Home » Posts tagged 'macrotourist'

Tag Archives: macrotourist

Content

- ‘It Bears Repeating: A Best Of…’

- ‘Publications’

- About

- Index–Today’s Contemplation: Collapse Cometh

- Index–Today’s Contemplation: Collapse Cometh, Multipart Posts

- Novel Quotes

- Privacy Policy

- Purchase Book(s)

- Readings (Summary Notes) December 2, 2022 update

- Readings & Video: Olduvai Theory, Peak Oil, Collapse, & more…

- Stouffville Corner

- Today’s Contemplation Essays: Compilation, Volume 1

- Video

Post categories

- Economics (12,610)

- Energy (5,679)

- Environment (5,912)

- Geopolitics (6,120)

- Liberty (6,571)

- Survival (3,422)

- Uncategorized (40)

Economic Links

- 720 Global

- Acting Man

- Adam Smith Institute

- Advancing Time

- Armstrong Economics

- Center for the Advancement of a Steady State Economy

- Contra Corner

- Credit Bubble Bulletin

- Credo Economics

- Daily Reckoning

- Deep Dive

- Economic Collapse

- Economic Cycle Research Institute

- Economics From the Top Down

- Economy and Markets Daily

- F.F. Wiley

- Goldcore Blog

- Gold Silver Worlds

- Great Recession Blog

- Heliocene

- Heretic’s Guide to Global Finance

- Hutch Report

- Institutional Risk Analyst

- Investment Research Dynamics

- Jesses’ Cafe Americain

- Ludwig Von Mises Canada

- Macro Hive

- Mark St. Cyr

- Mauldin Economics

- Mises Institute

- Money Metals Exchange

- Northman Trader

- Of Two Minds

- Palisade Research

- Political Economy Research Centre

- Positive Money

- Sprott Money Blog

- Statistical Ideas

- Steady State Manchester

- Stealthflation

- Steve Keen’s Debtwatch

- Surplus Energy Economics

- Swarm

- Trading Floor

- True Sinews

- Wall Street Examiner

- Wall Street on Parade

- Web of Debt

- Wolf Street

- Zero Hedge

Energy/Resource Links

- American Petroleum Institute

- Art Berman

- Ecosophia (formerly Archdruid Report)

- Choose the Future

- D. Ray Long

- Energy Balance

- Energy Central

- Energy Matters

- Energy Outlook

- Energy Xchange

- Hydrogen Skeptics

- Institute for the Study of Energy and Our Future

- James Howard Kunstler

- Oil Price

- Oil-Price

- Oily Stuff

- Our Finite World

- Peak Energy & Resources

- Peak Oil

- Peak Oil Matters

- Peak Oil News

- Real Green New Deal

- Resilience

- Resource Crisis

- Richard Heinberg

- Simon Michaux

- Smaller World (Jeff Rubin)

- Surplus Energy Economics

- World Oil

- Wrong Kind of Green

Environmental Links

- Ahead of the Herd

- Carbon Brief

- Cliff Mass Climate and Weather Blog

- Climate Access

- Climate Action Australia

- Climate and Capitalism

- Climate Citizen

- Climate Code Red

- Climate Conscious

- Climate Home News

- Climate News Network

- Climate Psychologist

- Climate Reality Project

- Climate Tipping Points

- Climate Zone

- Circle of Blue

- Connect 4 Climate

- David Suzuki Foundation

- Deep Green Resistance

- Desmog Blog

- Ecological Gardening

- Ecologist

- Ecosystem Restoration Camps

- Ensia

- Environment.co

- Environmental Defence Blog

- Environment News Service

- Extraenvironmentalist

- Gaianism

- Going Local Going Green

- Greenbiz

- Green European Journal

- Green Social Thought

- Pembina Institute Blog

- Plentiful Lands

- Rainforest Rescue

- Revelator

- Uneven Earth

- Watching the World Go By

- Watts Up With That?

- Wine Water Watch

- Yale Climate Connections

- Yale Environment

Geopolitical Links

Liberty Links

- Activist Lab

- Alt Market

- Axis of Easy

- Bomb Thrower

- DeclassifiedUK

- Dissident Voice

- Down With Tyranny

- Eric Peters Autos

- Future of Freedom Foundation

- Info Wars

- Intercept

- Jonathan Cook Blog

- Liberty Blitzkrieg

- Liberty Nation

- Mass Private I

- Occupy

- Open Democracy

- Personal Liberty

- Project Censored

- ROAR Magazine

- Ron Paul Institute

- Rutherford Institute

- Sovereign Man

- Target Liberty

- True Activist

- Washington’s Blog

- Wirepoints

News Links

- Al Jazeera

- Anti-Media

- Austrailian Broadcasting Corporation

- Axis of Logic

- Bloomberg

- Business Insider

- British Broadcasting Corporation

- Canadian Broadcasting Corporation

- Consortium News

- Corbett Report

- Counterpunch

- Duran

- Epoch Times

- Fairness and Accuracy in Reporting

- Fifth Column

- Guardian

- Insurge Intelligence

- Intercept

- Last American Vagabond

- Natural News

- New York Times

- Oriental Review

- Raw Story

- Reuters

- Revelator

- RT News

- Sharyl Attkisson

- Spiegel Online International

- TASS Russia News Agency

- Truthdig

- Tyee

- Waging Nonviolence

Other Links

- 15 15 15

- Ancient Origins

- Another End of the World is Possible

- Anthroecology

- Antonius Aquinas

- Articulating the Future

- Automatic Earth

- BIkeX

- Burning Platform

- Caitlin Johnstone

- Canadian Dimension

- Centre for the Understanding of Sustainable Prosperity

- Citizen Action Monitor

- Climate and Capitalism

- Club Orlov

- Collapse Chronicle

- Collapse Chronicles (youtube)

- Collapse Musings

- Common Edge

- Commons Transition

- Commune Life Blog

- Consciousness of Sheep

- Contemplations on the Tree of Woe

- Contrary Farmer

- Culture Change

- Daily Bell

- Daily Sheeple

- Degrowth Canada

- Donella Meadows Project

- Eclectications

- Ecoreality

- Epsilon Theory

- Eugyppius

- First Rebuttal Blog

- Fourth Turning

- Free Range Network

- Global Risk Insights

- Golem XIV

- Great Change

- Great Transition Initiative

- Holmgren Design

- How to Save the World

- Jason Hickel

- JoNova

- Just Collapse

- Kevin Hester

- Land Workers Alliance

- Life Itself

- Mark Brimblecombe

- Nature

- New Dawn Magazine

- On Line Opinion

- Orion Magazine

- Our Place in the World: A Journal of Ecosocialism

- Peak Prosperity

- Peter Turchin Blog

- Philosophers Stone

- Plentiful Lands

- Post Growth Blog

- Problems, Predicaments, and Technology

- Rainbow Juice

- Ramblinactivist’s Blogs

- Rapid Transition Alliance

- Real Green Adaptation

- Seneca Cliff

- Shelly Fagan

- SHTF Plan

- Solutions

- Strong Towns

- Swarm Blog

- Tom Dispatch

- Transforming Society

- Transition Voice

- Two Ice Floes

- Un-denial

- Viable Opposition

- World Compex

- Wozukunft

- Yves Engler

- Z Blog

Survival Skills

- Agroecology Now

- Backdoor Survival

- Basis Gear

- Bugout Survival

- Burpee

- City Prepping

- Climate and Economy

- Eat the Planet

- Equanimity

- Farms for Tomorrow

- Foodtank

- Garden Earth: Beyond Sustainability

- Garden Professors

- Gray Wolf Survival

- Grow Network

- Grow Organic

- Institute for Agriculture and Trade Policy

- Joybilee Farm

- Living Life in Rural Iowa

- Low Tech Magazine

- Natural News

- Next System Project

- Off the Grid News

- Off Grid Survival

- Organic Consumers

- Organic Prepper

- Permaculture Association

- Permaculture Research Institute

- Permies

- Practical Self Reliance

- Preparedness Mama

- Post Peak Medicine

- Restoring Mayberry

- School of Adaptive Agriculture

- Seed to Crop

- Seed Savers

- Small Farm Future

- Sproutabl

- Survivalist Blog

- Survival Mom

- Survival Update

- Survivopedia

- TEOTWAWKI Blog

- Toxic Plants

- Underground Medic

- Wayfinder

- Wilderness Survival

- Wilderness Survival Skills

Post Archives by Category

- Economics (12,610)

- Energy (5,679)

- Environment (5,912)

- Geopolitics (6,120)

- Liberty (6,571)

- Survival (3,422)

- Uncategorized (40)

Japanese Bubble Bursting Playbook

JAPANESE BUBBLE BURSTING PLAYBOOK

Every now and then I stumble across a new source of information that I can’t wait to share with my readers. Today is one of those days. If you have even the tiniest shred of interest in commodities, then head over to the Goerhring & Rozencwajg website immediately. It’s just terrific stuff.

I must admit to being partial to their bullish commodity story, but in a recent RealVision TVinterview, Leigh Goehring solved a problem that I have wrestled with for some time.

What if China rolls over?

We all know the China bear story. For the past couple of years, famed China skeptics like Jim Chanos (FT Article – “China:market bulls beat the short sellers – for now”) and Kyle Bass (Reuters Article – “China credit bubble ‘metastasizing’”) have been warning about a China credit bubble implosion. Although I am hopeful that China will avoid the apocalyptic scenario they paint, there is a little part of me that worries when I am betting against Chanos.

Chanos might have lost the Tom Selleck mustache (and in the process, given away a fair amount of his hipster cred), but I hate being on the other side of his trade. I am pretty sure God has an account at Kynikos Accociates. They are simply that good.

So I have always struggled with being long commodities in the face of a potential China credit implosion. After all, China is the world’s largest importer and user of commodities, a slowdown would be catastrophic for commodities, right?

Not so fast. As Leigh Goehring so aptly notes, a great analogy for a potential China credit crisis would be the Japanese credit collapse of 1990.

There can be no denying that in the wake of the Japanese bubble bursting, their economy suffered a credit contraction that rivals the world’s greatest slowdowns. Given this horrible setback, it would be logical to conclude that Japan’s commodity usage suffered a similar contraction.

…click on the above link to read the rest of the article…

The Inflation Scare of 2012

THE INFLATION SCARE OF 2012

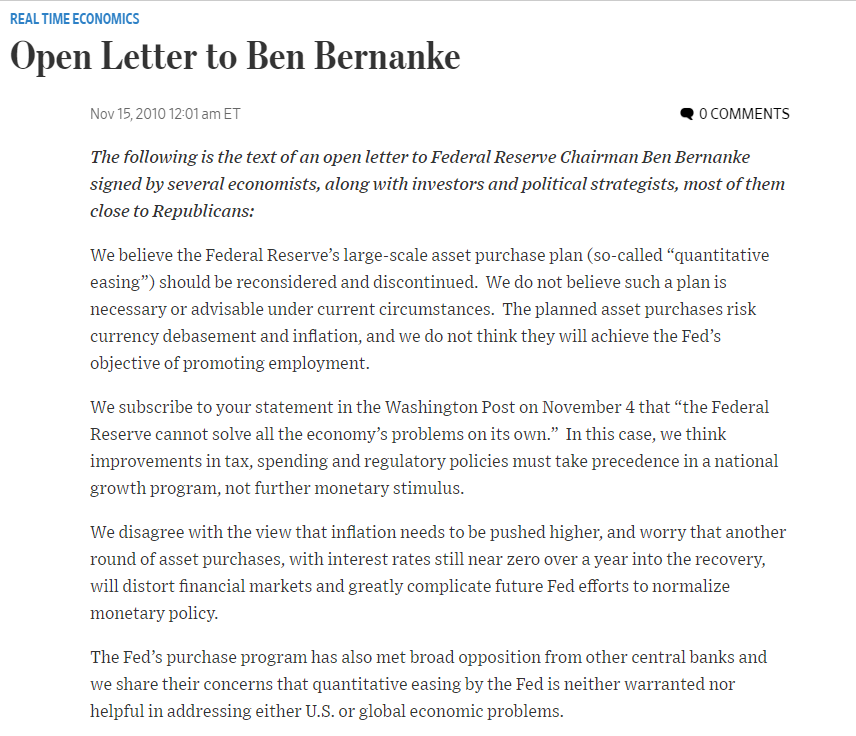

I would like to take you back to 2012. Just a few short years after the soul-searching-scary Great Financial Crisis of 2008-9, market participants had finally given up their worry of the next great depression enveloping the globe, but had replaced it with an equally fervent fear that inflation would uncontrollably explode. The Federal Reserve had recently completed their second round of quantitative easing, much to the chagrin of a large group of distinguished economic thinkers who had gone as far as writing an open letter to the Fed Chairman pleading he reconsider the program.

You remember that old A&E show Intervention? Well, this was like an academic peer episode – more neck beards and sophisticated language, but sadly, the same amount of crying.

So when the Fed’s favourite inflation gauge, the Core PCE index, spiked up to 2% in 2012, it was especially hard on Chairmen Bernanke. After all, his colleagues had just warned him that this was about to happen.

…click on the above link to read the rest of the article…

Gold–The Next Big Surprise

GOLD – THE NEXT BIG SURPRISE

It’s been a while since I have written about precious metals. To some extent, this has been on purpose. I am a long-term fan of our little yellow friend, but there are definitely periods when I am more bullish than others. Over the past half year, my enthusiasm for precious metals has been tempered by one important chart…

During this period, the yield on the US 5-year TIPS (Treasury Inflation Protected Security) has been steadily rising. It’s not a perfect comparison, but you can think about this as the risk free real yield – the yield you will earn after inflation.

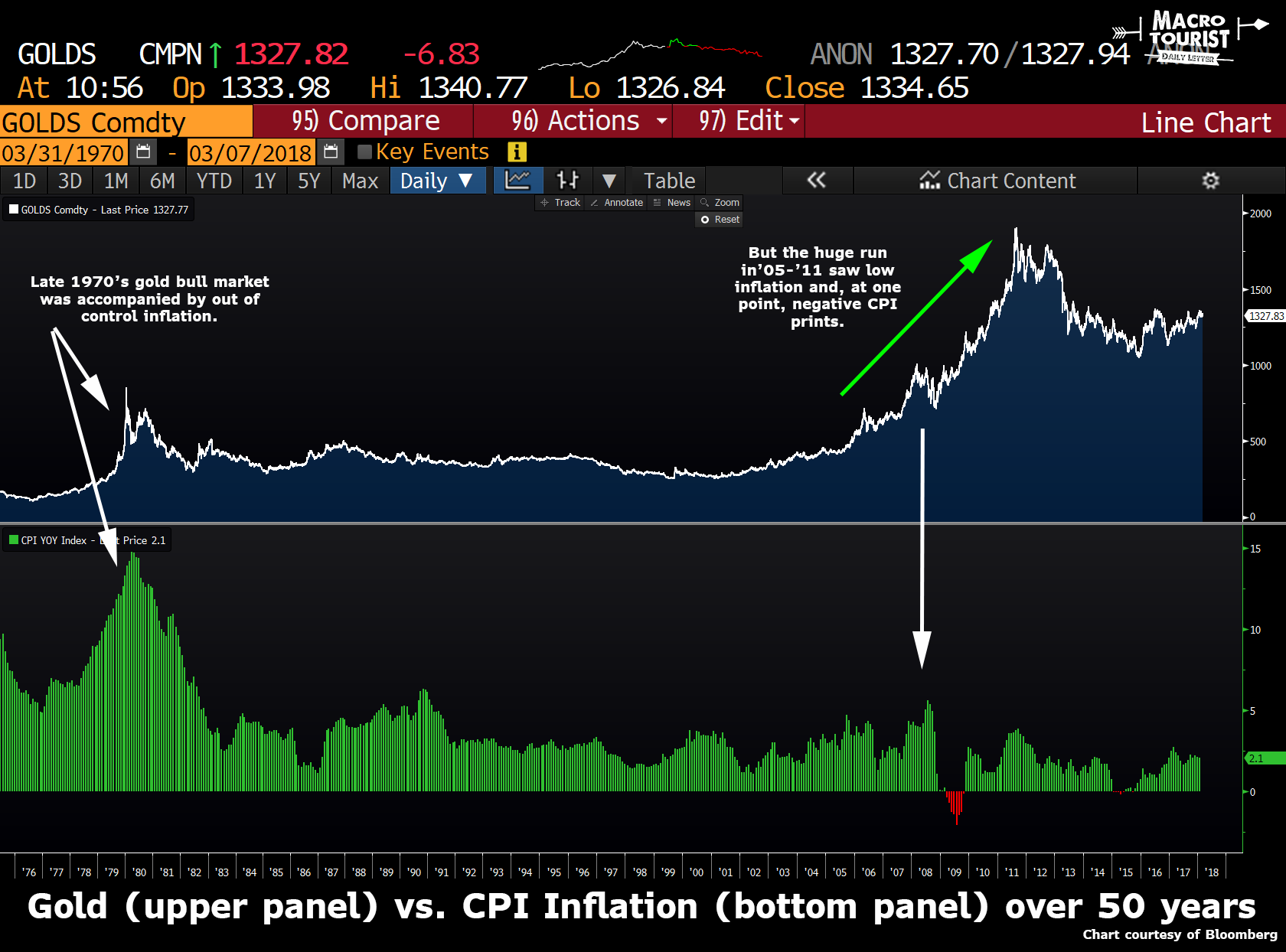

Many market pundits mistakenly believe inflation is the most important determinant of gold’s price level. That’s simply not the case. Although the great bull market of the late 1970’s was accompanied by high inflation, the 2005-2011 rise was in the midst of tame inflation, with CPI even ticking below zero for a period.

No, inflation is just one part of the puzzle for gold. The other important piece is the nominal interest rate. In the 1970’s, inflation was running at 10% or even higher. But for a while, interest rates were lower than the inflation rate. The real yield was therefore negative. In this environment, gold provided an attractive alternative to holding cash and other fixed income instruments that were suffering from financial repression. After all, gold is also a currency, with no yield. Yet the real benefit is that it is no one’s liability. With positive real yields it is difficult to justify owning gold, but push those yields into negative territory, and suddenly gold becomes more appealing.

And that’s exactly what happened in the 2000s. Inflation was low, but interest rates were even lower, creating one of the greatest precious metals bull markets of all time.

…click on the above link to read the rest of the article…

Latest Posts

-

Should we tweak the atmosphere to counteract global warming?

-

New Delhi chokes as trash mountain fire spreads hazardous fumes

-

Greece: Orange Sahara dust haze descends over Athens

-

Oil prices aren’t the Fed’s biggest problem right now — American demand is, says an economist

-

Pandemics in Roman Empire correlate with sudden climate changes

-

Sudan on brink of collapse and starvation as country marks one year of civil war

-

Letting Your Grass Grow Wild Boosts Butterfly Numbers, UK Study Says

-

Childhood: Conditioned to Pretend to Know

-

Europe is the fastest-warming continent, at nearly twice the average rate, report says

-

FBI says Chinese hackers preparing to attack US infrastructure

-

Cities are often 10-15 °C hotter than their rural surroundings

-

Plastics industry heats world 4 times as much as air travel, report finds

-

Water extraction and weight of buildings see half of China’s cities sink

-

Wave Goodbye to Another Set of Freedoms With the New Digital ID

-

What the Rising Gold Price Signals

-

Understanding climate warming impacts on carbon release from the tundra

-

Russia warns the world is on the brink of a ‘direct military clash’ between nuclear powers

-

Staggering Quantities of Valuable Metals Are Winding Up in the Garbage Bin

-

Ex-Manchester City Player’s Police Visits: Joey Barton’s Troubling Encounters Raise Questions About UK Speech Police

-

Oedipus: the Discovery of the Future

-

Hundreds of thousands displaced by flooding in Burundi

-

‘Where can you hide from pollution?’: cancer rises 30% in Beirut as diesel generators poison city

-

Humans may have nearly gone extinct.

-

I Saw the Future of Europe… In India

-

Put Government Press Secretaries Under Oath, Subject Them to Perjury Charges

-

A $250 Million War Game and Its Shocking Outcome

-

Australian Senator Says Elon Musk Should Be in Jail and The “Key Be Thrown Away” Over Free Speech Clash

-

War, fear of war spur global military spending to new record: SIPRI report

-

Black swan hedge fund says Fed rate cuts will signal market crash

-

Oil Companies Must Set Aside More Money to Plug Wells, a New Rule Says. But It Won’t Be Enough.

-

The vast ravines swallowing whole neighbourhoods around the world

-

The world dumps 2,000 truckloads of plastic into the ocean each day. Here’s where a lot of it ends up

-

The Strait of Hormuz and ‘the Spice’

-

The Age of Hyper-Imperialism

-

Don’t Talk To Me About Solutions

-

Give Me Liberty or Give Me Debt

-

Kick Back, Watch It Crumble

-

Among the ancestors

-

Down with Big Brother: Warrantless Surveillance Makes a Mockery of the Constitution

-

Israel’s strike on Iran: Crisis shows how badly Iran and Israel understand each other

-

A World At War (Again)

-

California cracks down on water pumping: ‘The ground is collapsing’

-

Living on Uneasy Street

-

Oh, The Irony: Congress Passes FISA-702 Extension, Allowing Warrantless Document Searches & Electronic Surveillance Of Americans, On Patriots Day 2024

-

Markets Are Biting Their Lips over Global Chaos

-

Hidden threat: Global underground infrastructure vulnerable to sea-level rise

-

Is Hunting and Gathering Really Better Than Agriculture?

-

EROEI and Civilization’s Forced Decline

-

Israeli Missiles Hit Iran, the Price of Oil Jumps 3 Percent

-

Is There a Road Map for What’s Ahead?

-

Almost Everything is About Oil in the Middle East

-

AI Computing Is on Pace to Consume More Energy Than India, Arm Says

-

Shipping Industry Pleads With UN For “Enhanced Military Presence” As Maritime Choke-Point Chaos Spreads

-

Scientists finally solved chilling mystery of why the Mayans vanished after thousands of years

-

Severe energy crisis paralyzes Ecuador for two days

-

Climate crisis: average world incomes to diminish by nearly a fifth by 2050

-

Orwellian Sydney Police: We Will Be the “Source of Truth”

-

Northern Permafrost Region Emits More Greenhouse Gases Than It Captures

-

Why Is Gold Rising Now, Where Is It Headed Tomorrow?

-

Russian Refineries Install Nets as Protection From Drone Attacks

-

What are Mises’s Six Lessons?

-

Telegram Founder Reveals US Government’s Alleged Covert Maneuvers to Backdoor The App

-

Homesteading: A Journey of Self-Sufficiency

-

The world’s economic myths are hitting limits

-

What Would a New Civil War Look Like?

-

Bank of America Accused of Political Debanking

-

Draining the World of Fresh Water

-

Getting to the other side of the biodiversity crisis

-

The distinct danger of being naive

-

Flooding in Central Asia and southern Russia kills scores and forces tens of thousands to evacuate to higher ground

-

“The Federal Reserve Is Clearly Trapped”: Lawrence Lepard

-

Iran on the Rise: Retaliation, “Important Military Targets”. Peter Koenig

-

A Blameless Explanation of Why Everything is Falling Apart, for Schoolkids

-

“Weasel Words” – Stella Assange Challenges US Over Julian’s Fate

-

Let’s talk about Civil War

-

Great Campaign Against the Great Reset

-

EU Officials Dodge Their Own Surveillance Law

-

Heatwave updates: IMD issues warning for Mumbai, Bengal, Goa; respite for Delhi-NCR

-

More climate-warming methane leaks into the atmosphere than ever gets reported – here’s how satellites can find the leaks and avoid wasting a valuable resource

-

Humans: the Movie

-

The Purpose Of War According To George Orwell (1984)

-

2020: The Year The System Showed Its Real Face

-

IMF Warns Biden’s Fiscal Profligacy Poses “Significant Risks” To Global Economy ‘In Great Election Year’

-

The longest — and probably largest — proof of our current climate catastrophe ever caught on camera.

-

Warning as Microplastics Escape Gut to ‘Infiltrate’ Brain

-

AI, Gold and Nuclear War

-

Fact Checkers Caught Looking the Other Way (Again!) As Pfizer Nabbed Spreading Vaccine Misinformation and “Bringing Discredit” on the Entire Industry

-

Nuclear Weapons Are the Biggest Single Danger for Humanity and All Forms of Life

-

Predicting the Future: How Good is the “Earth4All” Model?

-

State Violence Is The Norm

-

Europe’s Metacrisis Just Got Worse

-

Yanis Varoufakis Banned from Germany as Berlin Police Raid & Shut Down Palestinian Conference

-

A world war in waiting: After Iran’s attack, it’s almost here

-

Financial Forecast 2025-2032: Please Don’t Be Naive

-

Thermal Storage Hopium

-

On the Move

-

“Live Fast, Die Young”: USDA Shifts Plant Hardiness Zones

-

What About Prices?

-

AI, Cryptocurrency Will Double Data Center Energy Consumption by 2026

-

Forget the Black Swans; the Vultures already Circling us Are Bad Enough to Kill us

-

David Stockman on How the US Federal Debt Has Gone Parabolic…

-

What Optimism and Pessimism Are in the 21st Century, a Reflection on “Are We Doomed?,” And Two Narratives of the Human Journey

-

Did UAE’s Cloud-Seeding Operation Flood Dubai?

-

“Degrowth” is a tough sell

-

Water in Texas: A Window Into Water Problems Across the US

-

The Palestine Congress

-

The Flooding Will Come “No Matter What”

-

U.S. Funds Ukraine Groups Censoring Critics, Smearing Pro-Peace Voices

-

Iran Threatens America’s Military Bases Across Middle East If US Supports Israeli Counterattack

-

The largest renewable energy project in history fails: only desert is left and we have lost $2 billion

-

Today’s Contemplation: Collapse Cometh CIII–We All Believe What We Believe…Evidence Be Damned.

-

Today’s Contemplation: And Now For Something Completely Different, Part 6

-

Inflation is Causing Tectonic Shifts

-

Acceptance, Forgiveness, Gratitude

-

Did Lockdowns Set a Global Revolt in Motion?

-

Biden Tells Bibi: US Will Not Support A Counterattack Against Iran After Hundreds Of Drones, Missiles Sent

-

Snopes Changed Fact-Check After Pressure From Biden Administration: Emails

-

Today Contemplation: Collapse Cometh CI–Theory Is Great, In Theory: More On Our ‘Renewable’ Energy Future

-

Today’s Contemplation: Collapse Cometh C–Grieving: A Natural Response To Recognition Of Growth Limits

-

Today’s Contemplation: Collapse Cometh XCIX–Energy Future, Part 4: Economic Manipulation

-

Today’s Contemplation: Collapse Cometh XCVIII–‘Inevitable’ Growth: Helping To Keep the Profiteer Gravy Train Pumping

-

Middle East Crisis: Container Ship Hijacked Near Strait Of Hormuz Amid Soaring Iran Tensions

-

Iran Says If US ‘Interferes’ In Retaliation On Israel, American Bases Will Be Struck

-

Anti-Science? Scientific Reporting RE: Covid-19 mRNA vaccines

-

We have two years to save the planet: UN climate chief

-

What Farmers Say About Climate Change

-

Can Our Veggie Gardens Feed us in a Real Crisis?

-

Study identifies atmospheric and economic drivers of global air pollution

-

The “Business” of Central Banking—Usury and Tax Farming

-

Only 57 producers are responsible for 80% of all fossil fuel and cement CO2 emissions since 2016 – new report

-

World’s biggest economies pumping billions into fossil fuels in poor nations

-

Large-scale factory farms have become the biggest source of water pollution in the U.S.

-

Is nuclear energy the answer?

-

The CPI Rose Sharply in March Led by Shelter and Gasoline

-

Biggest Corporate Welfare Scam of All Time

-

Staving Off Revolution

-

How to Stop Worrying and Love the Bulldozer

-

We’re Supposed To Be Done Finding New Oil and Gas. We’re Not.

-

Post-Modernity

-

Yale Study Unveils Asteroid Strikes As Possible Trigger for Earth’s Ice Ages

-

IMF Prepares Financial Revolution – Say GOODBYE to the Dollar

-

Iran Blames UN Security Council ‘Inaction’ For What Comes Next

-

Biden’s Inflation Narrative Dies as Price Growth Rises to a Seven-Month High

-

‘Devastating to See’: Russia’s Orenburg Region Battles Historic Flood

-

Social Media Fact Checkers Claim Their Work Isn’t Censorship. Here’s Why It Is.

-

This Double Whammy Will Unleash Unprecedented Money Printing… or Break the U.S. Economy

-

Today’s Contemplation: Collapse Cometh XCVI–Technological ‘Breakthroughs’, Ponzi Schemes, and ‘Green’ Energy

-

Crude, Food Prices Jump As Looming Israel-Iran Conflict Spark 1970s Oil Shock Fears

-

Video: Canadians Plunged Into Poverty. Can’t Afford to Eat! Sign of Major Economic Collapse

-

Something Broke In Markets On Thursday

-

Global ‘Game Of Chicken’ Continues – MOAB >> NFP

-

Proposal to Move Bank Regulation Goalposts Signals Underlying Problems in Financial System

-

Today’s Contemplation: Collapse Cometh XCV–We All Believe What We Want To Believe

-

Today’s Contemplation: Collapse Cometh XCIV–‘Representative’ Democracy: A Ruse To Convince Citizens That They Have Agency In Their Society

-

India’s most innovative cities including Bengaluru run out of water

-

If a Tree Falls in a Forest…

-

Russia Is Struggling to Repair Refineries Due to Sanctions

-

Open comment post: the AMOC shutdown and the future of agriculture

-

Israel Warns Iran Of Massive Regional War If Directly Attacked

-

Today’s Contemplation: Collapse Cometh XCIII–Energy Future, Part 3: Authoritarianism and Sociobehavioural Control