same period of the 2018–19 fiscal year. In other words, it’s not as if little is moving through these ports. In fact, more is moving through them than ever before. That suggests demand is indeed higher.”

But why is demand so much higher? As Psaki said, Americans have more money in their pockets. Wages are up nominally. But it’s not because the economy is booming. As McMaken points out, it’s due to inflation.

…click on the above link to read the rest of the article…

We’re Living in a Chaos Economy. Here’s How to End It.

We’re Living in a Chaos Economy. Here’s How to End It.

The Federal Reserve has been increasing the money supply at an explosive rate. The federal budget, deficits, and the trade deficit are record levels. Governments, both foreign and domestic, have locked down people, restricting production and consumption. How should this be viewed by an economist?

There is clearly chaos in the economy, and hardly a day goes by when I don’t find unusual if not unprecedented situations in day-to-day economic life. However, many people and economists are either oblivious to the problems or in denial. Things are normal for them. Politicians are mostly in this camp. For economists and investment promotors, inflation is “transitory.” They don’t know how the economy works and they expect near perfection from the economy and entrepreneurs. This view is wrong.

The chaos is all too real for most others. Homemakers who spend household income are seeing their purchasing power shrink, their choices disappearing, and more of their time consumed stretching the family budgets. Christmas shopping will be worse than normal.

Chaos deniers are further entrenched in their experience by the mainstream media (MSM). The problems are either not reported by the MSM or are masked by aggregate statistics like price inflation, i.e., the Consumer Price Index, low unemployment, wage increases, and extremely high stock markets and real estate, especially housing prices. These stats make people feel good, or at least less nervous.

Below the government economists’ radar there is real economic suffering. Small businesses are hurting and going out of business. Based on Help Wanted signs I drive by every day, it is extremely difficult to hire employees or purchase inputs. One local BBQ restaurant recently had a sign that said, “Out of Chicken, Pork and Beef.”

…click on the above link to read the rest of the article…

Government “Stimulus” Keeps Having a Diminishing Effect

Government “Stimulus” Keeps Having a Diminishing Effect

The United States economy recovered at a 6.5 percent annualized rate in the second quarter of 2021, and gross domestic product (GDP) is now above the prepandemic level. This should be viewed as good news until we put it in the context of the largest fiscal and monetary stimulus in recent history.

With the Federal Reserve purchasing $40 billion of mortgage-backed securities (MBS) and $80 billion in Treasurys every month, and the deficit expected to run above $2 trillion, one thing is clear: the diminishing effect of the stimulus is not just staggering, but the increasingly short impact of these programs is alarming.

The GDP figure is even worse considering the expectations. Wall Street expected a GDP growth of 8.5 percent and most analysts had trimmed their expectations in the past months. The vast majority of analysts were sure that real GDP would comfortably beat consensus estimates. It came in massively below.

What is wrong?

In recent times, mainstream economists only discuss the merit of stimulus plans based on the size of the programs. If it is not more than a trillion US dollars it is not even worth discussing. The government continues to announce trillion-dollar packages as if any growth at any cost were acceptable. How much is squandered, what parts are not working, and, more importantly, which ones generate negative returns on the economy are issues that are never discussed. If the eurozone grows slower than the United States, it is always blamed on an allegedly lower size of stimulus plans, even if the reality of figures shows otherwise, as the European Central Bank (ECB) balance sheet is significantly larger than the Fed’s relative to each economy’s GDP and the endless chain of fiscal stimulus plans in the eurozone is well documented.

…click on the above link to read the rest of the article…

Antal Fekete, Gold, and Central Banks

Antal Fekete, Gold, and Central Banks

On the fourteenth of October 2020, Antal E. Fekete, the Hungarian-Canadian economist who saw himself as a monetary theorist following the tradition of Carl Menger, died in Budapest. Behind him was an eventful and fruitful life which was quite typical of the crazy last century. His experiences eventually filled Fekete with dark forebodings for the current century. We can only hope that this crazy year won’t become characteristic of an entire era, as his year of birth did.

Antal Endre Fekete was born on the eighth of December 1932 in Budapest. Mass unemployment was rife in the midst of a deep global economic crisis. Hungary was heading towards National Socialism on the back of a severe banking crisis. The totalitarian, anti-Semite Gyula Gömbös had taken over the government shortly before Fekete’s birth. All around, belief in the omnipotence of politics was leading to a spiral of interventionism and polarization which would ultimately lead to the old Europe being destroyed by totalitarianism and war. Monetary policy played a role in this that is underestimated to this day.

Fekete was one of the few old Europeans to recognize the central role of money, on the positive side as a means of amicable division of labor, on the negative side as a casualty and lever of political intervention spirals. This led the mathematician to monetary theory, in which he sought to expand and update the old Austrian school of economics. As with all original contributions, it is too soon to definitively assess whether he introduced new errors and what these errors were. Yet his prominence as a sharp thinker who combined theory with profound historical knowledge is undervalued. This is partly due to his quarrelsome personality, which came between him and almost all of his comrades in arms and companions…

…click on the above link to read the rest of the article…

How the State Spreads Mass Hysteria

How the State Spreads Mass Hysteria

The history of mass hysteria, or mass sociogenic illness is fascinating. Cases of mass hysteria have been documented since the Middle Ages. Let me just mention a few of the more recent cases.

When a radio play by Orson Welles, War of the Worlds, was broadcasted in 1938 shortly after the suspension of the Munich agreement, the play allegedly caused panic among listeners, who thought that they were under attack by Martians.

Another intriguing case is an episode of a Portuguese TV show called Strawberries with Sugar. In the episode, the characters were infected by a life-threatening virus. After the show, more than three hundred students reported similar symptoms as the ones experienced by the TV show characters such as rashes and difficulty breathing. Some schools even closed. The Portuguese National Institute for Medical Emergency concluded that the virus did not exist in reality and that the symptoms were caused by mass hysteria.Similarly, on Emirates flight 203 in September 2018, dozens of passengers started to believe they were sick after observing other passengers with flu-like symptoms. As a consequence of the panic, the whole flight was quarantined. In the end only a few passengers had a common cold or the seasonal flu.

It is well known that there exist nocebo effects, which are the opposite of placebo effects. Due the placebo effect, a person recovers from an illness because she expects to do so. When we suffer a nocebo effect, on the other hand, we get ill just because we expect to become ill.1 In a self-fulfilling prophecy, the expectation can cause the symptoms. Anxiety and fear exacerbate this process.2

…click on the above link to read the rest of the article…