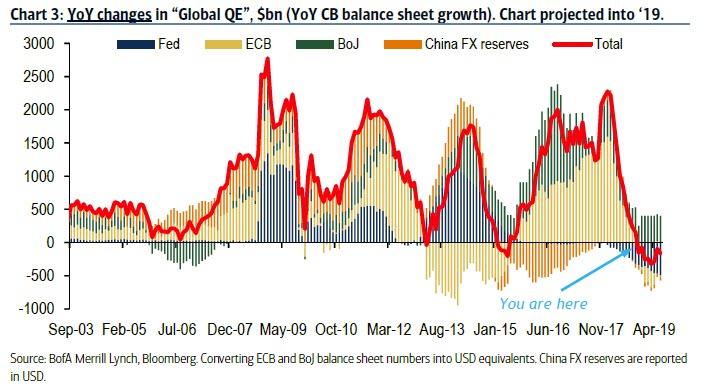

By now everyone has seen some iteration of this chart showing that the annual change in central bank liquidity is now negative.

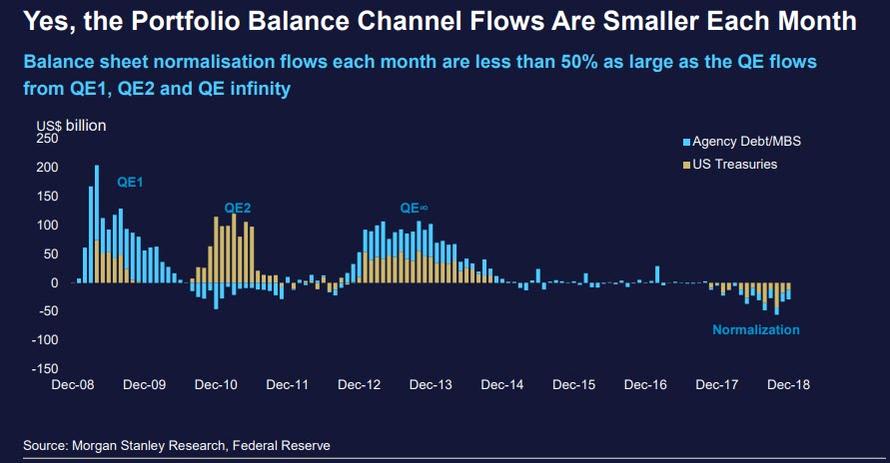

Another way to visualize just the Fed’s balance sheet contraction is courtesy of this chart from Morgan Stanley which shows specifically which assets – Treasurys and MBS – are declining on a monthly basis.

When it comes to markets – where the events of December were a vivid reminder that just as QE blew the world’s biggest asset bubble, so QT will deflate it – there is a simple explanation of this negative effect of QT on Markets – in terms of both flow and stock – and it is laid out as follows from Morgan Stanley:

- THE STOCK EFFECT (SE) – GROUP 1

- The SE relates to the long-term impact on Group 1 asset prices from the overall change to the central bank’s balance sheet and its impact on the stock of available Group 1 assets.

- THE FLOW EFFECT (FE) – GROUP 1

- The FE relates to the short-term impact on Group 1 asset prices from each flow that changes the size of the central bank’s balance sheet.

- THE PORTFOLIO BALANCE CHANNEL EFFECT (PBCE) – GROUP 1 AND 2

- The PBCE impacts both Group 1 and Group 2 assets and incorporates the pricing elements of both the stock effect and the flow effect.

But while the immediate effect of the expansion and shrinkage of the Fed’s balance sheet on various asset classes is rather intuitive – if not to Fed presidents of, course – a more pressing question is how will the upcoming liquidity shrinkage affect the global economy.

Unfortunately, the answer appears to be ominous.

…click on the above link to read the rest of the article…