|

| 50 SEK banknote issued by the Riksbank in 1960 |

“Do we need an eKrona?” asks Stefan Ingves, the Governor of the Riksbank, Sweden’s central bank. The Riksbank is probably the central bank that has advanced the furthest in discussions surrounding the introduction of a central bank-issued digital currency (CBDC)—a new form of risk-free digital money for use by the public. Canada, New Zealand, Australia, the ECB, and China are also dissecting the idea, with more central banks to come in 2018.

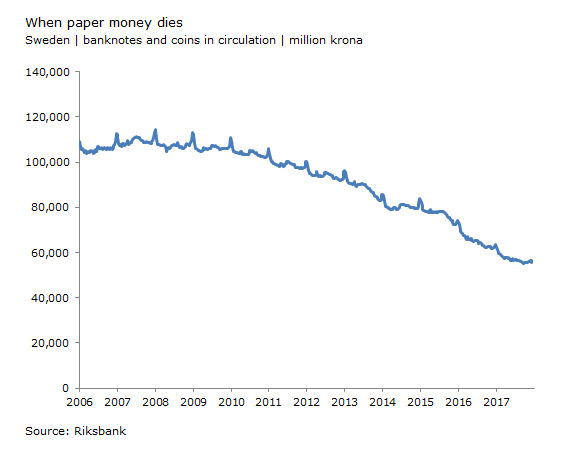

Sweden is approaching the issue from a unique angle, says Ingves. It is the only country in the world showing a consistent decline in cash and coin usage. I’ve written about this interesting pattern here, here, and here. Below is a chart:

Ingves floats two theories. Either the Swedish public no longer wants central bank money, or alternatively they do want central bank money but not the type that is “made of pieces of paper,” preferring instead an as-yet non-existent digital alternative. If so, then it may be the Riksbank’s duty to provide that alternative, says Ingves.

Duty is an admirable motivation, but let me propose another reason for why the Riksbank is exploring the idea of an eKrona—self preservation. I think Sweden’s central bank is terrified that it will become powerless in the future. It is desperately casting around for solutions to resuscitate itself, one of these being an eKrona. This fear is rooted in the fact that declining cash usage has led to a collapse in the resources that the Riksbank believes that it needs to function.

These worries about powerlessness are shared by central bankers around the world, many of whom expect advances in private payments technology to lead them to the same cash-light world that Sweden is currently entering.