Those of us who closely follow the credit cycle should not be surprised by the current slide in equity markets. It was going to happen anyway. The timing had recently become apparent as well, and in early August I was able to write the following:

“The timing for the onset of the credit crisis looks like being any time from during the last quarter of 2018, only a few months away, to no later than mid-2019.” [i]

The crisis is arriving on cue and can be expected to evolve into something far nastier in the coming months. Corporate bond markets have seized up, giving us a signal it has indeed arrived. It is now time to consider how the credit crisis is likely to develop. It involves some guesswork, so we cannot do this with precision, but we can extrapolate from known basics to support some important conclusions.

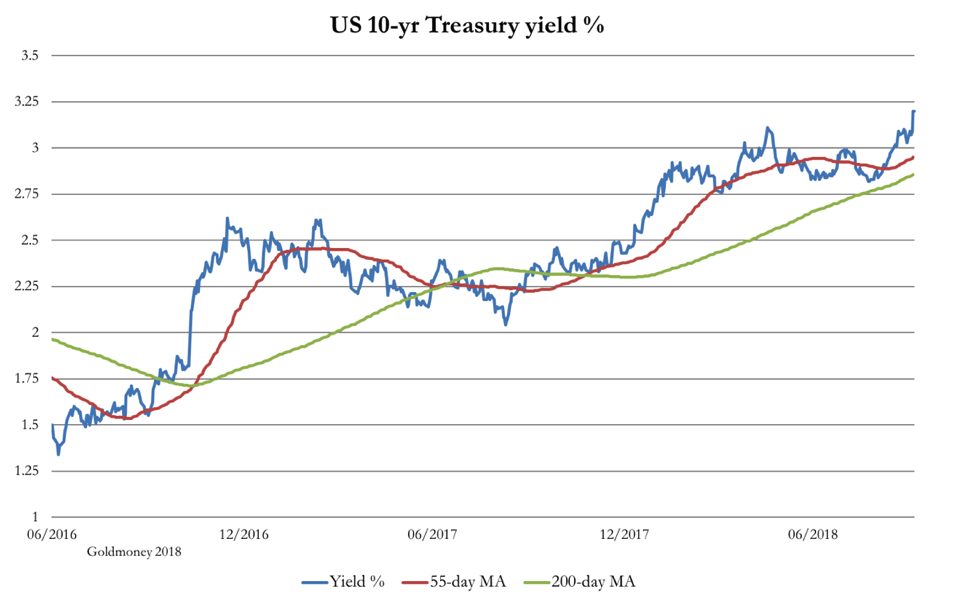

If it was only down to America without further feed-back loops, we can now suggest the following developments are likely for the US economy. Warnings about an economic slowdown are persuading the Fed to soften monetary policy, a process recently set in motion and foreshadowed by US Treasury yields backing off. However, price inflation, which is being temporarily suppressed by falling oil prices, will probably begin to increase from Q2 in 2019. This is due to a combination of the legacy of earlier monetary expansion, and the consequences of President Trump’s tariffs on consumer prices.

After a brief pause, induced mainly by the threat of an unstoppable collapse in equity prices, the Fed will be forced to continue to raise interest rates to counter price inflation pressures, which will take the rise in the heavily suppressed CPI towards and then through 4%, probably by mid-year.

…click on the above link to read the rest of the article…

CHICAGO – Every major financial crisis leaves a unique footprint. Just as banking crises throughout the nineteenth and twentieth centuries revealed the importance of financial-sector liquidity and lenders of last resort, the Great Depression underscored the necessity of counter-cyclical fiscal and monetary policies. And, more recently, the 2008 financial crisis and subsequent Great Recession revealed the key drivers of credit-driven business cycles.

Specifically, the Great Recession showed us that we can predict a slowdown in economic activity by looking at rising household debt. In the United States and across many other countries, changes in household debt-to-GDP ratios between 2002 and 2007 correlate strongly with increases in unemployment from 2007 to 2010. For example, before the crash, household debt had increased enormously in Arizona and Nevada, as well as in Ireland and Spain; and, after the crash, all four locales experienced particularly severe recessions.

In fact, rising household debt was predictive of economic slumps long before the Great Recession. In his 1994 presidential address to the European Economic Association, Mervyn King, then the chief economist at the Bank of England, showed that countries with the largest increases in household debt-to-income ratios from 1984 to 1988 suffered the largest shortfalls in real (inflation-adjusted) GDP growth from 1989 to 1992.

Likewise, in our own work with Emil Verner of Princeton University, we have shown that US states with larger household-debt increases from 1982 to 1989 experienced larger increases in unemployment and more severe declines in real GDP growth from 1989 to 1992.

…click on the above link to read the rest of the article…