The bear will soon be arriving in earnest, marauding through the canyons of Wall Street while red in tooth and claw. Our monetary central planners, of course, will once again—for the third time this century——be utterly shocked and unprepared. That’s because they have spent the better part of two decades deforming, distorting, denuding and destroying what were once serviceably free financial markets. Yet they remain as clueless as ever about the financial time bombs this inexorably fosters.

The sum and substance of Keynesian central banking is the falsification of financial prices. In essence, this means pegging interest rates below market clearing levels on the theory that more borrowing and spending will thereby ensue.

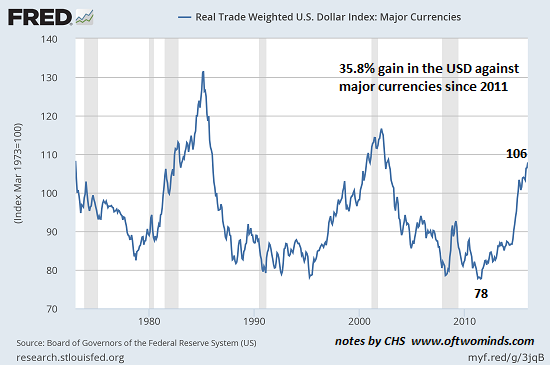

To this traditional credit channel of monetary policy transmission has been added in recent years the notion of an FX channel, which works through currency depreciation and export stimulus; and the wealth effects channel, which seeks to levitate the paper wealth of the top 10% of households so that they will feel emboldened to spend more at luxury retail emporiums, BMW showrooms and upscale vacation spots.

Needless to say, currency trashing might work for a tiny export economy like New Zealand. But on a global scale among the big national economies, it’s just a recipe for a race to the bottom. Ultimately it leads to nothing more than the inflation of imported commodities and goods and the reallocation of income and wealth from domestic industries and households to exporters and their shareholders. Japan proves that in spades.

With respect to the false FX channel, even Black Rock’s chief big thinker, Peter Fisher, hit the nail on the head last week on Bloomberg:

…click on the above link to read the rest of the article…