We are living through the largest pillaging of the American middle class in a half-century. It’s not in the headlines. This is extremely strange. In fact, this might be the first and only article you have read about it. This could be for a reason. If people knew what was happening to them, they would begin to feel very restless, even furious. Some people among the ruling class do not want that.

The Biden administration trumpets its economic achievements. It’s mind-boggling. Call it trolling. Call it gaslighting. Call it whatever you want but you know it is untrue.

Let’s look at the facts.

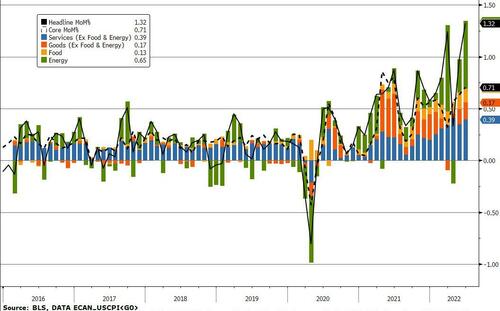

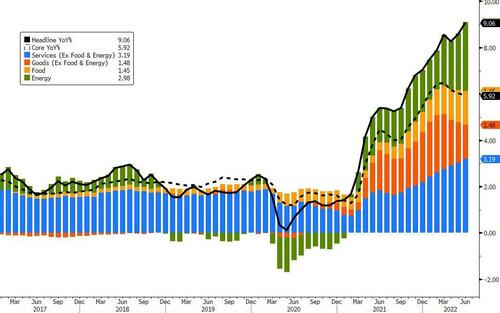

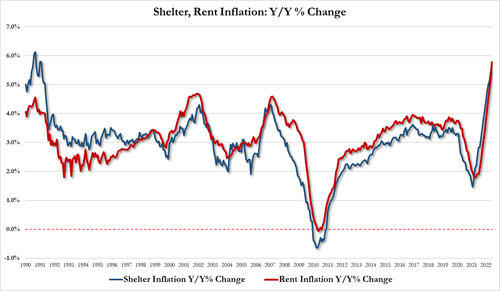

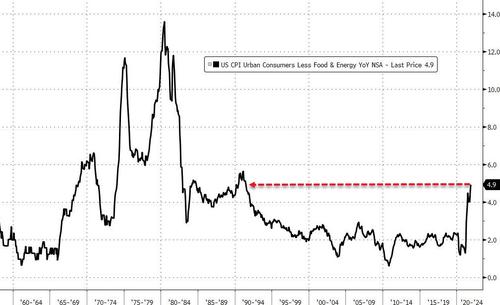

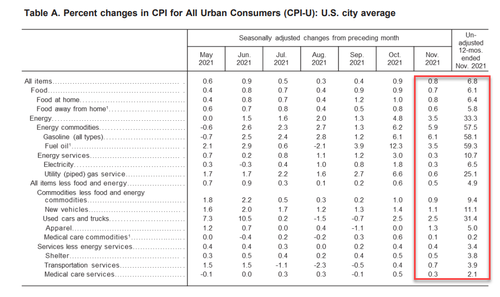

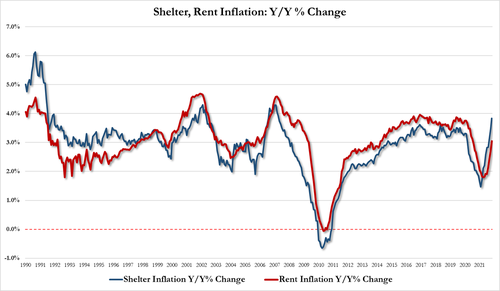

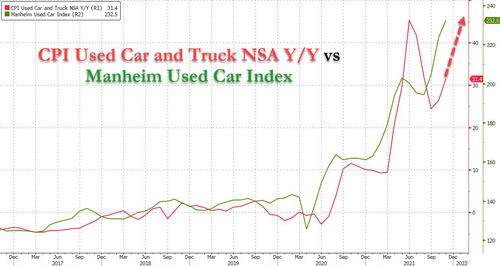

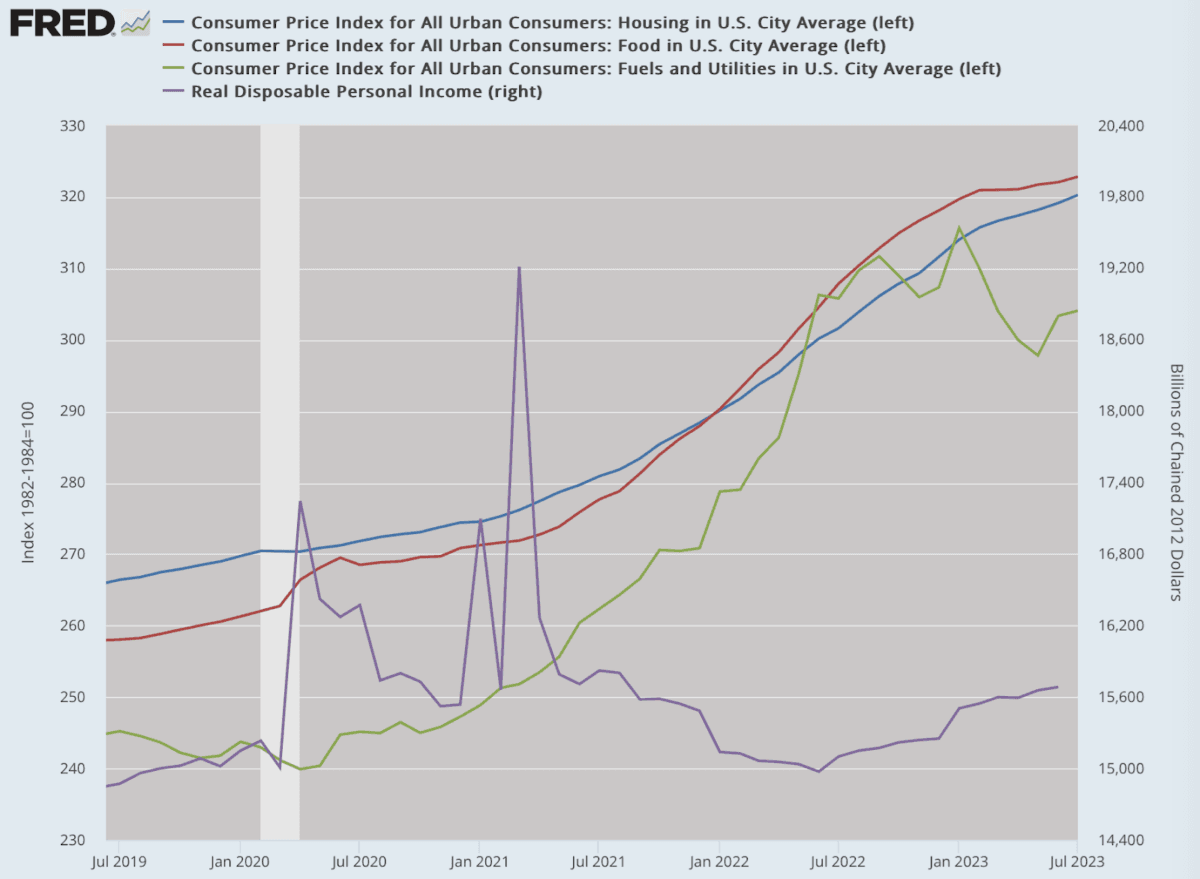

What do you spend money on month-to-month? It’s rent or your mortgage, food at home or out, utilities, and gas. Those are the basic categories. The Consumer Price Index includes far more than that, some items you do not purchase and some that are going up far less than others. So let’s look at government numbers on what you actually purchase; that is, the items and services that you consume that dominate part of your income. And let’s stretch that back three years.

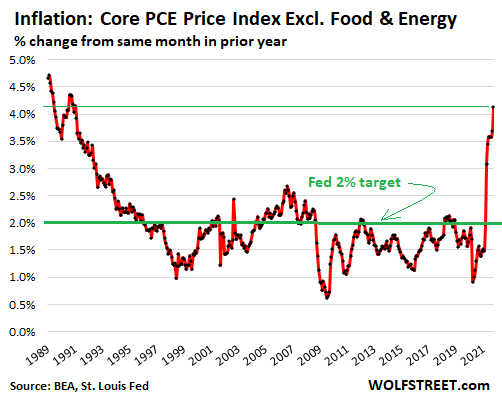

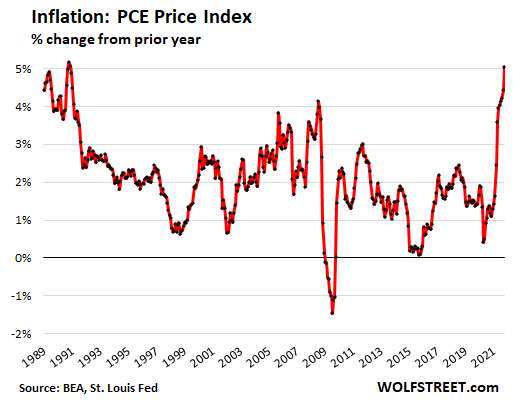

Everything is going up and up and has been for three years. Looking at the items on which you actually spend money, we find increases between 18-plus percent to 22-plus percent. Let’s say we average it all out at 20 percent.

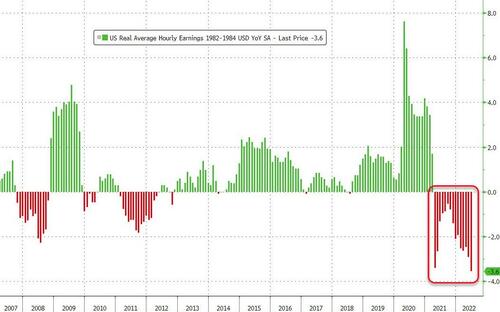

Now let’s look at real disposable income, which is income left over after expenses adjusted for inflation. That result is an increase of a pathetic 3 percent compared with three years ago. The stimulus payments felt great at the time but those are long gone, essentially a head fake. So your income demands are up 20 percent whereas your leftover cash is barely up at all. That’s essentially a disaster for your standard of living.

In short, you have been robbed.

…click on the above link to read the rest…